Well this article is not about Sex- it is about the Indian stock exchanges(S-EX) that are going to see lot of action in the coming few months. The main reason for this is the entry of MCX, along with re-launching of DSE (Delhi Stock Exchange).

It has been exactly 17 years since NSE broke the stronghold of 137 year old Bombay Stock Exchange to emerge as the leading exchange of the country. At present, NSE dominates with 83% in equities trading and 75% in derivatives market trading, BSE accounting for the rest. MCX , which already operates the largest commodities exchange in India got the approval to start its own exchange in July after winning a legal battle with SEBI. The strong hold that MCX has in bullion and currency futures market is very similar to NSE’s strong hold in equities market. MCX is promoted by FTIL Group (Financial Technologies India Ltd) which holds 26% of the equity in the company.Ironically, MCX itself is also listed on NSE and BSE platforms !

So how will the battle shape up? Can all the four exchanges survive together or will it lead to closure of a few exchanges? The whole game will depend on the technology and transaction charges and how fast these new exchanges can be in terms of the existing NSE or BSE platforms. If we consider the status of these two exchanges in terms of listings, it shows the following figures:

|

Exchange |

No. of listings |

Year of establishment |

|

National Stock Exchange (NSE) |

1646 |

1992 |

|

Bombay Stock Exchange (BSE) |

5133 |

1875 |

The timing of the exchange war is even more significant considering that electronic and algorithmic trading is increasingly popular in India and it may all boil down to speed which DSE claims will be its forte. At the same time, the dominant positions of NSE and BSE have been built over time and cannot be changed overnight. Studies have shown that normally one exchange emerges as the dominant player in any country- will the story get repeated in India this time?

The main advantage for traders might be in the transaction costs that are expected to go down sharply. There has been increasing demand to reduce the 0.125% Securities Transaction Tax, that forms the bulk of trading costs. With four strong players, this demand may now gather more voices as it also has the sympathy of SEBI which has been in favour of reducing these costs. Both BSE and NSE are lowering costs to a large extent and BSE has 75% lower transaction charges in Futures as compared to other exchanges – leading to increasing probability of a price war in near future. Other challenges that these exchanges will face is the infrastructure support they will need – an area where NSE rules with network of 200,000 terminals all across the country; BSE comes a distant second with 40,000 terminals. Moreover, there is increasing talk of adopting SOR (Smart Order Routing) which will enable investors to get the lowest price across exchanges. However, this would require a single clearing house for these exchanges, an event that looks unlikely in the short run.

MCX already seems to have drawn the first blood in this battle when it forced NSE to start charging transaction costs over currency derivative segments after it lodged a complaint to the Competition Commission of India. Whatever happens, this is one quadrangular battle to watch out for!

Food for thought: Will NCDEX also enter equities exchange in future following the footsteps of MCX ?

You might like reading:

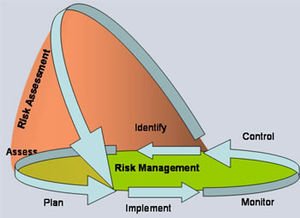

How to manage risk in Project Management !

Introduction Often tagged with a negative connotation, risk is looked upon as a negative entity affecting the course of project management process. Any experienced project manager would say otherwise. Unlike the traditional notions, risks are not always bad. There are good risks too. Hence risks are classified as Positive and Negative risks. Akin to negative threats which represent threats, positive […]

Chinese Smartphones in India – Are they in for the long haul?

Few years back, “smartphone” as a concept belonged to giants like Samsung, Apple and the likes (purely in terms of market share). It was all about brand value, high-end components, better display, better camera and better things that we (non-geek community) possibly don’t know about! But consumers had to pay a price – a significant one I may add if […]