China, the world’s second largest economy, has long been accused of manipulating its exchange rate with the dollar in order to boost its exports. In fact the US senate considers that the nearly 300 billion USD trade deficit that US has in its trade with China is largely due to Beijing’s policy of exchange rate. However, off-late the Chinese Yuan has significantly appreciated. Are we seeing a change in policy and what could be the results?

The Chinese currency works in an interesting manner and is allowed to fluctuate 0.05% on either side of the reference rate that the central bank (People’s Bank of China) sets daily. The Yuan has significantly appreciated to about 6.3636 against the dollar and its 12 month future price is trading at 6.40 against the dollar in the Hong Kong exchange. This is a marked change from the days of fixed currency exchange rate that Beijing has generally followed. In fact, Beijing had frozen its exchange rates in 2008 during the last crisis while it has now stated that it will maintain a more flexible exchange rate in the midst of this current crisis. So, what brings about this change in heart?

There is little doubt that China is heading towards a more open economy. China Securities Regulatory Commission (CSRC) recently cracked down on an investment company for insider trading that generated profits of 67 million USD. The interesting part of this crackdown was that it was widely publicized in the state media, which was quite different from the way Chinese normally go about their business. It is widely estimated that there have been rampant insider trading worth Rmb 200 billion (Reminbi) in the Chinese markets from 2002 to 2010.The CSRC, headed by Guo Shuqing, has specified quite clearly that he wants to clean up the Chinese markets.

The US senate has also made a legislation to penalize Chinese exports due to Beijing’s policy of undervaluing its currency. Moreover, the Chinese exports has fallen by about 35% this year and growing sentiments in Europe and US about Chinese goods flooding their market and loss of jobs may have also compelled the authorities to allow the Yuan to appreciate against the dollar. This will help China to answer critics and suggest that it is now following a fair policy in trade.

A weak Euro and a rising dollar have also raised questions about the viability of dollar as a reserve currency in the future. Can the Yuan fill that gap? There is little doubt that the Yuan provides a great deal of stability and a floating exchange rate is a step in the same direction though being the reserve currency will take away the advantage in exports that China enjoys so there is little doubt that Beijing will not prefer that at this moment. While that remains to be seen in future, there is little doubt that the Guangdong model has taken precedence over Chongqing model in Beijing for the moment.

Food for thought: Will you prefer Yuan as reserve currency against the dollar?

You might like reading:

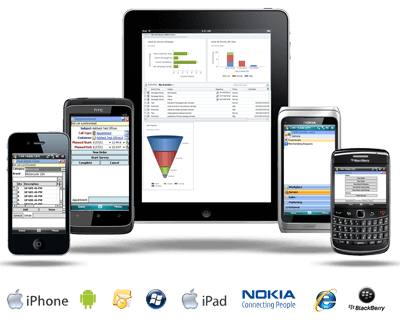

Mobile Banking and M-pesa in Developing Countries

With the advent of technological innovation, life of mankind has changed significantly. Mobile phone is one such innovation that has brought all humans closer with their ability to talk, share and communicate. Now we have such a huge platform to connect with each other and this platform can be further used in several other areas. One such use is Mobile […]

Tete-a-tete with the man behind SLI – Saurabh Saha

Mr. Saurabh Saha is a product professional with close to a decade’s experience in product development,product management,project management and entrepreneurship. He has been a part of the startup ecosystem for close to a decade in intrapreneurial and entrepreneurial roles.He also heads the entrepreneurship and innovation cell for SLI a think tank on Sustainability that operates across India and Europe. 1.From […]