For generations now there has been a generally accepted work ethic among the majority of Americans. Our relatives before us worked hard to provide for their families and hopefully passed along their work ethic and success to the next generation. We work hard when we’re young, provide for our families and save some money for a rainy day. Nowadays saving money for a rainy day can be difficult. Life moves at a faster pace and everything costs more these days. The current financial climate around the globe isn’t helping our pocketbooks either. When financial emergencies strike, there is often no substitute for cold hard cash. If you don’t have a savings account to turn to, what is your best option?

Only for Emergencies

A same day pay day loan is an excellent option for many individuals when emergencies rear their ugly head. For some, a complete lack of savings makes a loan necessary. For others, their savings simply isn’t deep enough to tackle the financial emergency they now face. Regardless of the circumstances, a same day pay day loan is one of the best options for handling emergencies. Same day pay day loans are quick and easy to obtain, making them a great option when finances are tight and an emergency arises. Best of all, a pay day loan can be obtained regardless of credit rating. Whether you have good credit, bad credit, or no credit history, lenders will consider your application with an open mind.

Easy Access

The process is simple, all you need to do is find a local retail pay day loan location or go online and search for “same day payday loans.” Whether you choose to work online or at a retail location, you’ll need to provide a name, address, phone number, social security/driver’s license number, and banking information on the application. Your application will then be submitted to a group of lenders and the one that is most capable of providing your loan to you will accept your application.

Many Lenders

Once this happens the lender will contact you to go over the terms and conditions, discuss the repayment schedule, and arrange for the direct deposit of the funds you need. When the loan term expires, there is no need to worry about missing repayments or making late payments. The lender can arrange for the funds to be withdrawn directly from the same account the pay day loan was deposited in. Same day pay day loans are particularly helpful when tackling financial emergencies because they are quick, short term, and easy to repay. We all strive for financial independence, but sometimes we get caught off guard by unexpected emergencies. When this happens, turning to a pay day loan is a great way to bridge the gap between your current financial emergency and your next paycheck at work.

[The article has been written by Matt H. He is a freelance financial writer with a focus on personal finance. He enjoy writing articles on debt management, personal financial planning, and guiding college students to a debt free graduation.]

You might like reading:

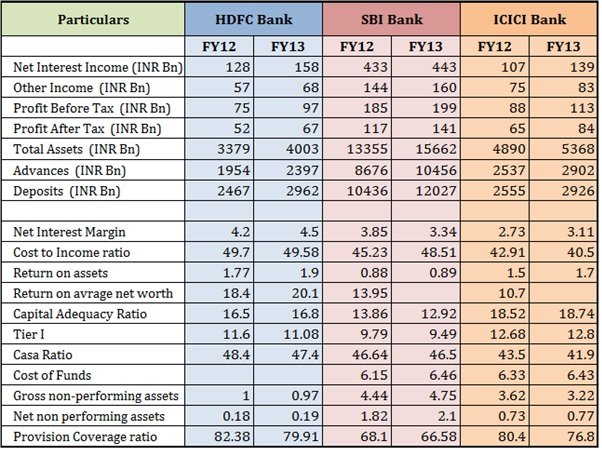

Indian banking sector benchmarking for FY12-13

As of 30 March 2013, top 6 banks by market capitalization have been selected for the purpose of analytics in this report. All the data and statistics in the publication are primarily based on the annual reports and investor presentations retrieved from respective bank’ official websites. This report doesn’t endorse any bank or suggests investors to invest in particular bank. […]

The Viral Story of Paranormal Activity

The year 2007 saw a number of releases ranging from sci-fi Transformers to mind boggling Bourne Ultimatum. While the year was ‘going big’ with such releases, there was another movie that was coming from nowhere. The movie was Paranormal Activity which was finally released nationwide in U.S. in 2009. The supernatural horror movie has been directed by Oren Peli, and […]