Global investment management industry is constantly evolving and undergoing a rapid shift in its view and understanding of financial markets and investment management. This article persuades the readers of the need for change in Indian investment management industry in order to catch up with the global innovations. Two recent paradigm shifts in the developed markets – Regime switching and factor investing are analysed in the context of Indian equity markets (can be extended to bond markets as well) to see if they can be applied and adapted in the Indian fund industry.

To begin with a disclosure – this article is intended for educational purposes only and should not be treated as investment advice. The results shown here are based on back tests and readers are advised that past performances are not indicative of future performances. In practice, it is not possible to capture the factor premiums 100% and hence the strategies discussed here are not investable as such without reasonable factor mimicking portfolios in place. The robustness of these strategies depends upon the robustness of the factor mimicking portfolios.These strategies are suitable only for long term investors with short term risk constraints and definitely not suitable for short term investors. Finally, this is based on cutting edge research in the investment management industry and simplified as much as possible for readers of diverse backgrounds to comprehend.

In addition to market risk, owing to the lack of a perfect proxy for the efficient market portfolio as suggested by the modern portfolio theory, stock returns are driven by certain other risk factors such as size, value and momentum etc. Traditionally small cap stocks are riskier than large-cap stocks and are expected to compensate the investors with higher returns in the long term. Similarly there are other risk factors that are identified to provide risk premiums. Approximately 300 such factors have been documented so far in both equity and fixed income space.

What is Factor Investing?

Recent days, institutional investors in the developed markets are showing a renewed interest in harvesting the premiums of risk factors has been gaining popularity around the world. Ang, Goetzmann and Schaefer (2009) in a report on the performance of Norwegian Pension Fund showed that the actively managed fund’s returns can be well explained by exposures to traditional risk factors such as value, size and momentum. These risk exposures can be undertaken in a systematic way rather than relying on active manager’s forecast skills. Lately, there is plenty of academic and applied research on factor based investment strategies. Plenty of literature found evidence that the active returns of portfolios after adjusting to the risk factor exposures are either statistically insignificant or negative. This raises the question that if there is no value added after adjusting to risk factors then what is the need to pay rocket-high fees for the active managers. Thus, there is a strong surge in low cost systematic investment strategies (also known as smart beta strategies) that aim to capture the premiums of long term rewarding risk factors such as value, size, momentum and volatility. Various factor based benchmark indices are introduced in the developed markets and everyday there is a new ETF or mutual fund is introduced in the market that tracks these benchmark indices (eg., Russell 1000® High Momentum Index)

What is Regime Switching?

Another interesting trend in the investment management industry that is gaining popularity after sub-prime crisis is “regime switching portfolios”. Regimes are persistent periods of time in which the underlying time series exhibit a consistent behaviour throughout. For eg., bull and bear markets are two regimes in stock returns, contraction and expansion are two regimes in business cycles, high and low volatility are two regimes in market volatility etc. There is sufficient evidence that different equities exhibit different performance in different regimes. Thus it makes perfect sense to construct separate portfolios for each regime and invest in the appropriate portfolio based on the forecast of the upcoming regimes and switch among them as and when the regime changes.

Evident Contradiction and the Solution

The aforementioned strategies clearly contradict each other – the former is against active management and the later argues in favour of forecasting regimes and active management. Extending upon the above findings, very recent researches propose the combination of the two strategies for better return and risk management ie., combining factor investing and regime switching. Regime switches might occur in various risk factors at different points in time and thus intuitively, if we are able to forecast the regimes and invest only in the favourable factors, the prospects of achieving better risk adjusted returns are better.

Illustration through Indian Equity Factors

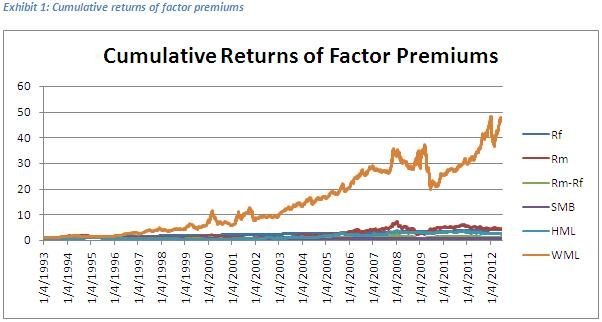

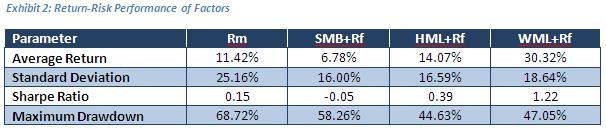

Enough with the background and let us do some number crunching. The cumulative returns of the long-short standard factor portfolios such as Rm-Rf (Market), SMB (Size), HML (Value) and WML (Momentum) representing the Indian markets (all the available data are included in the analysis)obtained from http://www.iimahd.ernet.in/~iffm/ are plotted in exhibit 1. As can be seen, the momentum factor tends to provide superior premiums compared to other factors. Exhibit 2 summarises the return and risk characteristics of investing in such factor portfolios. One can observe that the size factor is not rewarded in India. This is in-line with the global trend that in the mid-90s the size premium disappeared. Market risk, value and momentum are rewarded in the long term> The momentum factor suffered two major crashes (2000-2001[Tech bubble burst] and 2008-2009[Sub-prime credit and liquidity crisis]) again in-line with the global trend.

Regime Contingent Performance

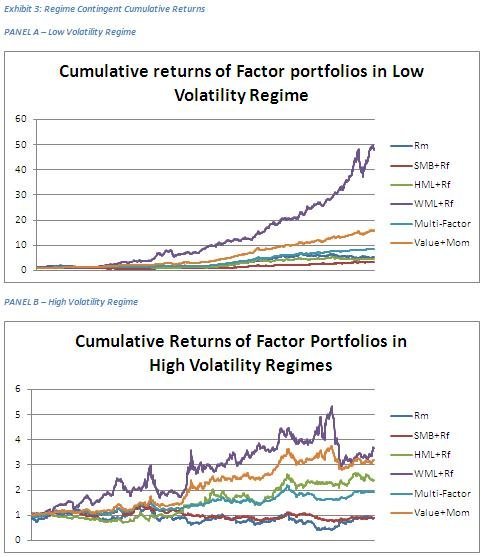

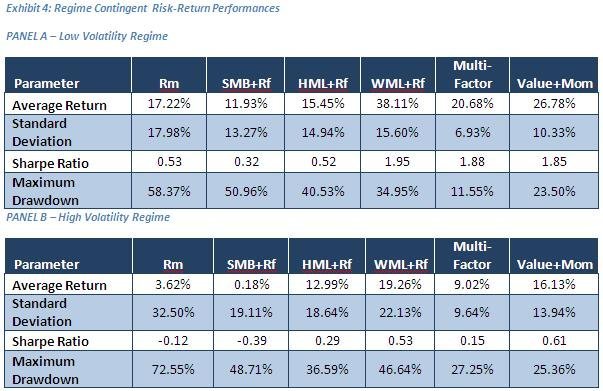

The entire sample period is segregated into low and high volatility regimes based on previous 15 day market volatility using hidden markov model with 2 states – high and low volatility. Readers who are interested in knowing in detail about markov model to estimate and forecast regimes may refer to http://en.wikipedia.org/wiki/Markov_chain. For the purpose of continuity and simplicity, let me give a brief overview of markov model. A markov regime switching model is a quantitative model to classify regimes based on markov probability chains in which the state of the time series in the next period depends only on the state of the previous period. Thus, the entire period is classified as high or low volatility regimes based on the previous 15-day market volatility. A much more naïve classification of regimes can also be done depending upon the investors’ sophistication level. Two different portfolios are constructed in addition to the factor portfolios – one, equally weighted portfolios of all the factors with daily rebalancing (in practice – daily rebalancing is not feasible); two, equally weighted portfolios of just value and momentum factors with daily rebalancing.

In low volatility regime the average returns of all the factors are significant including the size factor which did not provide a premium in the full sample period. In high volatility regime, only value and momentum factor provide any premium and the volatility is significantly high for all the factors. The multifactor portfolio which is the equal weighting of individual factors drastically reduce the volatility and the maximum drawdown in both the regimes thanks to the diversification benefits, however the Sharpe Ratio is significant only in the low volatility regime. In high volatility regime, the value+momentum portfolio performs the best with highest Sharpe Ratio and lowest maximum drawdown. If we consider just the return performance momentum factor still dominates both the regimes but it is important to consider the short term risks as most institutional investors are subjected to short term risk and budget constraints.

Regime Switching Portfolio

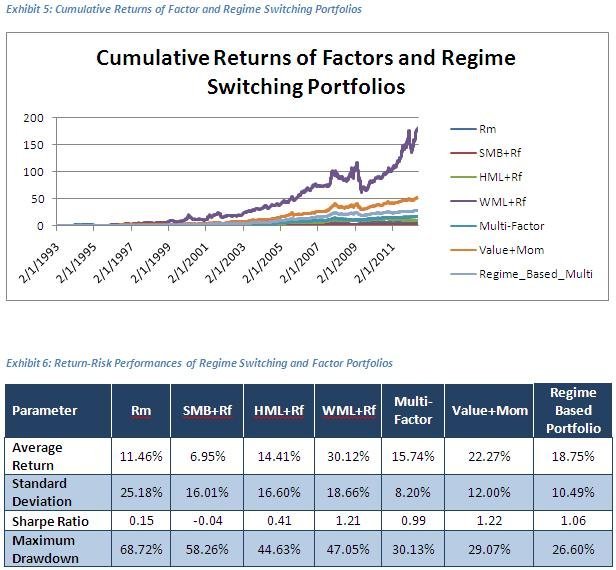

As shown in the previous section, the multi-factor equally weighted portfolio is more robust in low volatility regimes and value-momentum equally weighted portfolio is more robust in high volatility regimes. Let us analyse regime switching by investing in these two portfolios depending upon the regime forecast and switching between them as and when regime changes (ie., high volatility regime – invest in value+momentum and low volatility regime – invest in multi-factor portfolio). Exhibit 5 and 6 summarises the performance of the regime switching portfolio along with non-switching portfolios. As can be seen in the chart, the regime switching portfolio offers a smooth outperformance although the return performance is not as high as momentum factor or the value+momentum portfolio. The Sharpe Ratio is significantly high and the maximum drawdown is the lowest for the regime switching portfolio compared to the non-switching portfolio.

Conclusion

Investing in value and momentum factor portfolios offer significant premiums in the long term and investing in multiple factors offer diversification benefits with better risk to reward ratios taking advantage of the imperfect correlations among the factors. Combining the factor investing with regime switching further adds value by providing smooth performance thus limiting the downside risk in the short term. Indian investment management industry should re-evaluate and update itself to incorporate the latest developments in the industry by providing more robust investment solutions at low cost thereby improving the investor confidence and the strength of the industry and markets as a whole.

Tags: equity factor premium indian market stock market stocksYou might like reading:

Unlocking Africa’s Singapore: Rwanda

Rwanda is a small, land-locked country located in east Africa. Bordered by Uganda, Tanzania, Burundi and the Democratic Republic of Congo, Rwanda has a population of over 12 million people. The major economic sectors are tourism, mining and agriculture. The three official languages are Kinyarwanda, English and French. Rwanda is known for the worst genocide in history. Over 1 million […]

Multifaceted transformation of Marketing Channels

From various perspectives, Marketing is as old as human progression itself. From Ancient Greece to our advanced days, society has based its exchanging and offering upon correspondence with a specific end goal to move items speedier than the man beside him. I’ve always seen it as an idea much like Darwin’s “Survival of the fittest” or what we will call […]