|

S.No.

|

Store Code

|

Year

|

|

1

|

PNE001

|

1995

|

|

2

|

PNE002

|

1995

|

|

3

|

PNE003

|

1997

|

|

4

|

PNE004

|

1998

|

|

5

|

PNE005

|

2001

|

|

6

|

PNE006

|

2003

|

|

7

|

PNE007

|

2004

|

|

8

|

PNE008

|

2006

|

|

9

|

PNE009

|

2008

|

|

10

|

PNE010

|

2012

|

|

11

|

PNE011

|

2012

|

|

Category

|

Establishments (Nos.)

|

Employment(Nos.)

|

|

Shops

|

11,718

|

28,866

|

|

Commercial Establishments

|

22,925

|

193,557

|

|

Hotels

|

3,967

|

9,237

|

|

Theatres

|

30

|

313

|

|

Total

|

38,640

|

231,973

|

|

Source: Pune Municipal Corporation: Environment Status Report, 2005

|

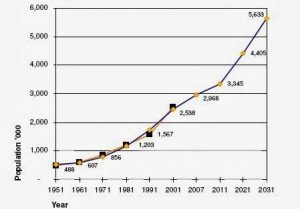

Exhibit 3: Population Growth Estimate

|

Year

|

Average net sales growth per store in %

|

|

2005-2006

|

45

|

|

2006-2007

|

42

|

|

2007-2008

|

35

|

|

2008-2009

|

24

|

|

2009-2010

|

20

|

|

2010-2011

|

34

|

|

2011-2012

|

29

|

|

2012-2013

|

25

|

|

Activity

|

Cost as % of Sales(Year 2012-13)

|

|

Rent

|

12%

|

|

Electricity

|

2.50%

|

|

Employees

|

5.50%

|

|

Maintenance

|

2%

|

|

Promotional Activities

|

1.50%

|

|

Others

|

6%

|

|

Total

|

30%

|

|

Year

|

Operating Profit Margin

|

|

2005-2006

|

11%

|

|

2006-2007

|

11.50%

|

|

2007-2008

|

9.80%

|

|

2008-2009

|

7.60%

|

|

2009-2010

|

7.20%

|

|

2010-2011

|

8.20%

|

|

2011-2012

|

7.80%

|

|

2012-2013

|

7%

|

You might like reading:

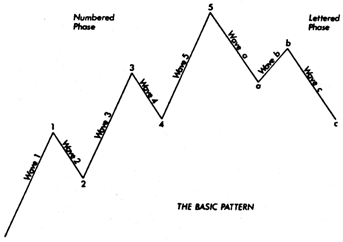

Can Elliot curve reflect the product life cycle curve ?

The Elliot wave theory or the 5-3 curve is an extremely convenient tool for judging the trends in stock and commodity prices. The Elliot wave is marked by 5 impulse waves marked by 1,2,3,4 and 5 and 3 correction waves a,b and c. In the Elliot wave theory, the pattern keeps on repeating itself and each point on the curve […]

Winning through Business Model Innovation Strategy

Abstract: Typically, innovation is seen more as an offering in the form of a new product/ service, whereas a Business Model Innovation (BMI) deals with an innovation that provides companies with an advantage to not only compete on the value proposition of its offerings, but also aligns its formula for profits, resources and processes which would be helpful in enhancing […]