Traditionally, companies have focused on studying the market by undertaking market research and getting information about the bottlenecks, opportunities, market forces etc. Once the market forces seem favorable (or at least to a company in conjunction with its resources), the company ventures into the market with its own product/service to serve a particular segment of that market. If things go well, the firm reaps profits thereby attracting newer firms to enter into the segment which will subsequently erode away all the economic profits. The firms then look to maintain/improve their position in that particular market segment while simultaneously looking out for other greener pastures.

A recent market research conducted by me (spanning close to 200 respondents) found that there are plenty of companies offering Customer Relationship Management (CRM) products to real estate builders, developers, brokers and all the intermediaries who are involved in the purchase-build-sell cycle. While this is nothing out-of-the-ordinary, the patterns of responses that I got while conducting the survey definitely was. The real estate players were classified as small, medium and large (based on their annual turnover) and their responses were grouped accordingly. In the case of small players, those with an annual turnover of less than Rs. 10 crores, it was found that they

- primarily use Excel worksheets to manage their leads’ data

- are aware of the existence of CRM but are not interested to move over from Excel

- use their experience to distinguish between true buyers and fake buyers (those who contact real estate players and do not seem interested afterwards)

- are skeptical of the use of technology to better manage their data

- are worried about the loss of confidential information

- do not have the resources to train employees on the new platform; they are of the opinion that this training of employees on a new platform, in this case CRM, will lead to lower productivity as training involved investment of significant time and money

On the other hand, in the case of the large real estate players, those with an annual turnover of more than Rs. 25 crores, it was found that they

- use a mix of Excel, databases and CRM to manage their leads’ data

- rely extensively on technology to manage their day-to-day processes

- are unhappy with the existing system (they want additional and customized features) but still do not want to try out a new vendor; the reasons for persisting with the existing system include familiarity with the system, new software would require training of employees which is costly both in terms of money expended as well as lowering their productivity

The medium level real estate players, those with an annual turnover between Rs. 10 crores and Rs. 25 crores, had a mix of Excel, databases and CRM (depending on which end of the spectrum they belong to) and were not interested in trying out a new CRM product (See Exhibit-1).

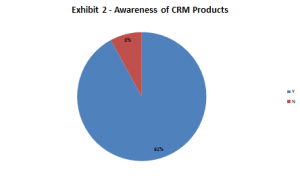

A closer understanding of the CRM players in the market revealed that all their offerings were more or less on the same lines with features such as social media tracking, web portal integration, SMS alerts to sales force for tracking the leads, IVR integration for making calls easier, financial forecasting etc. This is reflected through a whopping 92% of the respondents stating that they are aware of the existence and usage of CRM products (See Exhibit -2). It was also found that all these players focused their attention towards the significant features and benefits of their products. While it is necessary to channel a good amount of energy of your own products’ capabilities, it is important to realize that the users are reluctant towards the purchase because they

- fear loss of confidential information

- believe that the investment will take a toll on their employees’ productivity

- believe that they can manage their data with Excel alone

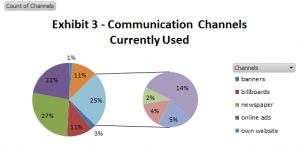

It emerges from the above discussion that the marketing effort should focus on appeasing the fears of the players regarding the security of the data and also instill the much needed confidence regarding the usage of CRM and how it is superior compared to the current system. Unfortunately, all the CRM providers miss this point and they seem to market only the features of their products without addressing the underlying issue (See Exhibit-3). This is a mind-boggling insight – An entire industry, comprising of players selling CRM products to real estate players under the claim that they make their lives easier, fails to address the underlying issue thereby leaving a whole market untapped. It is precisely due to this reason that these CRM providers are unable to sell their products in the quantities that they would love.

It is therefore imperative for any company to first create communication channels that addresses the above mentioned issues before they venture into marketing their offerings. The earlier one does this, the larger will be one’s market share and the ensuing profits. This just goes to reiterate the fact that blue ocean strategy is difficult to create and hence companies are comfortable adopting the red ocean strategy. But this case is even more startling because adopting a red ocean strategy helps none and everyone’s trying to find out why (because they are myopic to the success of their product and seem careless regarding the underlying issue). It is quite interesting to see when the real winner will emerge!

Exhibit 1 – Sub-set of responses from real estate players for not using/adopting CRM:

* The company names are deliberately labeled as “ABC” to preserve confidentiality

| Company Name | Data usage methodology | Reason1 for non-usage | Reason2 for non-usage |

| ABC | Excel | Can’t train employees | Wastage of time and resources |

| ABC | Excel | experience helps to identify true buyers which is very limited | |

| ABC | Excel | data security issues with tech | |

| ABC | In-house software | comfortable with existing software | |

| ABC | Excel | experience helps to identify true buyers which is very limited | small size of the firm makes such investment in CRM unncecessary |

| ABC | Other software | comfortable with existing software | |

| ABC | Excel | experience helps to identify true buyers which is very limited | |

| ABC | Excel | experience helps to identify true buyers which is very limited | technology difficult to learn |

| ABC | Other software | small size of the firm makes such investment in CRM unncecessary | |

| ABC | Other software | confidential info – threat of stealth | |

| ABC | Excel | Can’t train employees | Wastage of time and resources |

| ABC | Excel | comfortable with usage | |

| ABC | Excel | experience helps to identify true buyers which is very limited | |

| ABC | Other software | data security | not really sure about the capabilities of CRM |

| ABC | Excel | potential technology crash | |

| ABC | Excel | Can’t train employees | data security |

| ABC | Other software | Can’t train employees | extremely comfortable with existing system |

| ABC | Excel | experience helps to identify true buyers which is very limited | firm does not have the scale to invest in CRM |

| ABC | Database | Can’t train employees | Wastage of time and resources |

| ABC | Other software | extremely comfortable with existing system | Wastage of time and resources |

| ABC | Other software | existing product is far superior than CRM | |

| ABC | Database | new software will require data migration | data security issues with tech |

| ABC | Database | CRM functionalities are too complex to use | |

| ABC | In-house software | experience helps to identify true buyers which is very limited | |

| ABC | Database | extremely comfortable with existing system | |

| ABC | Excel | data security | credibility issue |

| ABC | Excel | experience helps to identify true buyers which is very limited | data security |

| ABC | Excel | extremely comfortable with Excel | not interested in trying new technology |

| ABC | Database | in-house development makes the existing system meet the exact needs | |

| ABC | Excel | Can’t train employees | |

| ABC | Excel | experience helps to identify true buyers which is very limited | Can’t train employees |

| ABC | Excel | data security | credibility issue |

| ABC | Excel | extremely comfortable with Excel | not interested in trying new technology |

| ABC | Other software | extremely comfortable with Excel | not interested in trying new technology |

You might like reading: Cross culture communication in corporate world

You might like reading: Marketing to bottom of the pyramid

Tags: Bottlenecks communication CRM Market Research real estateYou might like reading:

XIMB hosts Xpressions: The biggest B-School fest of Eastern India

“Xpressions’15”, the flagship Management-Cultural fest of Xavier Institute of Management, Bhubaneswar, concluded successfully on 15th November 2015. Spread over three days, 13th, 14th and 15thof November, the fest witnessed a huge number of participants from reputed colleges such as XLRI, IIM Bangalore, IIM Shillong, Great Lakes InstiturOf Management, IMI Delhi, MDI Gurgaon, etc. Around 3000 studentsparticipated in various events such […]

Strategic Change in the e-commerce Industry

With e-commerce booming at the rate of 16% this year as compared to the growth in physical retail store domain of 1.5%, it is undoubtedly the fastest growing sector where all top retailers want to invest. Unlike in a traditional market where ‘bricks and mortar’ are usually required, any vendor that can connect to the network can sell a product […]