While the entire decision of ‘who will succeed Ratan Tata?’ was being made, I had probable names in my head and Cyrus Mistry wasn’t even close to being a guess. Against all those hunches, Cyrus Mistry indeed is the next chief of the sprawling Tata empire.

Now, here I present my personal opinions on this selection. The $83 billion Tata group is an empire which has products from salt to soaps to software under its ambit. Incumbent Ratan Tata has set a legacy so high in standards, not only for his own company but for the entire business community, that a person with a significant but unrelated experience restricted to one industry raises a doubt in my mind to be placed at the helm of the group and take charge of the reign of this conglomerate. Cyrus Mistry’s professional experience maybe at the best in one industry, but I had expected a more diversified profile at the least. Nonetheless, a one year period with Ratan Tata might provide a good hold of the intricacies of this business to him. Secondly, Tata group is known in business for adapting to competition, in fact setting a league for competitors. Cyrus Mistry with this level of experience might not be adventurous enough to immediately expand and get into any new ventures.

Amid the current scenario globally, particularly in the US and the Eurozone and the fact that 58% of Tata group’s revenues stem from the overseas markets make it all the more important for this new entrant to hold upto expectations of the shareholders, customers and most importantly command respect in the entire Tata Group for himself as a group chairman. Any discrepancies in the management operations could make him a defoliant for all the stakeholders mentioned above and impact the business house. Mr. Mistry has not headed any Tata group company so far. Running a construction business with $2 Billon revenues is very different from running a $83 Billion business empire which derives majority revenues from overseas markets. The company’s growth has already slowed due to the debt crisis in Europe and the continuing slow recovery of the US economy. The two markets, if combined account for two third of the company’s business. Therefore this point of time holds utmost significance for the group to enter newer markets and diversify the product base. Tata steel, Tata motors and Tata Power are in a dire need of a structural revamp, owing to the financial condition of these.

The only reason of this choice I can point out is that Mr Mistry’s Father’s construction firm is the largest shareholder of Tata Sons with a stake of 18% and on the board for the past five years. There is also a healthy connection between the two families as the media pointed out. Business standard rightly mentions that ‘Cyrus P Mistry is a relatively unknown commodity’.

But, I still believe that passing an instant judgement would not be right; we need to watch what the MD of Shapoorji Pallonji, his family construction business, does with Tata Sons. Acceptability is one thing, his winnability another.

You might like reading:

XLRI Placement Report 2015: 100% Placements in 3.5 days

Xavier School of management (XLRI) has achieved 100% placement in 3.5 days for its current outgoing batch of 2013-15, the largest batch to ever sit for final placements in the history of XLRI. Placement 2015 at XLRI Jamshedpur was completed in a record time of 3.5 days with probably the shortest ever recruitment season in the institute. Key Trends in […]

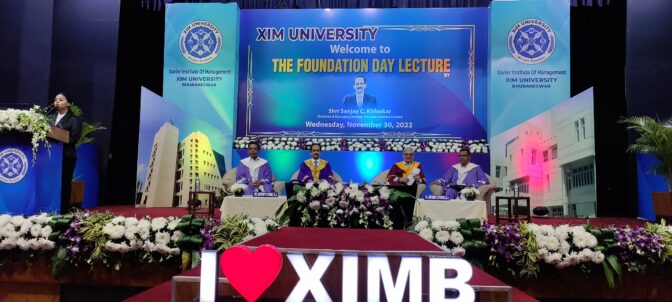

XIM Bhubaneswar: Foundation Day 2022

“Faith in oneself and continuous hard work is the key ingredient for a successful business conglomerate”- – Shri. Sanjay C. Kirloskar Xavier Institute of Management, XIM University, Bhubaneswar celebrated its Foundation Day Ceremony on the 30th November 2022, at the Old Campus, Bhubaneswar. XIM University has been scaling great heights with the support and dedication of all the stakeholders with […]