The Finance Club of IIM Raipur, Finatix , conducted its 2nd financial inclusion programme – Sanchayan on 13 September 2015 in Mujgahan village in Sejbahar. It is aimed at generating awareness about various government schemes that empower people financially by helping them allot their financial resources in appropriate platforms. Sanchayan attempts to fill the information void that exists among the villagers about these schemes and tries to equip them with specific knowledge required to enjoy the benefits. Finatix discussed about 5 important schemes of the Central Government – Jan Dhan Yojna, Atal Pension Yojana, Pradhan Mantri Jeevan Beema Yojna, Sukanya Samriddhi Yojna and MUDRA bank.

“We felt that the people are eager to save their hard earned money and invest in relevant platforms to make their lives better, but do not know the exact procedure of doing so. There is a lack of last mile connectivity with banks and information flow is not completely free. So we thought of making the villagers realize their eagerness by equipping them with the information tool. For instance, the villagers were surpried to learn that they can get insurance cover of Rs. 2 lakhs on death by paying a premium of as little as Rs. 12 per annum or Rs. 1 per month under the Pradhan Mantri Jeevan Beema Yojna” said Rohit Kumar, Executive Member of Finatix.

The villagers were made aware about the overdraft facility of Rs. 5000 that they can avail out of their Jan Dhan bank accounts. The vital information, that a person needs to make at least one transaction within 6 months of opening the account, came handy to people. Similarly, the working youth of Mujgahan were surprised to learn that they can get a pension of Rs. 5000 per month after the age of 60 by contributing just Rs. 210 per month.

Apart from the information void, several other factors also impeded the implementation of government schemes. “We contacted the nearby bank to get us covered under the Pradhan Mantri Jeevan Beema Yojna, but the bank officials asked us all to come to the bank. It would be good at the part of the government if a Banking Correspondent could be appointed for our village. It is difficult for the 500 of us to go to the bank for getting insured”, said Sandeep Yadav, Sarpanch of Mujgahan.

The villagers showed a very positive outlook toward the girl child scheme. Mothers of girls were glad to know the benefits government provide under the Sukanya Samriddhi Yojna. “I will get an account opened in the name of my daughters at the earliest opportunity so that I can ensure their good education and marry them well. An annual contribution of just ` 1000 giving high returns when my daughter turn 18 is a relieving assurance,” said Vimla, a mother of 2 daughters and 1 son.

The members of Finatix are looking forward to spread relevant financial information in other villages as well. They solicit active support from the institute and the government in their endeavor to achieve financial inclusion for the region.

Tags: B-schools education iim India peopleYou might like reading:

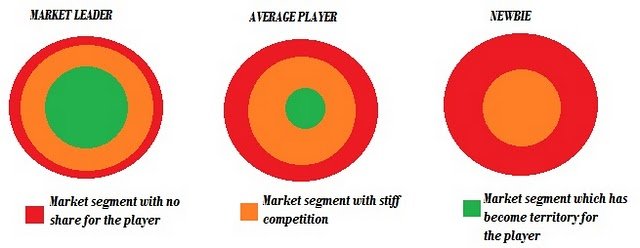

Counter Attack: Creating Territories – Is it feasible ?

[This is the counter attack post to Creating Territories ] I completely agree with the Microsoft’s Windows OS example presented by the author. However, if we consider the case of IT Service Industry (I share loyalty of almost 3 years with the industry), things appear to be different. The Multi – Vendor Outsourcing Strategy adapted by many organizations, leaves very […]

Goa Institute of Management Placements 2015: 56 companies on campus

Goa Institute of Management (GIM) has once again accomplished 100% placement for the Class of 2015. The batch of 245 students saw an increase in 10% of the average salary to 8.75 lacs compared to last year. Roles & Recruiters Sales & Marketing Sales & Marketing area witnessed students securing offers from organizations such as Pidilite, Tata Motors, WCCLG, Godrej & Boyce, […]