China over the last three decades has seen tremendous pace of development and double digit growth rates to emerge as the second largest economy in the world. It presently holds more than 3 trillion USD in reserves and is looking at capital account convertibility in the near future.

In the 12th five year plan (2011-2015), China will look at a GDP growth rate of 7 to 7.5% down from 11% that it achieved in the 11th five year plan. However, investment in fixed assets as percentage of GDP currently stands above 50% while domestic consumption contributes less than 35%, thereby questioning the sustainability of the economic model that China has developed.

Overall, while China has taken steps to avoid hard landing for now, it has a long and tough road ahead to ensure its transition to a consumer driven economy.

1. Economic Background of China

“Imbalanced, uncoordinated and unsustainable problems with China’s development have emerged.”

– Hu Jintao, President, People’s Republic of China in 2011

China was well known for its inventions and highly industrious environment with huge fertile land, a fact which was acknowledged by Adam Smith in his

book Wealth of Nations, published in 1776. In fact as early as 1820, China accounted for 33 percent of the world economy compared to India at 16 per cent, Western Europe at 24 percent, Eastern Europe at 9 percent and America at 2 percent. However by 1950, the per capita GDP of China was only three-fourths of what it was in 1820, while economies in Europe and America were increasingly commanding better living standards. The Cultural Revolution that followed under Mao Zedong during 1967-68 saw the real GDP contract by 5.7% and 6.1% in the two years respectively. The rise of modern China started with the leadership of Deng Xiaoping and opening of the economy in the late seventies. The manufacturing prowess of its factories and investments in infrastructure has today made it the world’s second largest economy with GDP of 7.3 trillion USD (Largest in PPP terms) along with double digit growth rates for a significant period of time.

The financial downturn post 2008 and low demand from both EU and US has brought forward the need for China to have a consumption led economy as its factories are facing increased pressure in world markets. Therefore, the need is to create a sustainable alternative model focussed on quality of growth and domestic consumption in the world’s most populous state.

2. Factors affecting low consumption in China

2.1 Effect of interest rates:

As the Rmb is pegged to USD, the Chinese central bank is faced with dual challenges:

1. Ensuring the foreign exchange rate stays within a range in order to keep its exports competitive

2. Maintaining the price index to control inflation.

In its attempt to maintain the exchange rate, the central bank purchases USD from open market operations. However, in order to do so, it must sell Rmb which creates the risk of inflation due to increased money supply. This is controlled by selling low interest bills to the banks and having high reserve requirements for the commercial banks. Furthermore, in order to stimulate the economy, there are significant interest rate cuts that are made by the central bank which lead to two results:

- Household deposits have a negative real return on their deposits as a result their earnings are reduced, leading to lower spending.

- Low cost of borrowing leads to investment in real estate which has given significantly high returns for investors

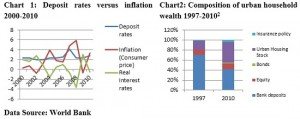

In fact if we compare the two charts below, it clearly indicates the pivotal role interest rates have played in creating an investment driven economy:

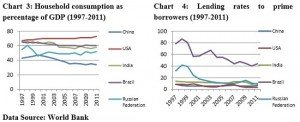

China is spending more than 9% of its GDP in residential housing and though prices have dropped by 20% in recent years, real estate and properties continue to be preferred asset class. The real peak in residential property purchases starts from the year 2004 onwards, the same period from which the average real return on deposits has been negative. If we consider the household consumption as percentage of GDP, we can see that China has the lowest among BRIC countries and more importantly it has dropped from 47% in 2000 to just 34% in 2011.

Considering the chart above, we can clearly see that China has lowest lending rate (excluding US). Thus there is a direct co-relation between the low interest rate and high investments which is further leading to low domestic consumption. Therefore, increasing interest rates may lead to increasing household consumption.

2.2 Social Safety Net:

The importance of a social safety net cannot be ruled out as Chinese population is aging. The health-care sector has been identified as one of the strategic emerging industries in the 12th five year plan. According to a report by Xinhua, about 380 million people were covered by the social pension insurance system in the last three years. If we look at the demographics of China, the median age has increased from 32.1 years in 2000 to 37.4 in 2010 while the percentage of population in 0-15 year age decreased from 20.8% to 15.7% during the same period, thereby indicating a greater portion of GDP which will need to be spent on public health care, which in turn can lead to lower savings and higher household consumption.

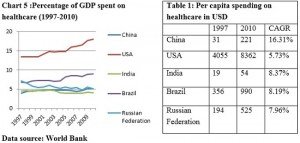

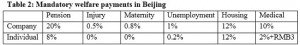

Even though China has a significantly higher CAGR in terms of per capita, the consumption led economies (excluding India) have started at higher initial base and have higher percentage contribution of GDP to health care. By 2020, China is looking at universal healthcare using a three way contribution (individual, provincial and central) and healthcare spending is expected to touch 1 trillion USD by 2020 making it the second largest health market in the world. Furthermore China has implemented mandatory welfare payments for employers as well as individuals in order to tackle the problem of social insurance.

2.3 Impact of wage rates

The annual growth rate in wages is expected to be in the range of 13 percent Y-o-Y as per the 12th five year plan as against 12.5 percent in the 11th five year plan. In fact, increase in real wage rates has been the highest in China among all major economies in the midst of financial crisis, further compounded by an appreciating Rmb against dollar.

The per capita rural income increased by 17.9 percent to 6977 Yuan with real growth rate of 11.4 percent. In case of urban population, per capita increased by 14.1 percent to 23,979 Yuan with increase in disposable income at 8.4 percent and 0.6 percent Y-o-Y after taking into account price factors. Low unemployment rate of 4.1 percent further signifies possible higher consumption in future. As productivity has also increased, it is hoped that Lewis turning point will not occur in near future.

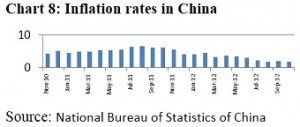

2.4 Impact of inflation

The inflation rate in China reached a low of 1.9 percent in September 2012 and has seen a declining trend after reaching high of 6.5 % in August 2011, further strengthening possibility of consumption driven economy.

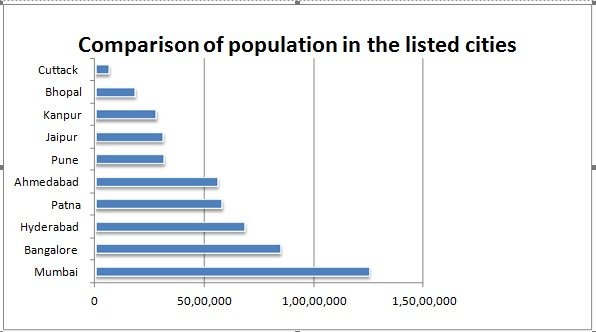

2.5 Non-uniform GDP growth

Even though China has almost equal proportion of rural and urban population, the GDP is highly disparate with huge growth in eastern provinces. Furthermore, the Gini Coefficient has marginally increased to 0.438 in 2010 from 0.425 in 2005, indicating greater inequality.

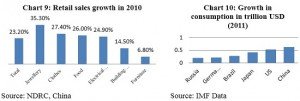

3. Recent trends in Chinese consumption patterns

China has recorded the highest growth in household consumption for 2011 which is a very healthy sign and its retail sales have also grown significantly over the period. However, the sales growth during the national golden week holidays (September 30 to October 7) dipped to 15% from 17.5% last year. Furthermore, brands like Nike have reported weaker demand in an increasing price conscious market.

4. Steps that can be taken to increase consumption

4.1 Increasing interest rates: The central bank seems to be moving in opposite direction with two rate cuts since June, the property prices have risen in 49 of the 70 cities tracked by the government, implying over reliance on investment for economic growth is perhaps going to continue. However, investment in housing often leads to consumption of complementary goods like cars; hence controlled investment in housing is needed for the economy.

4.2 Targeting moderate growth: The focus should be on quality of growth with spending on social safety net. The 12th five year plan looks at 7% growth in GDP, however they normally serve as the floor level for economic growth in China.

4.3 Abolition of Hukou system: At the heart of low consumption is the Hukou or residential permit system which does not allow migrant workers to purchase property in urban China. The 230 million migrant workers in urban China drive the economy. The urban population on an average spends 30% more than its rural counterpart. If we assume that Hukou is abolished, it will enable the migrant worker to take a long term view, reduce savings, invest in urban property and also bring his family to urban China. If we assume that each worker brings at least 1 member of his family with him, the total urban population will go up by 460 million which in turn will lead to rapid increase in consumption, besides containing the property bubble which occurs due to reselling for capital gains. According to an estimate, if Hukou is abolished, domestic consumption will increase by about 1.8% of GDP.

4.4 Increase in social spending: This will enable the household to reduce their savings rate and increase consumption. Furthermore, unemployment benefit should be provided to workers who have been found to be redundant for more than 6 months, from the existing one year period.

4.5 Reduction in luxury tax: Luxury tax contributed to 1.2 trillion Rmb or 78% of government spending in 2010, owing to extremely high tax rates consisting of import duties, VAT and consumption tax leading to 80 percent of luxury goods being purchased overseas. Reducing luxury tax will help in increasing domestic consumption; the loss in revenue will be compensated by increased sales.

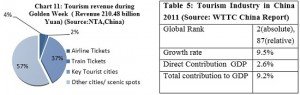

4.6 Innovative policies like toll free: The decision of Chinese government to implement toll free policy during the four main holidays seems to have paid rich dividends. Approximately 80.9 million people travelled by road each day, leading to total of 647 million during the holidays- the free passes cost the government approximately 20 billion Yuan. Furthermore, key scenic spots cut ticket prices by approximately 30 per cent to boost more visitors. However, as a result of these policies per capita travel spending during the holidays was reported at 495 Yuan ($79).

5. Conclusion

China is bound to undergo a structural change in its economy in the coming decade. While low interest rate policy followed so far by the central bank will continue to increase spending in fixed assets; the demand for luxury goods and increase in consumption indicates China can restore household consumption to 2000-2001 levels. However, China will face increasing challenges owing to an aging population, ethnic tensions and appreciating currency which will hurt its advantage in export oriented manufacturing industries. The able leadership of Xi Jinping and Li Keqiang along with the central leadership of the Communist party will need to make few tough and innovative decisions to ensure the successful implementation of the 12th five year plan. Though it targets household consumption at 50-55% of the GDP, a more realistic outlook will be around 40%, which seems to be achievable.

References:

The Dragon and the Elephant – David Smith, Published by Profile Books, 2008 Edition

Sustaining China’s economic growth after the financial crisis- Prof. Nicholas Lardy, IMF presentation 2012

China widens pension coverage as population increases: http://english.cntv.cn/20120702/106071.shtml

China Statistical Year Book 2011

China Health Care spending may touch $1 trillion by 2020: http://www.bloomberg.com/news/2012-08-29/china-health-care-spending-may-hit-1-trillion-by-2020.html

China Briefing-5, October 2012

Key targets of China’s 12th five year plan: http://news.xinhuanet.com/english2010/china/2011-03/05/c_13762230.htm

National Bureau of Statistics of China

China’s inequality Gini out of the bottle: http://blogs.wsj.com/chinarealtime/2012/09/17/chinas-inequality-gini-out-of-the-bottle/

China’s Provincial GDP figures in 2011: http://www.china-briefing.com/news/2012/01/27/chinas-provincial-gdp-figures-in-2011.html

http://www.reuters.com/article/2012/10/07/us-china-goldenweek-idUSBRE89608K20121007

http://blog.euromonitor.com/2012/10/china-is-no-longer-a-slam-dunk-growth-market-for-nike.html#more

Bloomberg, Aug 20: http://www.bloomberg.com/news/2012-08-20/china-new-home-prices-rebound-after-interest-rate-cuts.html

http://www.guardian.co.uk/commentisfree/2012/aug/25/china-rural-migrants-more-respect

Hukou and consumption heterogeneity: – Binkai Chen, Ming Lu, Ninghua Zhong

China Luxury Tax, HSBC Global Research, 18th July 2011 http://www.research.hsbc.com/midas/Res/RDV?p=pdf&key=vPe3ZF0NzA&n=303000.PDF

National Tourism Administration, China