-

Editorals wrote a new post

Inflation has always been a worry and threat to every long-term investors. Any investment which is inflation-protected can protect investors from the loss of purchasing power that inflation can cause. In 1997, US first issued inflation-protected securities called Treasury Inflation-Protected Securities, or TIPS. TIPS are sometimes also known as Treasury Inflation-Indexed Securities. Credit risk and nominal interest risks are the two risks which have direct impact on investment decision of long-term investors for traditional fixed income securities. Investors can easily manage credit risk but nominal interest rate can’t be easily managed as it is difficult avoid the impact of inflation on securities. TIPS tries to overcome this by keeping pace with inflation as defined by consumer price index (CPI). TIPS are considered as extremely low-risk investments because they are backed by US government and their par value rises with inflation while their interest rate remains fixed.

TIPS can be purchased directly from government through Treasury Direct System (TDS). The minimum investment required is $100 with either 5-, 10- or 30-year maturities. Interest on TIPS are paid semi-annually. For example, let’s consider a $10,000-US TIPS was purchased with a 4% coupon. Also assume that inflation during the first year was 10%. So the face value of TIPS would adjust upward by 10%, to $11,000. As coupon payment (4%) is based on face value, so it is also adjusted and are paid $440 semi-annually. Hence both the bond’s face value and interest payments are protected against inflation. Thus TIPS protect investors from inflation but nominal bonds do not. But during deflation and negative inflation, nominal bonds are more attractive relative to TIPS because future interest payments become more valuable on a real basis. The trade-off between traditional and TIPS bonds is that latter offer much lower rates than traditional bonds. TIPS may have negative rates as investors may have to take a certain loss of purchasing power due to protection on inflation. Yields from conventional and TIPS bonds can be represented by following expressions:

TIPS Nominal Yield = Real yield + lagged actual inflation rate

Treasury Nominal Yield = Real yield + expected inflation rate + inflation risk premiumHow to purchase TIPS?

TIPS can be purchased in the same way as other fixed Income securities are purchased. TIPS can be purchased either directly as individual bonds through a broker / the US Treasury or owning the securities through mutual funds. Purchasing individual bonds are suitable for those investors who are seeking to match specific cash flow needs and purchasing bonds directly from Treasury is the best (cheapest) option for this. Buy and hold investors have advantage of purchasing TIPS directly as they can lock in a known real rate of return and a final maturity date. However, keeping TIPS directly creates problems for taxable investors as there are often mismatch between when adjustments to principal are taxed (current year) and when they are paid at maturity. Direct TIPS holders also face problems in reinvesting the semi-annual coupons in similar securities. Purchasing TIPS directly, however, allows investors to avoid the management fees associated with mutual funds.

Mutual fund can be the best option for the investors whose goal is to receive a fully diversified fixed-income portfolios of TIPS. Fixed income is important for investors of all sizes in the context of portfolio asset allocation. In the long run, fixed income securities have lower levels of return volatility but at the same time they also provide lower returns than equities. Investments in mutual fund provides investors to preserve the full purchasing power of assets involved in TIPS portfolios by automatic reinvestment of distributions. Investors of mutual fund of TIPS receive both the coupon and inflation adjustments in the same tax year. Thus, in order to maximize benefits from diversifications and to have proper exposure to assets, TIPS should be purchased through mutual funds. Purchasing TIPS through mutual funds for TIPS can add value over time by active management strategies.Who should invest in TIPS / Why TIPS

The benefits of investing in TIPS are:

1. Diversification Benefits:

TIPS play an important role in a diversified portfolio by providing a positive inflation –adjusted return for long-term investors. It’s a unique asset class that offers more opportunities to investors. For reducing the riskiness of the portfolio, TIPS play a major role. Although the fixed income securities provide lower returns than equities, but also provide much lower levels of return volatility and mostly helpful during the time of market stress when equities fall substantially.

Historically, TIPS have Low Correlation to Fixed Income and Equity Investments.

2. Low Risks

Conventional bonds are more risky than the TIPS. Thus, TIPS provide investors with a safer asset than has historically been available. As TIPS has only real interest rate risk, combining them with conventional bonds allows investors to disentangle inflation risk from real interest rate risk and thus to manage financial risk more efficiently.3. Lower Volatility Inflation Hedge

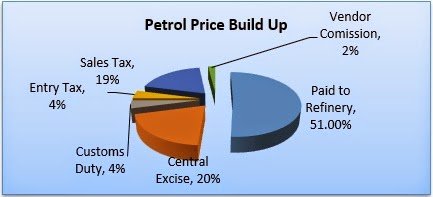

Among asset classes commonly used as inflation hedges, TIPS are the least volatile.Historically TIPS have Exhibited a Low Standard

Deviation of Returns

Asset Class

Annualized Return

Standard Deviation

Sharpe Ratio

TIPS

6.36%

6.20%

0.65%

U.S. Investment-Grade Bonds

5.21%

3.55%

0.82%

Foreign Govt. Bonds

4.77%

7.03%

0.35%

U.S. High-Yield Bonds

7.50%

9.84%

0.52%

U.S. Stocks

4.42%

15.51%

0.14%

Foreign Stocks

5.01%

17.65%

0.15%

Real Estate

10.71%

22.28%

0.37%

Commodities

6.18%

23.51%

0.16%

Factors affecting the demand of TIPS

Some of the factors that may affect demand for TIPS include:

▪ Inflation expectations

▪ Risk appetites

▪ Absolute real yield levels

▪ Flows into TIPS mutual funds

▪ Supply

▪ Expectation of strong CPI printsRates & Terms

TIPS are issued in terms of 5, 10, and 30 years. TIPS Inflation Index Ratios can be used to calculate the inflation adjustment to principal on previously issued TIPS. TIPS Inflation Index Ratio is defined as the ratio of the current CPI to the original CPI. TIPS can be held until maturity or sold before maturity.

TIPS Performance Factors

Return on TIPS is basically depends on two factors: real interest rate change and change in inflation.

Interplay of Interest Rates and Inflation

Changes in the interest rate impact the prices of the TIPS. But, unlike conventional bonds, TIPS prices are based on the real interest rates rather than the nominal interest rates and maturities tend to be longer. Inflation also impacts the performance. Positive inflation is good for TIPS and negative inflation is bad for TIPS. However, purchasers of TIPS in the secondary market or TIPS mutual funds must understand that the current market inflation expectation is already priced into the bond. Inflation ex-ante estimates must be less than the ex-post estimates to get benefited by the TIPS. Further, if inflationary pressures are causing rising rates, the picture becomes less clear.Unexpected Inflation

Real Interest Rates

Falling

Rising

High

Best

Uncertain

Low

Uncertain

Worst

Unexpected Nature of Inflation

Inflation is very difficult to predict. The predicted values are based on the historical data, which does not include the current economic scenario. Moreover, because of inflation, salaries and wages are raised which is taken as a positive factor, until the inflation eats the purchasing power. Because of this reason, it is better to include the securities protected against inflation to be included in the portfolio.Risks Associated with TIPS

Following are the risks associated with the TIPSType Of Risk

Explanation

Credit Risk

TIPS are issued by US government; therefore there is no credit risk.

Operational Risk

TIPS are not exposed to operational risk.

Market Risk

Not an issue for investors holding it until maturity. But, the moderate level of volatility has the potential to become an issue if the investor does not hold the bond till maturity.

Sovereign Risk

US government issued TIPS is having very low sovereign risk.

Liquidity Risk

TIPS are issued by US government; therefore there is no liquidity risk.

Interest rate Risk

Rare chance of deflation, or falling prices. This might occur during the depths of the financial crisis, when fears of a worldwide financial meltdown raised the possibility of deflation and led to a sharp decline in the prices.

Other Risk

CPI fails to track the actual inflation or the rising prices of products or services investor needs.

Impact of Taxes on TIPS

Income earned through investment is subject to taxes. Taxes do not differentiate between the real income and nominal income and re-exposed the indexed bonds to inflation risk. In the event of inflation and taxes it is possible that TIPS can have negative after-tax returns. All interest income and appreciation of the principal of an indexed bond are taxed as normal interest income, even though the appreciation of the principal only keeps the principal constant in terms of purchasing power. Even though the tax code brings inflation risk back to indexed bonds, the risk is small compared with nominal bonds. For every percentage point increase in inflation, the after-tax real yield on a nominal bond is reduced by a whole percentage point, while the after-tax real yield on an indexed bond is reduced only by the fraction of the marginal tax rate facing the investor of the bond.

Conclusion

Like conventional Treasury bonds, TIPS can decline in value over any short-term period. In other words, investors should not view a TIPS portfolio as a risk-free inflation hedge. To mitigate the impacts of unexpected and high inflation, investors should consider TIPS as a long term investment. In short term, both positive and negative real returns are possible. Given the current low-yield environment, the return outlook for TIPS is muted and likely to be more volatile than in the past. Nevertheless, the strategic case for bond diversification remains strong—including that for TIPS—given the uncertainty of the future inflation outlook. Clear understanding of the TIPS relation with inflation, interest rates and market expectations is important to make a well diversified portfolio. TIPS offer a lower volatility inflation hedging alternative. Many investors may find the features of TIPS mutual funds a more convenient way to invest in the asset class. The performance of TIPS during a rising rates period depends on the interplay of rising real interest rates, which negatively impact their prices, and unexpected inflation, which positively impacts their price. Bottom line, for long-term investors, including an allocation to TIPS is likely to improve diversification. As TIPS are one of the less volatile inflation hedges, they can be attractive to conservative investors.

About the Author:

Sumit Agarwal

He is presently pursuing his MBA from Indian Institute of Management, Ranchi with majors in finance and minors in Analytics, Operations and Marketing. Prior to this, he has worked in the steel industry for about 2 years. -

Editorals wrote a new post

-

Editorals wrote a new post

-

Editorals wrote a new post

-

Editorals wrote a new post

-

Editorals wrote a new post

-

Editorals wrote a new post

-

Editorals wrote a new post

-

Editorals wrote a new post

-

Editorals wrote a new post

- Load More Posts

Latest Articles

XIM hosts The Annual Budget Conclave 2023

- February 10, 2023

64th Batch of Bihar Police Training at IIM Bodh Gaya

- August 31, 2022

Groups

Friends

Jayita

@jayita_das

AKSHAT-JAIN

@akshat-jain

Muskaan-Agarwal

@muskaan-agarwal

Abhirup

@abhirup_bhattacharya

ishani-chaudhary

@ishani-chaudhary

nice read