Africa has 54 countries listed in it and is the stands second in area population among the continents. Its GDP in 2008 was $1.6 trillion equal to that of Russia or Brazil, Consumer spending stands at $860 billion, world’s 60% of arable land lies with Africa, 52 cities of Africa have population greater than 1 million, 20 companies have revenue of at least $3 billion. Moreover future prospects are even more promising. Consumer spending is expected to increase to $1.4 trillion by 2020 and it will have 1.1 billion people of working age by then. With such strong fact file and promising prospects how can we not think about Africa as a new emerging market for future?

Emerging market is considered to be one which has plenty of resources, large working population, good business opportunities, and large consumer market. Investor’s interests are highly influenced by his perceived potential for large returns. Investors are inclined towards emerging markets which have relatively promising macroeconomic indicators for future and where legal environment supports investment.

When an investor looks for a market to invest then many factors are considered by him which he thinks will affect his return on investment. Some of the parameters considered by foreign investors for healthy business are:

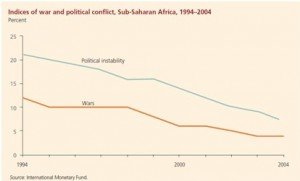

1. Political stability: It is very important for a country to be politically stable to run a successful business this is because it helps in predicting the environment in the country for next few years and provides assurance of a healthy business, political disturbance can disrupt production and consumption .we can see from the graph below that political instability and wars in sub Saharan region have decreased considerably over last decade. No doubt certain parts of western region like Liberia, Nigeria are still not much stable but in other parts financial inflow has improved considerably due to political stability and support of government.

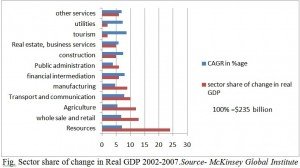

2. Economic stability: Real GDP of the continent increased by 4.9% from 2000 to 08, its infrastructure, telecommunication, retailing, construction all the sectors are booming. Real GDP has increased at average of 5% + in all the sectors as shown below which paves the way for development of the country and a strong economy.FDI as %age of Gross fixed capital formation has increased from 14.4% to 16.2% from 2003 to 2009.African countries have lowered inflation, decreased foreign debt and increased budget surplus. Moreover economic reforms by government like reduced trade barriers, privatization of state owned enterprises have strengthened the economic system and has provided new opportunities to investors.

3. Increasing consumer base and working population: The continent has more than 500 million people of working age and most of increase in GDP per capita every year comes from expanding work force. The educated and skilled workforce at cheap wage rate will attract investors and can become a source of large scale production. Secondly, it already has rising middle class, with more number of households in the range than that in India. High disposable income of rising middle class results in increased domestic consumption, which in turn increases the domestic demand and hence the cycle of demand and supply starts.

4. Changing financial landscape: Number of stock exchanges has increased considerably in a decade. In 1993 there were only 10 stock exchanges while now there are 19 stock exchanges with 800 companies listed and total market capitalization of $1 trillion. Private equity fund raising has increased from $92 million in 2001 to $2500 million in 2007.Most of world’s major investment groups (JP Morgan, City Bank and AIG) have already established specialized funds to focus on Africa.

5. Transparency: Corruption is a major hindrance in the path of providing a stable climate for investment. Measure of transparency is the control of corruption. Corruption perception index ranks countries each year according to level of corruption on a scale of 0 (highly corrupt ) to 10(very clean).SA has (4.5),Botswana (5.8), Ghana (4.1), Namibia (4.4), cape Verde (5.1) which is better than India and other emerging economies and promises better environment for setting up business. Corruption can still be reduced using strong legal environment, which will help in opening of more industries.

6. Business Opportunity: Consumer, telecom, retail and banking sector has been growing at a very fast pace as compared to other emerging economies. Spending on consumer goods has been increasing with an inclination towards high quality goods. Moreover the continent has huge uncultivated arable land, which needs to be used using better quality seeds, fertilizers and tools. Introduction of better infrastructure can facilitate more production of better quality agricultural products which will increase both downstream and upstream products in the value chain. Some countries in Africa (like Algeria, Angola, and Nigeria) are rich in oil and natural gas resources and most of their income comes from these resources. If they use petroleum wealth to develop their manufacturing and service sector, and invest more in infrastructure, education then sustained growth can be achieved.

7. Role of Government: Government plays an important role in establishing political and economic stability; it can encourage or discourage foreign investment using various economic policies. Secondly it also has to maintain an impartial legal framework and keep an eye over transparency measures. It can encourage investments in regions which are less developed by providing special facilities or reducing taxes or other such incentives. It is government which ensures fair trade, encourages spread of power and discourages concentration of power in few hands, and thus has to ensure a stable macroeconomic environment which in turn provides better investment climate conditions.

Considering all these factors in mind, Africa has long term growth prospects due to its increasing working population and large middle class with rising disposable income. In few years it will have cities with consumption level of Delhi and Mumbai. It is not that the whole continent is showing promising prospects but few countries in Africa like Botswana, South Africa, Ghana, Mauritania, and Cape Verde have appeared as emerging markets because of increased political and economic stability and strong regulatory framework brought in by government. While some other countries like Benin, Gabon, Madagascar are still struggling and have been categorized as upcoming emerging markets. Such promising facts and long term growth prospects are bound to attract MNCs towards Emerging markets in Africa which will pave the future of Africa.

References

Mckinsey Global institute http://www.mckinsey.com/

African Development Bank group http://dataportal.afdb.org

The Economist http://www.economist.com/

Stock Exchange websites

International Monetary Fund

You might like reading:

India’s sovereign wealth fund NIIF and its investment strategy

India’s sovereign wealth fund NIIF is reportedly in talks to make its first investment in the Indian startup ecosystem in kidswear retailer FirstCry. Let us try to understand the structure of NIIF. The National Investment and Infrastructure Fund (NIIF) was started in 2015 and is headquartered in Mumbai. It presently manages a corpus exceeding 4 Billion USD. Among domestic investors, […]

Supply chain of movies: How does it work ?

A supply chain is a system of organizations, people, technology, activities, information and resources involved in moving a product or service from supplier to customer.” The above is a definition of a ‘Supply Chain’ taken verbatim from Wikipedia. Now whenever words like Supply Chain Management, Operations Management, Logistics, Production Control, Distribution and Delivery are thrown around, most people tend […]