Reserve Currency & Its Importance:

Reserve Currency is a foreign currency that the central banks and other major financial institutions hold for international trade, to pay off international debt obligations, or to influence their domestic exchange rate. US Dollar is the current primary reserve currency. Attaining a reserve currency status allows the issuing country to borrow money at a cheaper rate, as there is always a bigger market for that currency than others. This is commonly referred to as “exorbitant privilege” from the reserve currency status. It also guarantees additional revenues from seigniorage—the interest-free loan generated by issuing additional currency to the other countries who hold the reserve currency (Dobbs, Skilling, Hu, Lund, Manyika, & Roxburgh, 2009). It permits the issuing country to indulge in international trade without incurring transaction costs. Moreover, it reduces the currency risk for domestic importers and exporters because of greater denomination of trade transactions in the country’s own currency. On the flip side, this status demands a greater burden of responsibility because domestic monetary policy has more spillover effects on the world economy.

HistoryThe reserve currency status has changed from the silver punch-marked coins of fourth century India to Islamic dinar of the middle-ages to Dutch guilder of the seventeenth century and, more recently, from UK sterling to the US dollar during World War II (Reisen, 2009). Below a pictorial representation of the transition in history. The transition from UK sterling to US dollar was mainly due to the emergence of the USA as an economic superpower and the economic weakness of the UK.

China and its growing importanceChina has the world’s second-largest nominal GDP, totaling approximately US$7.47 trillion (Gu, 2012). It is the world’s second-largest trading power behind the US, with a total international trade value of US$2.97 trillion–US$1.58 trillion in exports (#1) and US$1.39 trillion in imports (#2). Growing at 9.5% in 2011 and propelled by vigorous domestic and external demand (International Monetary Fund, 2011), China’s rise as a global power is undeniable and there is no doubt that China will eventually eclipse the US as the world’s most important economy.

Renminbi’s potential as reserve currency

Chinese currency – Renminbi, has the potential to be the next reserve currency given the current macro economic conditions. This can be accentuated by comparing the current macro economic conditions with the period of transition of the reserve currency from the UK sterling to the US dollar:

GNP: The US had overtaken UK in terms of economic output and GNP in 1890s to become the world’s leading economy (Papaioannou & Portes, 2008). Eventually the US dollar dethroned UK pound in 1944 to become the primary reserve currency. In the current scenario, China, growing at the rate of 9.5%, is expected to overpower US in terms of GNP in the next 10 years. (International Monetary Fund, 2011). Therefore, Renminbi has a potential of becoming the next reserve currency in the coming 30-40 years.

Financial Position: US gained a net creditor position in 1915 (Papaioannou & Portes, 2008). It started exporting to the world and its use in finance and trade widened. Today, China is the world’s largest creditor with US$1.58 trillion in exports and the US is in a net debtor position similar to UK after the WWI. Further dominance of China in international trade will compel the trading partners to hold a part of their reserves in Renminbi dominated assets, making it a potential candidate for the reserve currency status.

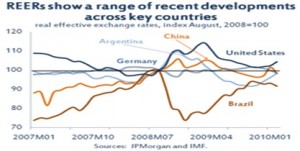

Weak Major reserve currency: After WWI, the pound was weakened. This made the promotion of dollar easier. Similarly, today, repeated measures to control inflation (quantitative easing) have not only devalued the US dollar but also made it comparatively volatile (the standard deviation of Real Effective Exchange Rate of US dollar for the last 10 years is 8.88% while that of Yuan is 6.01% ). This has impelled the world economies to look for a substitute reserve currency.

In spite of the above indicators, Renminbi is still far from receiving a reserve currency status. This can be attributed to the following reasons:

Investor confidence: At the time of the UK sterling-US dollar transition, the US was a trusted storehouse of capital, a democracy where the rule of law was firmly established. However, a command-led and dictator-led economy, China is less reassuring to the investors. This will potentially inhibit them to keep their savings in Renminbi.

Capital Convertibility: China has been historically reluctant to let its capital move across its borders inhibiting the investors to park their money in Renminbi and withdraw it when needed. The reserve currency needs to be fully convertible. Though China has started taking some steps to achieve this (like setting up currency swap agreements with several countries like Argentina and letting institutions in Hong Kong issue bonds denominated in Renminbi) (Economist, 2011), it would take years for it to achieve full capital convertibility.Chinese Bonds & Security Markets: China’s bond market is shallow and illiquid, with limited access to foreigners. 40% of the bonds issued have a maturity of less than 5 years . Apart from this, its foreign exchange and derivatives market is weak. In order to achieve a reserve currency status, a country must have a developed and liquid bonds and securities market so that the investors worldwide can hold the currency reserves.

US Dollar as Safe Haven: In the late 1920s, the world was affected by the Great Depression and the pound was weakened. The US had accumulated great reserves in pound to replace it. This was a strengthening factor for the US dollar to achieve a reserve currency status. A similar event happened in 2008, where the world economy was affected by a severe financial crisis which weakened the dollar. Just like US in 1920s, China had great reserves in US dollar. But the difference laid in the fact that the pound lost its support after 1920 whereas the US dollar was strengthened as one of the safest havens after 2008.

Conclusion and Recommendations:As evident from the above discussions, currently China is not prepared to dethrone the dollar. However, this might be possible in the next 30 years if it adopts measures like turning the Renminbi into a convertible currency whose value would be dictated by the market transactions and free trade. It would also have to work on its domestic financial reforms, and make its bond and securities markets more liquid. These steps would help the Chinese currency achieve reserve currency “exorbitant privileges”. However, these would also expose China to the potential risk of rising exchange rate (due to free trade) and a reduction in exports and hence the growth rate.

[The article has been written by Shavi Gandhi. She is an MBA from IIM Ahmedabad and is an alumni from Delhi College of Engineering.]

Tags: china dollar foreign exchange pound reserves yuan

You might like reading:

Cracking SNAP 2014 : Probable Shortlists

Results of SNAP 2014 which was conducted across various centres across India by Symbiosis International University (SIU)on 21st December, 2014 is Out! The University has declared the result for augmentingto its 13 management institutes. This year more than 50,000 students sat for the exam to decide their fate. Now after declaration of results most of the aspirants are still confounded […]

Tete-a-tete with Abhishek Agarwal, Co-Founder, Bold Kiln

Bold Kiln is a company, co-founded by Ankit Pandey and Abhishek Agarwal, that enables start- ups to develop into full-fledged businesses by providing an array of services that anyone who decides to take on the entrepreneurial route might find themselves in need of. We caught up with Abhishek and tried to find out more about his journey. Q1. Firstly, a […]