US Federal tapering seems to be a new buzz word. This led to markets correcting on 20th August 2021 with the Indian stock exchanges correcting by 300.17 points (BSE) and 118.35 points (NSE). Globally as well the stock exchanges such as Hang Seng, Shanghai Composite and Nikkei shrunk by over 1%. As investors, this may be just the beginning of a long and overdue correction as Fed is expected to reduce bond buyback by the end of 2021 otherwise referred as tapering.

Let us understand Tapering in details. The Quantitative easing which the Fed had started post the 2008 crisis involved buying back of treasury bonds from the market. This in-turn led to increase the liquidity in the market in order to stimulate growth by lowering interest rates. The increased dollars in the market then made their way back into emerging economies such as India leading to astronomical growth in the indexes. Tapering is basically the opposite of the the quantitative easing which the US had followed earlier.

Let us quickly understand what the present tapering may imply:

- Tapering is the theoretical reversal of quantitative easing (QE) policies, implying that stimulus for the economy is no longer needed

- It largely refers to reduction in purchase and holding of central bank assets, such as treasury bills and bonds.

- Financial markets may experience a downturn and a jerk reaction in response to tapering

- The jerk reaction may force US Fed to postpone the tapering plans especially at a time when their economy is recovering after covid.

Once tapering is in effect, FIIs will start pulling money out of emerging markets such as India as was witnessed on 20th August. This will be required owing to lack of liquidity in their domestic markets. As dollars will move out of the country, it will appreciate significantly against the Indian rupee thereby making our exports more competitive. However the effect of tapering may be limited in the long run for a large consumer driven economy such as India especially when it is expected to have major recovery after the economy shrunk 7.3% in FY 20. Investors though can expect a moderate return of 7-10% in the next two FY owing to this this disruption.

However, if we explore the US move, there are some interesting possibilities that can be drawn by analyzing the ownership of the US treasury bonds. US presently has over 7 trillion dollars of debt, of this Japan owns about 1.2 trillion USD and China about 1.09 trillion USD. As tapering happens, China may start selling some of its holdings in order to retain the liquidity in its domestic market. In case the quantum of such sales is significant, it may have a reverse impact of tapering and fuel higher interest rates in US slowing its recovery further. This can be a soft way for China to take an upper hand in the ongoing trade stand-off with US. Further, as interest rates will rise in US, it will be forced to continue the buyback – clearly it has all the makings of a catch22 situation.

How will the Indian markets be impacted ? In the near-term FII withdrawal will create a significant downturn in the sensex as well as weakening of the Rupee. In the long run, it remains to be seen as the world geo-politics keep changing. Regardless of everything else, interesting times ahead for investors and one will need to keep a close watch on the markets.

Tags: bonds Fed quantitative easing USAYou might like reading:

596 Students from over 25 Countries participate in Utopia 2016

Around 596 students from 25 countries participated in a rhapsody of 14 different cultural and sports events at Utopia 2016, the International Cultural Fest of Symbiosis Institute of Business Management (SIBM) Bengaluru, held on 31 st July, 2016. The students were predominantly from countries like Nigeria, Afghanistan, Nepal, Mauritius, Congo, etc. Just as each colour is needed to form a […]

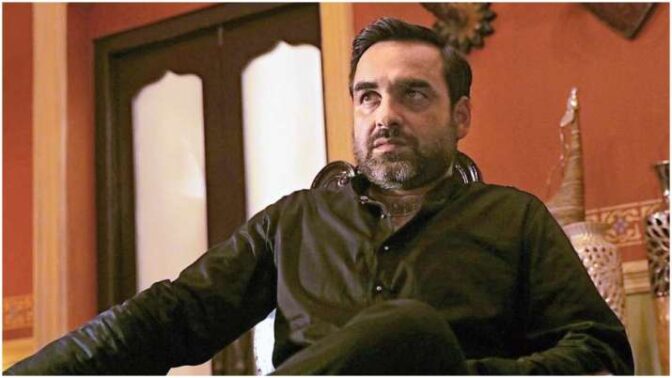

12 management lessons from Mirzapur web series

Mirzapur is one of the most popular web series in the OTT platforms in India. The series focusses on a quest for power in India’s heartland driven by rage and revenge. It shows a combination of how illegal weapon trade, drugs and crime are intertwined with politics in this country. The protagonist of the show “Kaleen Bhaiya” known as the […]