The key objective of banking and financial market development is to aid economic growth and development, with stability and equity across sections of society, so that the gains of development are shared equally ( or at least less unequally) such that social and political stability is maintained on a sustainable basis. The primary role of banks and financial markets is to intermediate resources from the savers to the investors,and allocate them in an efficient manner among competing uses in the economy, thereby contributing to growth both through increased investment and through enhanced efficiency in usage of resources.

As the financial markets developed due to liberalization measures initiated since economic reforms began in early 1990’s, the pace and sequencing of reforms has been calibrated and marked by great degree of pragmatism,to ensure that these serve our specific needs in the context of socio-cultural, political and economic realities followed in the post independence period, focusing on a more socialistic broad based approach,while being equally conscious of the risks that they can generate if not managed well, as we have learnt from Asian financial crisis in the last decade.

The central bank has taken a proactive role in the last decade and a half of economic policy reforms,completely transforming the money market, the government securities market,equity and corporate debt market and foreign exchange market in a careful manner in step with those in other markets of the real economy. The sequencing of reforms has been driven by the need to develop market infrastructure, technology and capabilities of market participants and financial institutions in a consistent manner.In a low income economy like India the cost of down side risk is very high,so the objective of financial stability has to be kept in mind while developing financial markets,for effective transmission of monetary policy impulses to the rest of the economy. Since monetary transmission cannot take place without efficient price discovery,especially with respect to interest rates and exchange rates, a deep, liquid and integrated market is necessary to get the benefits and at the same time resilience of various market segments need to be built with sophisticated risk management systems.

The structural reforms in early 1990’s initiated a phased and coordinated deregulation and liberalization of financial markets,which hitherto was marked by administered interest rates, quantitative restrictions, captive market for government securities,pegged exchange rate,and current and capital account restrictions. As a result of reforms since 1991,the financial markets have transited to a regime of market-determined interest and exchange rates,current account convertibility, phased capital account liberalization and an auction based system in the government securities market.Policy initiatives have tried to ensure financial stability, curbing excessive fluctuations and volatility in interest rates, exchange rates and hence moderating inflation without choking credit to productive sectors,thus mitigating risks arising out of deregulation and globalization of financial markets and helping in the efficient allocation of resources in the real sectors of the economy.

Overview of current status of the Economy and financial markets:

Before going into the specifics of different segments of the financial market, let us take stock of the macroeconomic environment trends, which has ramifications for the policy measures, initiatives and extent of deregulation and liberalization planned for the future:

Fiscal 2006-07 has seen sustained ,robust macroeconomic performance, especially in industrial production with particular focus on the capital goods sector, which augurs well for the long term ,since there seems to be optimism regarding growth and hence more sustainable investment led growth can be expected due to structural reform in the economy.

The services sector growth , besides software and ITES, is led by sub-sectors of trade, hotels, transport, communication, insurance, real estate and business services.The inflationary conditions mainly are driven by supply bottlenecks in primary food articles and manufactured products. The Consumer price index ( CPI) is more than Wholesale price index ( WPI), thus showing higher impact of higher food prices in consumer basket.

Monetary policy has concentrated on managing liquidity ( to moderate inflationary conditions) with judicious mix of LAF ( liquidity adjustment facility) and securities under MSS ( market stabilization scheme) introduced since 1994. The approach is to ensure credit availability for legitimate productive sectors ( by higher provisioning norms in bank loans for so called unproductive sectors), consistent with objective of price stability,growth , savings and investment.Significant improvement in public finances of both Centre and state governments on the back of buoyancy in tax and non –tax revenues. Milestone of introduction of VAT in most states has been initiated and discussions regarding long term GST ( goods and services tax) by 2009-10 has been proposed, keeping in mind the reforms taking place in the real economy.

Dynamism in the external sector with strong growth in merchandise exports of goods and services, comfortable balance of payments situation despite volatile crude prices ( partly offset by rupee appreciation). Foreign exchange reserves have crossed USD 200 billion and strong capital flows are financing the current account deficit. Short term interest rates continue to be key instrument of monetary policy since LAF has become principal mechanism of moderating day to day liquidity conditions.

(Remaining parts of this article will be posted in subsequent parts)

[The article has been written by Amit Gupta. He is a strategic management consultant with interest in teaching, corporate training and business planning for start-ups. He also focuses on setting up projects in the skill development domain.]

You might like reading:

Property price bubble in China- Part I

“It doesn’t matter if a cat is black or white, so long as it catches mice.” – Deng Xiaoping, Former Chinese premier These words of none other than the architect of liberalized China indicate the spirit of modern China- the economic powerhouse of the 21st century. Yes, china has arrived on the world stage and has brought about series of […]

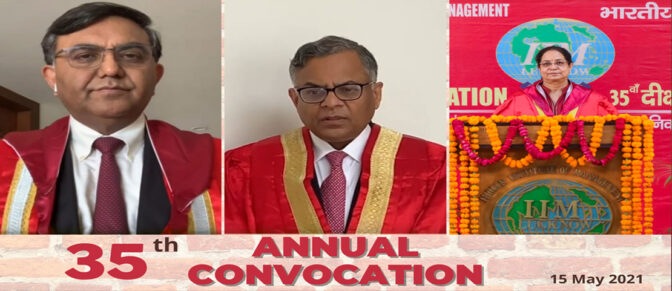

35th Annual Convocation : IIM Lucknow confers Degrees to 646 students

For the first time since inception, the Indian Institute of Management Lucknow held an Online Convocation (in view of the current pandemic situation in India). The 35th Annual Convocation of IIM Lucknow saw 646 students being awarded their degrees by the Chairman, IIM Lucknow Board of Governors, Mr. N Chandrasekaran and Director, IIM Lucknow, Prof. Archana Shukla. Dr. Janmejaya Sinha, […]