Equity as an asset class is known to give the highest returns among other asset classes such as bonds and derivatives. In fact, it can be considered as an inflation hedge as if the price of commodities increase it will be matched with higher sales thereby implying significantly higher cash flows. Equity investments also provide one the benefits of capital appreciation (owing to rise in stock price) and a dividend earning apart from diversification benefits. The diversification benefits are owing to co-relation of less than 1 between equity and other asset classes. This however does not hold true in case of economic downturns when the co-relations become closer to 1.

So how does one decide the right stock for oneself? I mean how do I choose which is the right equity investment for me ?

The investments that an individual does is directly linked to person’s risk tolerance. A person with high risk tolerance will prefer high growth stocks with potential for capital appreciation. On the other hand, a person with low risk tolerance will prefer stable dividend paying stocks. All investments are also subject to environmental, social and Governance (ESG) preference of the investors and as per their investment policy statements (IPS). So how should portfolio managers filter the stocks prior to applying a segmentation approach.

This can be done by portfolio managers in three ways:

- Negative Screening : This involves eliminating the stocks that do not meet the requirements of the investor. This screening can be based on risk-return or on the basis of individual preference.

- Positive Screening : This involves selecting all the stocks that the investor will be willing to invest in. This filter can be on the basis of size (large cap, small cap or mid cap), style (value or growth), geographic considerations (developed, emerging or frontier economies) or in terms of economic activities

- Thematic screening : This involves adopting a theme based approach such as investing only in a certain category of stocks using the sector or industry to which the stock belongs. It might also be owing to the investor’s preference for certain issues such as environmental concerns that he decides to select the particular stock. Another type of thematic screening is Impact investing. This involves investing in certain stocks and then further investing separately in their projects. Thematic screening also involves picking of stocks based on trends rather than the fundamentals or the past performance of the company.

Equity as an asset class is known for its volatile nature in terms of price variance. However they help in diversification of risk in the portfolio and are a major asset class for investment purpose. Segmentation of the market also plays a critical role in deciding the right stocks for the portfolio. The key however is to remember that portfolios should be dynamic in nature as over time a small cap stock might become a mid-cap and add geographical areas of operation. Hence, they should be monitored on regular basis.

Tags: portfolio stocksYou might like reading:

Gyandoya 3.0 – HR Conclave ‘21, IIM Bodh Gaya

The Indian Institute of Management, Bodh Gaya successfully conducted its annual HR-Conclave ‘Gyanodaya 3.0’ on 27th November, 2021. The conclave provided a platform for the future leaders to interact with business experts and acquire valuable insights from their experiences and expertise and be ready for the corporate world. The event shed light on the evolution of the HR domain over the […]

Future Starts with Us!

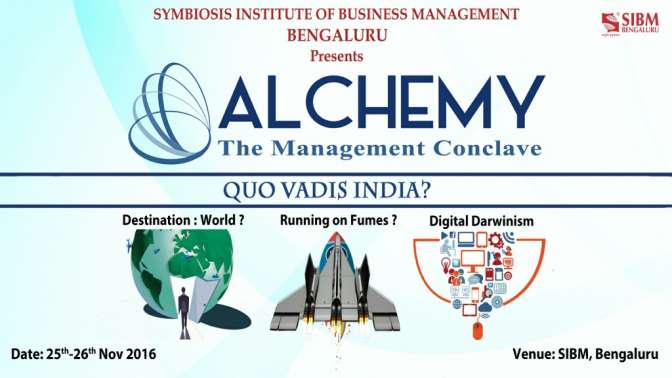

Symbiosis Institute of Business Management (SIBM) Bengaluru recently hosted its Annual Management Conclave, Alchemy 2016 – a two day event wherein eminent speakers from diverse industries share a common platform to share their views on where they see India in the distant future. This year’s theme for Alchemy was Quo Vadis India which translates into ‘Where are you going India’. […]