Whenever, one talks about country’s economy, the two parameters GDP and

inflation plays important role in determining country’s economy. Before getting into the details, lets look at brief definition of GDP and Inflation.

GDP: The gross domestic product (GDP) is the amount of goods and services produced in a year, in a country. It is the market value of all final goods and services made within the borders of a country in a year. It is often positively correlated with the standard of living, alternative measures to GDP for that purpose.

Inflation: The consumer price index (CPI) calculates the change in consumer price of a set of goods and services such as food, clothing, fuel, housing, medical, transport, education etc.

I believe, any country is considered to be in growth path, if year on year GDP% growth is greater than inflation % otherwise inflation is bound to eat up into the growth. Towards, comparison of GDP & inflation parameter, I have taken 3 countries. US which was most affected by economic downturn and China & India, which is claimed to be least affected economic downturn.

USA

|

| US GDP annual rate for 2010 is 2.6% |

The US inflation rate for 2010 is 1.1%. This means, GDP growth is much higher than inflation which is a positive sign for US towards growth. As per the graph, it was only for few months in the year 2009, growth was around -6% and inflation around -2%, which mean inflation was higher than GDP, this period could well be termed at the worst period in US economy due to recession.

Now let’s look at China’s GDP and Inflation

CHINA

|

| China’s GDP growth percentage is around 10% for year 2010 |

China inflation rate was in range of 3 to 5%. However, comparativelyGDP rate of 9% is higher when compared to inflation, which I believe is a positive sign.Moving on, let compare India’s GDP Vs inflation.

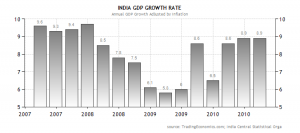

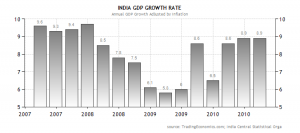

INDIA

|

| India’s GDP rate is for 2010 is around 9% |

India’s inflation rate is 9.7% around October 2010. As per an article in a leading daily, the food inflation has said gone beyond 14% in the later part of 2010. Interestingly, all through 2008 to 2010, the inflation has always scored higher percentage when compared to GDP percentage. If this is true, I do not understand on what basis, India is claiming to have withered recession with minimum impact ?Again, with inflation galloping in India, are we moving towards hyper inflation ?

[The article has been contributed by M.Guha Rajan. He is a software management professional as well as a PMP certified Project Manager. He is post graduate in management and holds a degree in computer engineering with over 15 years of post degree work experience.]

Tags:

GDP growth inflation

You might like reading:

Posted: December 4, 2022

XIM Bhubaneswar conducted the Finance Conclave: FINOMICS 2022, hosted by X-FIN – The Finance Association of XIM. This year’s theme was “ESG: Ratings, Valuation & Investing.” The event was hosted on 19th November 2022 and was graced with the presence of Mr. Rahul Agarwal, Head of ESG Research Services, CRISIL GR & RS; Mr. Debasis Panigrahi, Founder of Mridayaa Ventures […]

Posted: April 6, 2015

In Favour In a psephological context, the flaneurs of Indian politics have, more often than not, predisposed the two biggest national parties in our polity towards dynasty and Hindutva practices respectively. Needless to say, these concomitant references accompanying the grand-old and the not-so-grand-old political structure of the congress and the BJP need modifications (pun not intended) by breaking with their […]