In his book Eclipse, Prof. Arvind Subramanian has predicted that the Chinese Renminbi will replace the US Dollar as the world’s reserve currency by the year 2021. In my view, that period might come even sooner.

China has long been accused of being a currency manipulator by the western countries. The process it follows is quite interesting, yet simple: Being an export driven economy, China enjoys a current account surplus which implies it is a net foreign exchange earner, i.e. Exports are more than Imports. Due to this, there is inflow of USD into the Chinese economy. Now in order to maintain the exchange rate, the People’s Bank of China (PBOC) buys the Dollar from the market by selling Renminbi thereby increasing the supply of Renminbi in the market. Increased money supply fuels inflation and in order to curb it, the central bank then issues treasury bills at extremely low interest rates to commercial banks, thereby limiting the excess supply in the market. Thus by a single stroke, it is able to fix foreign exchange rate as well as inflation. The negative side is that it reduces borrowing costs leading to investments in real estate (fuelling a property bubble) as real deposit rates are negative.

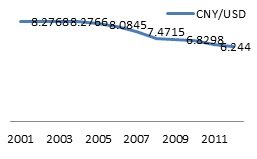

However, China, in its 12th five year plan is undergoing a transformation from a fixed asset based to a consumption driven economy. With foreign reserves of 3.3 trillion USD, China is no longer looking to increase Dollar holdings instead it is just trying to maintain the level. On the contrary, in order to fuel domestic consumption during the Lunar New Year, the PBOC pumped in 450 billion Yuan in the money markets to keep interbank lending rates low, the highest single day capital infusion in the history of its central bank. Furthermore, China is allowing its currency to move freely in recent years which can be seen by the changes in exchange rate from 8.3 Rmb/$ in 2001-02 to current level of 6.24 Rmb/$ and appears sincere in its efforts to have a more market driven currency in future.

But why should an export driven economy allow its currency to appreciate? China needs its currency to be acceptable in the world markets which is possible only if it is trading near its true value. This will help Renminbi to be a substitute to Dollar as reserve currency. For instance, the US today has the liberty of printing as much dollars as it needs whether to bail itself out or for quantitative easing. China seeks the same power.The steps that China has taken support this view.

From 2009 onwards, China has allowed movement of Rmb outside its borders resulting in almost 14% of China’s trade being settled in Rmb today. The USD accounts for 60% of trade settlement worldwide. China has allowed its exporters and importers to settle trade in the local currency and avoid usage of USD. The setting up of clearing bank in Taiwan and an offshore currency market in Hong Kong facilitate the same. According to one estimate, London today has around 14 billion Yuan of deposits! Even retailers like TESCO have decided to trade with their Chinese vendors in Renminbi, signifying its rising acceptability.

The Chinese Yuan is expected to appreciate in recent years leading to premium pricing of low interest paying Yuan denominated bonds in off-shore markets like Hong Kong. High demand for these bonds is a positive sign for the Chinese aspirations. The authorities recently allowed about 70 billion Yuan of off-shore investments in the local financial market in the mainland and greater China region and have promised to allow another 200 billion Yuan in near future. While the flow of currency is still highly regulated, yet there is significant inflow and outflow of Yuan post 2009, reaching a slowdown in 2011 before again rising last year.

China still has to answer the question of capital account convertibility in order to realise its dream. This poses many challenges. For instance, the reaction of the wealthy elite and what percentage of their assets will they start holding in foreign currency and its impact on the Renminbi. More importantly, will Chinese companies be able to sustain their exports in case of a sharp uncontrolled appreciation of Rmb and its long term impact on Chinese foreign reserves? Furthermore, labour costs have been rising steadily all across China in recent years which may further affect its economy. It is for this reason that the leadership in Beijing has adopted a slow and cautious approach.

Despite these issues, the discovery of Shale gas reserves in US has turned the table in China’s favour. US will no longer be dependent on Africa and Middle-east for its energy needs resulting in an imminent change in its policy for the region. The vacuum that will be created will be filled by none other than China. India, its contemporary in emerging economies, is not in a position to take advantage of the situation. China has currency swap agreements with 20 nations in the region including Kenya and UAE. Furthermore, its heavy infrastructure investment in energy rich poor African nations has given China the much needed financial and political muscle in the region. China on its part is insisting on trade in Yuan and asking these countries to have their foreign reserves in the form of Renminbi. Few nations like Zimbabwe are willingly taking steps in this direction, paving the way for the dawn of the Chinese century.

Whether the status of reserve currency for China leads to creation of a hard or soft power may emerge as a critical question in future. Politics, not economics, may yet have the final say in deciding the outcome.

You might like reading:

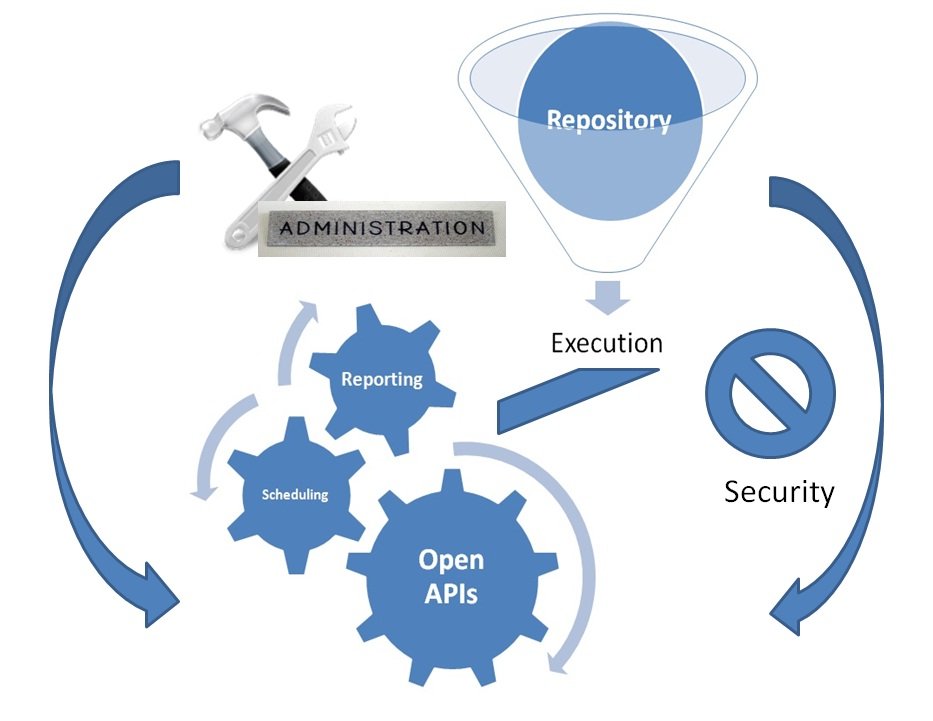

Rethinking Dashboard Governance – the future of IT organizations

The increasing realization gaps and performance gaps across IT organizations is taking attrition levels to new highs. Also these gaps are wrongly decoded and IT governance has confined itself to technological advances rather than restructuring the organizations; which has remained a myth of late. Today IT organizations require enterprise-wide change in order to effectively align them with businesses and profit […]

4 Ads that highlight the beauty of nature

There are some print ADs that simply steal your breath away, more so when they depict nature in a way that is rarely seen. Here’s a look at 4 such campaigns that steal your breath away ! Campaign 1: Romantic FM The beauty of this AD lies in the fact that it focuses on creating an universal appeal set in […]