- Textile industry contributes nearly 14 per cent of the total industrial production of the country.

- It also contributes around 3 per cent to the GDP of the country.

- This sector is the second largest employer after agriculture.

- India earns about 27 per cent of its total foreign exchange through textile exports.

- In the last three years, the sector has attracted a total investment of US$ 5,770 million.

- The major raw materials for the textile and apparel industry include cotton, jute, silk, wool and man-made fibre.

- Indian Textile Market is growing at CAGR (Compounded Annual Growth Rate) of 10 per cent, is expected to reach $221 billion by 2021.

- Production of Raw cotton grew to 35.3 million bales (approx. 7700 Kg) in 2011-12 from 28 Million bales (approx. 6100 Kg) at a CAGR of 4.7per cent.

- The Fabric production has grown at a CAGR of 5 per cent over the last 10 years. Further, Cotton Fabric constituted 50 per cent of total fabric production.

- In 2011, apparel had a major share of 69 percent of the overall market as disposable income and usage of credit card & debit card among middle-class people increased over the years.

- Government has established 75 Apparel training and design centers across India to increase technical skills in apparel industry.

- The apparel sector has over 25,000 domestic manufacturers, 48,000 fabricators and around 4,000 manufacturers/exporters. Over 80 percent of the total units are small operations (less than 20 machines) and are either proprietorship or partnership firms.

- Indian Textile industry is mostly unorganized and fragmented. The organized players being Welspun India Ltd, Alok industries and Arvind mills.

- Over the years India’s share in the world trade has increased from just $4.7 Billion in 1990 to $31 Billion in 2011 and is growing at an annual rate of 10 per cent since 2005. The major export commodities are readymade garments, cotton textiles, and man-made textiles.

- Abundant availability of raw material: India has enough production of cotton, jute and other raw material necessary for textile industry. India has the largest area under cotton cultivation and also produces nearly twenty three types of cotton.

- Low cost and skilled labour: India has low labour cost and vast pool of skilled and unskilled labour. India has skilled manpower in both technical and management fields. The textile industry is the second-largest employment generating industry in both rural and urban areas, after the agriculture industry employing nearly 35 million employees.

- Lower lead time: Fully established textile value chain from fibre to cloth to garment exports in India, cuts down the lead time for production and reduces the shipping time. Flexibility and ability to produce customized apparel has been other important factors for textile industry. Support for technology upgradation and good quality are also the other important factors.

- Increasing Investments: Over US $ 35 billion of investments have been made in the textile and clothing sector during the last 4 years. Indian textile industry accounts for about 24 per cent of the world’s spindle capacity and eight per cent of global rotor capacity. India has the highest loom capacity (including hand looms) with 63 per cent of the world’s market share, making it an attractive industry to invest in future too.

- Textile machinery industry: This supporting industry helps in converting raw yarn into cloth, and India being a traditional textile industry has support of efficient machinery industry.

- Training: India has built the sufficient infrastructure in various textile departments like design, production, sourcing and merchandising. Various institutes like National Institute of Fashion Technology, Indian Institute of Technology and Apparel training Institutes offers many courses in Textile Engineering, 75 such apparel training and design centre have been established across India.

- IT industry: It would be supporting industry in terms of logistics, packaging, documentation.

- Leather Industry: It is a related industry to textile industry. Growth of one industry would definitely affect the other.

- The textile industry is vertically-integrated across the value chain and extends from fibre to fabric to garments.

- Dominated by unorganized sector: The organized sector contributes more than 95 per cent of spinning, but hardly 5 per cent of weaving fabric. Small Scale Industry (SSI’s) performs the bulk of weaving and processing operations. The unorganized sector forms the bulk of the industry, comprising handlooms, power looms, hosiery and knitting, and also readymade garments, khadi and carpet manufacturing units. The organized sector contributes merely 3 per cent to the total fabric production of the country, rest by the unorganized sector.

- Highly competitive and fragmented: The existence of large number of small players makes the Indian textile industry extremely competitive. The textile segment is highly fragmented and many large textile companies are also conglomerates of medium-sized mills.

- Entry of foreign players: Many Multinational Companies like Banana republic, FCUK, GAP have entered Indian textile market in distinct areas. The intense competition within industry propels the firms to work in order to increase production.

- During 2012-13, the country’s textiles exports stood at USD 34 billion. For the current fiscal, the ministry has set an ambitious exports target of USD-50 billion. The growth factors are

- Rising demand in exports: The sector has also witnessed increasing outsourcing over the years as Indian players moved up the value chain from being mere converters to vendor partners of global retail giants. The strong performance of textile exports is reflected in the value of exports from the sector over the years, in FY12, textile exports jumped by 19.4 per cent to USD33.2 billion.

- Increasing domestic consumption: Rising incomes has been a key determinant of domestic demand for the sector; with incomes rising in the rural economy as well, the upward push on demand from the income side is set to continue.

- Growing Population: By 2010, India’s population had close to doubled compared to figures 30 years before. India’s growing population has been a key driver of textile consumption growth in the country. It has been complemented by a young population which is growing and at the same time is exposed to changing tastes and fashion

- Central Silk Board Act, 1948

- The Textiles Committee Act, 1963

- The Handlooms Act, 1985

- Cotton Control Order, 1986

- Development of the textile sector in India in order to nurture and maintain its position in the global arena as the leading manufacturer and exporter of clothing.

- Maintenance of a leading position in the domestic market by doing away with import penetration.

- Stressing on the diversification of production and its upgradation taking into consideration the environmental concerns.

- Development of a firm multi-fibre base along with the skill of the weavers and the craftsmen.

- 100 per cent FDI (automatic route) is allowed in the Indian textile sector.

- SITP was approved in July 2005 to facilitate setting up of textiles parks with world class infrastructure to promote apparel exports. 12 such locations have been approved.

- Free trade with ASEAN countries will boost exports.

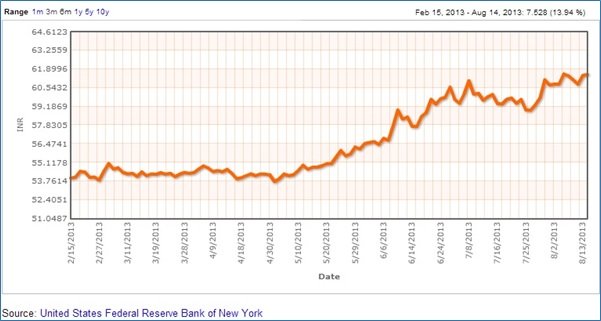

- Rupee fluctuations have made export planning for long term difficult.

- As India is heavily dependent on monsoon for irrigation, it can affect textile industry if in case our country goes through lean phase of monsoon because in that case jute and cotton production will be seriously impacted upon.

|

S.No.

|

Forces

|

Effect (Positive if reduces the threat, negative if increases threat)

|

Overall

|

|

1

|

Demand-side economies of scale being enjoyed by large domestic retailers due to distribution networks and customer base

|

Positive

|

Low to medium

|

|

2

|

Supply-side economies of scale of large retailers

|

Positive

|

|

|

3

|

Low switching costs due to strength of apparel manufacturers

|

Negative

|

|

|

4

|

Challenges in establishment of distribution channels due to high cost of prime real estate

|

Positive

|

|

|

5

|

Cost disadvantage to foreign players due to knowledge and experience of established local players

|

Positive

|

|

S.No.

|

Forces

|

Effect (Positive if increases the power, negative if decreases the power)

|

Overall

|

|

1

|

Buyer to supplier ratio is low. So, retailers can leverage their size to source from multiple suppliers

|

Positive

|

High

|

|

2

|

Purchase volumes are large. So, retailers have power over suppliers

|

Positive

|

|

|

3

|

Threat of backward integration is high especially in case of foreign players as it will help them cut costs

|

Positive

|

|

S.No.

|

Forces

|

Effect (Positive if increases the power, negative if decreases the power)

|

Overall

|

|

1

|

Large number of small suppliers; Limited number of large suppliers

|

Neutral

|

Medium

|

|

2

|

Low production volumes due to high fragmentation

|

Negative

|

|

|

3

|

Ambition of large suppliers of forward integration into retail

|

Positive

|

|

S.No.

|

Forces

|

Effect (Positive if reduces the threat, negative if increases threat)

|

Overall

|

|

1

|

High availability of substitutes in various forms (ex: low-cost custom made clothing)

|

Negative

|

High

|

|

2

|

Low switching costs to the consumer

|

Negative

|

|

S.No.

|

Forces

|

Effect (Positive if increases rivalry, negative if decreases rivalry)

|

Overall

|

|

1

|

Increased opportunities with rapid growth

|

Negative

|

Medium

|

|

2

|

High concentration in unorganized sector; Growth in organized sector

|

Positive

|

|

|

3

|

Limited product differences per segment but is increasing

|

Positive

|

|

Company

|

Business Areas

|

|

Aditya Birla Nuvo (comprising Madura

Garments, Pantaloons and Jayashree Textiles)

|

Madura garments and Pantaloons-Lifestyle

Market

Jayashree textiles-domestic linen and

worsted yarn

|

|

Alok Industries ltd.

|

Home textiles, woven and knitted apparel

fabric, garments and polyester yarn

|

|

Arvind Mills Ltd.

|

Spinning, weaving, processing and garment

Production

|

|

Bombay Dyeing

|

Bed linen, towels, furnishings, fabricator

suits, shirts, dresses and saris in cotton

and polyester blends

|

|

Garden Silk Mills Ltd.

|

Dyed and printed fabric

|

|

ITC Lifestyle

|

Lifestyle Market

|

|

Raymond Ltd.

|

Worsted suiting, tailored clothing, denim,

Shirting, woolen outerwear

|

|

Reliance Industries Ltd.

|

Fabric, formal menswear

|

|

Vardham Group

|

Yarn, fabric, sewing threads, acrylic fibre

|

|

Welspun India Ltd.

|

Home textiles, bathrobes, terry towels

|

- It is the largest branded apparel player in India. It is also the largest manufacturer of linen fabric in India. It has a large retail presence through 1443 stores spanning across 3.7 million square feet. It has combined annual revenue of approximately 1 billion USD from the textile business.

- ABNL also acquired Pantaloons to further strengthen its retail portfolio.

- Madura Fashion and Lifestyle is the largest branded apparel player in India with strong brands such as Louis Phillipe, Allen Solly, Van Heusen, Peter England etc. in its ambit.

- Pantaloons: Customer reach stands at 69 Pantaloons stores and 26 factory outlets.

- Jayashree Textiles: It is the domestic market leader in Linen segment. It brands and promotes linen fabric under the brand name “Linen Club”. It has revenues in excess of Rs. 1000 crore.

- Capacity built over years has led to low cost of production per unit in India’s textile industry; this has placed the country’s textile exporters in line with the key global peers. On the contrary this has led to a medium level of power with the suppliers.

- India has a fully established textile value chain from fibre to cloth to garment exports which cuts down the lead time for production and reduces the shipping time. With favouring conditions of labour, raw material, technology and high investments, the industry is well fed with the required inputs.

- The supportive infrastructure required for the industry is aptly been satisfied right from technological expertise to even the governments setting up of training institutes and policies. As the industry is predominantly unorganized, it has huge potential to be tapped into if it becomes more organised.

- The influence of buyer is pretty high considering the low buyer to supplier ratio, high volumes of trade and also because of the option of substitution. But the mounting demand conditions with growth in the potential buyer population ultimately support the industry’s overall performance.

- Boost in the consumption of both domestic and imported products due to the rise in the disposable income levels, consumer awareness and prosperity to spend, has created more growth opportunities for textile industry.

- The textile industry has been an attractive option for investments, with the cotton textile segment accounting for around 75 per cent. It has shown an increasing trend be it the market size, production or exports which makes investors further optimistic about it.

- Thus, looking at the present scenario it is evident that textile industry in India provides for promising growth prospects for the future.

You might like reading:

Local currency depreciation – Do we have a panacea?

When Indian currency is witnessing the worst ever depreciation, it remains interesting to explore what measures could help finance ministry to contain the same. As depicted in the diagram, Indian Rupee has depreciated by almost 13-14% against dollar and that has further jeopardised the actions of Indian Finance Ministry which was juggling hard already to improve India’s GDP, which managed […]

Complexities in Discounted Cash Flow

Discounted Cash Flow (DCF) analysis stands as a widely employed financial valuation technique, offering insights into the prospective worth of an investment based on future cash flows. Despite its widespread use, the method grapples with several intricacies and critiques. This article aims to delve into the key challenges linked to Discounted Cash Flow analysis. Future Cash Flow Predictions: A pivotal […]