Brazil is getting ready to stage the two grandest sporting events in the world. Billions of dollars would flow into the system to build the necessary infrastructure facilities. The extravaganza brings in for the country, multitude of opportunities, yet, with some serious challenges.This paper traces the economic history of Brazil and exemplifies how the nations hosting mega sports events like Olympics & World Cup have benefited in the past. It also throws light on the nations, whose economies did not fare as expected post, these events.

The economic scenario of Brazil is not out of the woods. This paper brings out the concerns related to the fiscal and regulatory issues that continue to impede the growth of Brazilian economy.The paper also figures-in the investments to be made in various sectors of Brazil like infrastructure, telecommunication, media and tourism. The financing vehicle for the event and associated challenges for such large-scale events are also entailed.

Brazil Gears Up For The Games

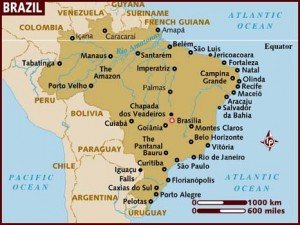

With most of the emerging markets having taken the opportunity to host a major sport event, now its Brazil turn to throw a carnival-style extravaganza. Brazil is gearing up to host the two largest events in quick succession- The 2014 FIFA World Cup and 2016 Olympic Games (Rio de Janeiro), the sporting events which are big brands in themselves as much as revenue earners for the host countries. The Olympics are awarded to Rio and the 2014 World Cup will be conducted in 12 Brazilian cities. Hallmark events like these will demand exemplary infrastructure and this would be critical to reduce the wide infrastructure gap that the country has been facing and hence would promote GDP growth. Billions of dollars would be swarmed into majestic arrangements like big stadiums, public transportation works, sewage systems, bullet trains & Bus Rapid Transit System and others. Brazilian government has set up a fairly large infrastructure plan of around $22.5 billion to stage these events. Much of this funding is expected to be supported by public sources like development banks and local governments. Private funding will also be a marked contributor.

These ‘Mega-Events’ attract hoards of wealthy sports enthusiasts descending on a city’s hotels, restaurants, and businesses, and showering them with fistfuls of money. A recent report released by Grant Thomton businesses in emerging markets tells that such big sporting events have tremendous ability to attract investors to their economies. However, as per the report, developed economies view these events as less important. The magnitude of preparations is huge and underscores Brazil’s enthusiasm in elevating its image as superlative participant in global economic and political arenas. Worldwide media attention would encourage Brazil to brand itself once and for all on the international platform as a vivacious, lavish, sophisticated and a diverse nation. The combination of these prodigious events would be a large order for any city and country; hence lot needs to be done to make ready the events.

Economic History of Brazil

Brazil’s economy has transformed from one of precarious nature to one as concrete as a brick. It can be said to be one of the obvious rags-to-riches stories in global economic history.

With the arrival of Europeans to Brazil in 16th century and rising labor demand outstripping local population, European colonists did bring African as slaves to work in sugarcane fields. Over time, the country saw the increase in population of Africans. The slaves were impoverished, landless and illiterate. Slave trade was abolished in 1850 and all the slaves were set free in 1888. Degrading trade terms (1973 oil shock) and soaring foreign debt led to the economic crisis of 1980. The period between 1981-93 involved phases of stagflation, inflation and crisis. Brazil was compelled to make significant economic changes due to hike in interest rate in world market. To stabilize the crisis situation, Brazil decided to reschedule its foreign debt payments.

With the launch of Real Plan in 1994, inflation was kept in check, which resulted in redistribution of income on the side of the needy. The plan boosted the GDP growth and the net FDI flows increased by ten times from 1994 to 1998. The Real Plan successfully removed inflation by pegging real to the U.S dollar. However, exacerbating current account deficit forced Brazilian Central Bank to announce that real cannot be pegged to U.S dollar. In 2002, Lula da Silva won the presidential elections and was re-elected in 2006. During his government, the economy began to grow more rapidly. Brazil has taken great strides from debt-struck nation of the past to the resilient economy of today. Tighter fiscal and monetary policy controlled the then rampant expansion of credit. Interest rates were relaxed further as and when needed, but in a prudent manner.

Brazil being the producer and exporter of many commodities enjoyed a great position to benefit from rising commodity prices. Since Brazil is not over dependent on foreign oil, it has derived a creditworthy level of self-sufficiency by innovating on use of bio-fuels. Brazil manufactures ethanol fuel from sugarcane, the process being more energy efficient and cost effective. This distinctiveness make Brazil world’s largest ethanol exporter. In present times, Brazilian economy has strengthened itself, which provided a cushion against 2008-10 financial crises. Economic growth of Brazil has continued to grow at a high rate reaching 7.5% in 2010.

Examples from Past

Hosting the Olympics can affect many aspects of the host city’s economy, from tourism to infrastructure and from local wages to tax revenues. Every country’s economy has its own peculiar strengths and weaknesses and cannot be tarred with the same brush when talking about the impact of mega sports events like Olympics and World Cups. The adeptness of management to make the developments and preparations cost efficient is apparently a momentous factor to find out the economic legacy of such an event. Historically, there have been mixed reactions on the impact of Olympics on host cities economies. The 1972 Munich Olympics and the 1976 Montreal Olympics made considerable losses, while 1984 Lost Angeles, 1992 Barcelona and 1996 Atlanta Olympics made substantial profits. The quantum of investment and the positive economic impact of Olympics in Barcelona are not comparable with any other host city.

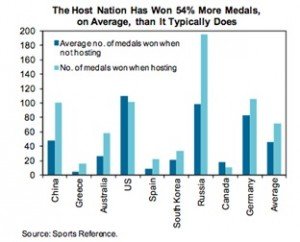

In London, the cost incurred on Olympics has been estimated to be £8.5bn that represents 0.55% of annual UK GDP or 1.4% of annual government revenues. The long-term benefits take the form of the facilities that will be left behind once the Games are over and the promotion of sport in the community. It is generally considered easier to measure the short-term benefits that accrue from international events such as Olympic Games, but more difficult measure the longer term economic impacts, as these are often more intangible. Much as there are short- and long-term economic effects from being the host nation, there are also short- and long-term benefits for sport in the host nation. The graph below depicts that on average, the host nation has won 54% more medals than when it was not the host nation.

This constitutes a pattern of economic growth called ‘ripple effect’ which investments in infrastructure result in improvements in overall production conditions for domestic and foreign enterprises that makes these financing even more attractive.

Headwinds for Brazil

As far as growth is concerned Brazil is underperforming as compared to other emerging nations. A case in point is over the last ten years China’s per capita GDP grew by 8.5%, and that of India and Russia grew by 7.5% and 4.5% respectively. Brazil economy is grappled with problems in spite of 4.4% CAGR over the past 5 years. The currency appreciation has led to too many cheaper imports. However the real problem is the austere austerity measures, over-taxing and over-regulating that hinders the way of investors and corporates. Huge fiscal deficits have resulted from immense government expenditure by way of subsidies and offshore oil explorations. A slew of protectionist measures are risking the reform agenda. Brazil is doing all to make its imports expensive and exports more competitive from raising tariffs to cutting rates. Brazil has a very complicated tax mechanism mainly import tariffs, which is an Achilles’ heel for the country.

Many strategists envisage Mexican economy to surpass that of Brazil in coming 10-12 years. The difference being steady growth rate of 3.9% for Mexico and shuffling annualized rate of 1.9% of Brazilian economy. Though speculative, Mr. Berber, a Nomura strategist, surmises that countries will cross-economic paths in 2022. (shown below)

The dipping GDP and growth figures elicited an egoistic response from the Brazilian president Rousseff saying that the economy should not be appraised by looking at GDP figures only. This provoked lawyer Oliveira to retort by indicating Brazils poor performance on Human Development Index that comprises of health, education and living standards. The upcoming mega sports events poses a tough challenge as much as opportunity it offers to the country. Brazil will be tested on what measures it takes to revive its economy and to maintain its pride and status.

Investments in Infrastructure, Telecommunication, Media & Tourism

Infrastructure legacy becomes the core of two mega sports events to be held in Brazil in 2014 and 2016. Brazil’s infrastructure quality has been ranked at 104 out of 142 countries surveyed, behind China (69th), India (86th) and Russia (100th). This puts Brazil in tough standing. The Brazil government has sought to invest $470 billion in new roads, airports, ports, and power plants by attracting foreign investments. Extensive investments into Brazil’s sporting facilities, urban areas, tourism and transportation sector is required.

The construction sector of Brazil is dominated by three key companies, which are Construtora Norberto Oderbrecht S.A., Camargo Correa S.A., and Construtora Andrade Gutierrez S.A. These companies will play a major role as Engineering & Construction projects undertakers and will also play a participatory role as projects’ investors. The financial risks like cost overruns and project delays emanating from the infrastructure projects will be mitigated by the diversification of the three big construction players across the world. Completion of projects like building of stadiums and other facilities on time would be challenging. The transportation sector also raises imminent demand for huge investments to endorse the upcoming events. Brazil’s transportation overhaul was anyways needed but its fast-tracked and effective follow-up will resolve the mobility issues across the cities in Brazil. This will have a long lasting positive effect on the Brazil’s economy, transportation companies and investors as well.

Investment worth $5.8bn will be made to develop environment friendly Bus Rapid Transit corridors that will connect four of the city’s main districts Deodoro, Barra, Copacabana, and Maracanã. Besides construction of metro lines, flyovers, roadways and renovation of airports will also exact considerable amount of money. A “Plan for Accelerating Growth” has been rolled out that will provide $18bn for developing urban infrastructure in host cities for the World Cup & the Olympics. With the country’s preparations for the events, there will be boost in its economy, as the country will benefit from the added infrastructure & magnifying tourism industry. This will also provide stimulus to Brazil ETFs and enhance investors’ confidence. Media companies will also have to make huge investments for transmission rights & other resource allocation for the games. Telecommunication companies too will need capital to pump money in new technologies & expand their network. The outlays for infrastructure in transportation et al will give a fillip to the tourism industry.

How is Brazil going to afford the financing of the FIFA World Cup and the Olympics?

BNDES Bank

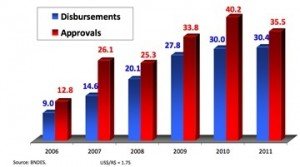

BNDES (Banco Nacional de Desenvolvimento Economico e Social) is the Brazilian Development Bank founded in 1951 and headquartered in Rio de Janeiro. It provides long term financing for projects in agriculture, infrastructure & industrial sector projects in the country and is the mainly associated with country’s development, foreign trade and industrial policy. Over the years support of BNDES for infrastructure has been expanding (as shown in the figure below).

The bank is going to provide the major chunk of funding for the mega sports events in Brazil. Due to its integral link with the sovereign it is expected that the sovereign will fully endorsed the bank in the face of crisis or credit rating downgrade risk. Moreover, despite the scale of investment entailed in the project, S&P sees the bank in decent profitability & liquidity position.

Sports Incentive Law

This unique law will allow businesses and individuals to invest some percentage of their income tax in programs connected to Olympics and other sports or any other projects approved by the Sports Ministry. Companies can invest up to 1% of what they would pay in income tax, and for individuals this investment is 6%. Brazil Sports Ministry expects to raise around $150 mn by dint of this law.

Private Financing

Considerable funding will also be solicited from the private players like big Engineering & Construction companies who will also play a role of direct investors besides the role of project contractors. The success of event will also depend on the ability to attract sponsors to finance the extravaganza.Brazil also expects to raise $15bn from bilateral trade with India.

Conclusion

Brazil is well poised to organize the splendid events in 2014 and 2016 provided a careful assessment of its strategies, structure & social legacies is made. The pressure of economy not performing up to the mark should be dealt with by encouraging significant investments in infrastructure over the medium term. With the financing scenario at comfortable levels, a prudent fiscal policy that alleviates the rigidities faced by the private sector companies is the need of the time. Though the implementation and realization of such changes may take time, let this be sooner than later.

Overall, the paper paints an optimistic picture of Brazil as it stands to host the two most glorious events- FIFA World Cup 2014 and Olympic Games 2016.

References:

- IMF

- Nomura

- BNDES

- http://www.mondaq.in/article.asp?articleid=92270

- http://www.sports-reference.com/

- http://rio2016.com/en

You might like reading:

Opinion : How our point of view matters !

I have been pondering about the meaning of anthropology. I gathered from the discussions that it gives us the skill sets to convert business questions to constructive questions on human. The biggest resource any company can have is ‘humans’ and as an HR manager, I need to have an anthropological mind to study their behavior better. I have been introduced […]

Land acquisition or Customer acquisition : Are they similar?

While there has been a lot of buzz over methods adopted for land acquisition in India in recent times specially in Noida and Singur, a random thought actually crosses the mind: Is customer acquisition similar to land acquisition ? In first look, the concepts look poles apart, but are they really different? Let us consider how: 1. Both require convincing : […]