In its golden jubilee year, continuing with the legacy of JBIMS, the first MSc. Finance batch witnessed stellar placements. Launched in 2013, MSc. Finance is the first of its kind course focusing on creating industry –ready financial professionals’ right out of B -School. Having a batch of only 30 students, it has a good representation of the students from varied educational and professional backgrounds.

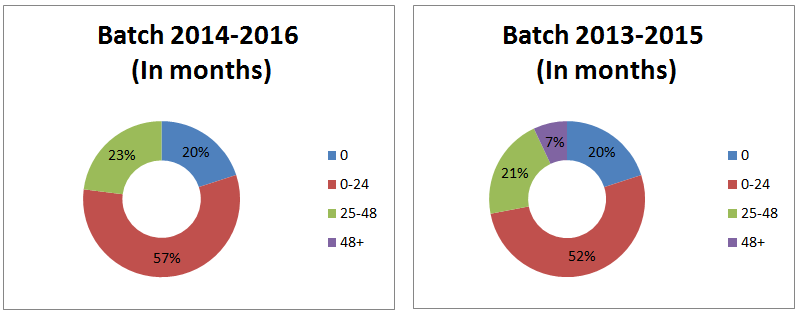

Experience Profile

The course has managed to build industry relations with more than 45 corporate organisations for summer and executive placements.

Recruiters

A few of the marquee organisations include Goldman Sachs, PWC, Aditya Birla Group, Trafigura, ICICI Bank, SREI Infrastructure, BNP Paribas, ICICI Prudential, Axis Securities, DE Shaw, Indus Valley Partners, HDFC Bank, Religare, Essel Finance ,Olam International, Axis Bank, Motilal Oswal, IIFL, IBM, Abbott Laboratories, SBICAP Securities among other organisations.

Highest Package: ₹ 19.7 LPA ; Highest Stipends: ₹ 1.5 Lac

The median package for executed placements stood at ₹13.1 LPA.

The average stipend offered to the students stood at ₹ 60,000.

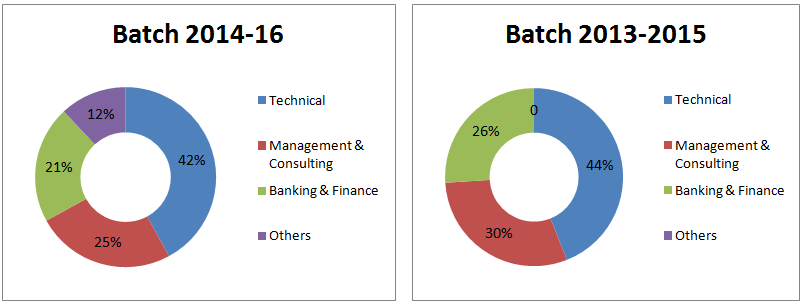

Leveraging the deep financial acumen of the students, the intensive course curriculum has managed to land them across various financial domains and leadership roles in finance.

The Placement season saw participation from Investment banks, Commercial Banks, Consulting firms, financial services companies, conglomerates, and many other companies from the service sector.

Some of the most coveted profiles in the Investment Banking industry like M&A advisory, Private Equity, Transaction advisory, and Trading & Hedging along with other traditional roles like Corporate Banking ,Corporate Finance, Risk Management, Currency Trading, Treasury Management and Financial Planning & Strategy were also offered.

Read JBIMS MBA Placements: https://ideasmakemarket.com/2015/04/jbims-placement-report-2015.html

Read JBIMS MBA vs MSc. Finance: https://ideasmakemarket.com/2015/05/msc-finance-vs-mba-finance-jbims.html

Tags: JBIMS MSc Finance PlacementsYou might like reading:

STRATONOMICS – THE CONSULTING AND STRATEGY CONCLAVE HELD AT XIMB

Constrat, the consulting and strategy consortium of Xavier Institute of Management, Bhubaneswar (XIMB), hosted its annual conclave-‘Stratonomics’. The theme for the conclave this year was ‘Digitization of value chain and Industry 4.0’. The panel of speakers included Mr. Debashish Mahapatro, CEO, Verve Consulting and MD, Eastbrook Landholdings; Mr. A Karthik, GM (Programs), Ashok Leyland; Head-Product Management (Trucks) and Mr. Sovit […]