A lot of hue and cry has already been made about Carlos Slim’s visit to India about 6 months back and its possible impact by the Indian media. However there can be nothing farther from the truth.

Yes, it is true that he met with some of the leading telecom company heads in India, but it may be more in line of exploring a JV with one of the players ( Not sure why Tata Docomo was not on his list, considering Docomo is keen to exit the Indian market ).

India is one of the toughest telecom markets in the world, with little room to grow in the urban market. The real opportunity however lies in the rural markets with mobile penetration at less than 6.7% of total population as per as 2014 data. Considering that almost 70% of India’s population resides in rural areas, this itself represents a huge opportunity.

The Big Worry !

However, before getting gaga over the opportunity, let us consider two simple metrics while making any investment decision. In a market where every player is suffering from losses, with little pricing power, entering the market is a sure shot recipe for disaster. It is no wonder that market leader Airtel is bleeding in a huge pile of debt given these dynamics (though one can largely attribute it to Airtel’s much hyped acquisition of Zain Telecom).

The second metric to consider is Business environment. By business environment, I refer not only the availability of Spectrum but also government interventions which will become a major deterrent as and when the situation will demand. Consider the simple lack of clarity with respect to the upcoming spectrum auctions. For instance, will the spectrum cap of 50% in 2300-2500 Mhz be done away with, inviting more competition in an already hyper competitive market ? Will the 700 Mhz spectrum considered ideal for 4G services be part of this auction? What will be the reserve price for the spectrum auctions?

The solution… perhaps the Slim chance

The real driver appears to be mobile data as per the telecom sector is concerned, with Airtel and Reliance Jio leading the way. However, in a price sensitive market like ours, it is unlikely that even premium internet services will have much leeway while pricing their services. The much hyped pan India 4G rollout by Reliance Jio is continuously getting delayed. The solution to these issues may lie in initiatives like internet.org and Airtel zero for telecom operators or in complete out of the box solutions like internet sharing as launched by Idea cellular recently.

But why does Carlos Slim, the 74 billion USD worth business tycoon, want to enter India ? It is driven both by pricing pressures in his domestic market and the attractive growth prospects in a market like India. His company America Movil controls about 70% of mobile and 80% of fixed line connections in Mexico, however the service prices have fallen by nearly 17 percent in the last two years in the country. This has largely been owing to government reforms targeted at Slim’s clout in the telecom sector and removing national roaming charges and charging fees from competitors for using its network. Amidst all this, the fact that 100% FDI is allowed in Indian telecom sector, it does present a somewhat interesting opportunity for Mr. Slim.

The lessons…

Here again one must not forget the experience that Telenor had in the Indian market before finally selling its stake to Unitech and exiting the market. The much rumored stake sale in Videocon telecom to Carlos Slim, also appears to be either untrue or fallen apart. This is considering Videocon’s decision to sell spectrum to rival company Idea and is apparently looking to exit the market. In my view, Mr. Slim will do much better by considering both the events in case he finally decides to enter India.

Considering he finally does enter the market : Well, hello America Movil- Can we get lower call rates :wacko: ?

Well, that’s precisely the sentiment he will need to counter to win this tough market. Will he ( rather, can he ) do it ?

Tags: airtel america movil carlos slim telecomYou might like reading:

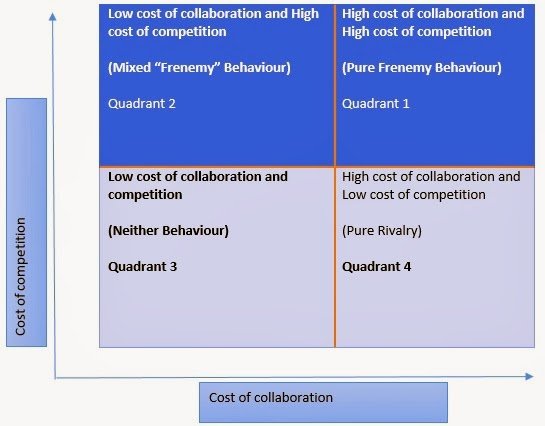

Being a “Frenemy”- A reality of business !

Keep your friends close, and enemies closer.– Sun Tzu, Art of War The term “Frenemy” refers to someone who doubles up both as a friend as well as a rival – it can refer to an individual, a corporate or even a nation with respect to geopolitics. While it is quite normal to find frenemies at workplace, increasingly this relationship […]

Pan IIM Alumni Meet 2015 – Delhi

“When the going gets tough, the tough gets going”, has been rightly said for start-up theme base Pan IIM Alumni Meet 2015 at Delhi on July 26 at Taj Vivanta. We were given a warm welcome by Mr. Saif Khan, the chief facilitator for the event, who made the entire show go on with tremendous enthusiasm. The event was completely […]