Xavier Institute of Management, Bhubaneswar hosted FINOMICS, its annual finance conclave at the Mirador, Mumbai on 16th August 2105. FINOMICS is the flagship event in the finance domain, organized by X-Fin, the finance association of XIMB. It aims to bridge the gap between industry and academia by getting industry stalwarts and alumni to share their widespread knowledge to understand the nuances of finance. The session was attended by eminent industry leaders, alumni, faculty members and students.

The conclave was conducted in two sessions. The topic of discussion for the morning session was, “India as an investment destination”. Mr. Amod Khanorkar, the moderator and an alumnus of XIMB, kick started the discussion on the agenda, talking about need for India to capitalize on the opportunities created by the current situation of a slowdown in China and a stable government in India. Mr. Sanjay Tripathy, Senior EVP at HDFC Life, was the first speaker. He discussed about the macroeconomic edge that India has, while cautioning for better utilization of resources and execution as the two primary concerns of the economy. The second speaker, Mr. Prashant Prabhakaran, Executive Director and President-Retail Banking at India Infoline Ltd, spoke of the opportunity lost by India in the last 6 years, but reiterated the attractiveness of India as an investment destination. The last speaker for the session, Mr. Anup Bagchi, the MD and CEO of ICICI securities Ltd, gave his take on the historical perspective of India as an investment destination and the need for corrective policies in land acquisition, IPR protection and labour laws. This was followed with the announcement of the winners of Financius, the article writing competition and unveiling of Finshastra, the annual business magazine of X-fin. The session concluded with the vote of thanks given by the coordinator of X-Fin, Ms. Prerna Goel.

The afternoon session was held on the agenda, “Impact of board composition on the financial performance of the firm”. Dr. DV Ramana, Professor at XIMB, moderated the event. Mr. Joseph Bosco, Director at Caramel Knowledge Ventures, spoke about the need of directors of sufficient caliber, and the responsibility of independent directors towards the organization. The second speaker Mr. Hemant Upadhyay, Managing Consultant at Hay group, spoke about the importance of diversity in the board and its positive effect on the quality of corporate governance. The final speaker, Mr.Suresh Raina, Managing Partner at Hunt Partners India, took a different take, and highlighted the challenges faced by an independent director of a company.

The session concluded with Prof. Banikanta Mishra launching MS Finance, a new course at XUB. The course aims to create super specialists in finance with over a thousand hours of study in finance subjects. It will be a two-year course with the option of completing one year at the globally reputed Fordham University, USA. The course will also offer scholarships for economically weaker brilliant students.

The conclave provided a great opportunity for the students to interact with industry stalwarts and learn from their experiences.

Tags: Finance ximbYou might like reading:

IIM Rohtak PGP Final Placement 2016: 48 recruiters on campus

IIM Rohtak is proud to announce the conclusion of its final placement process for the academic year 2014-16. The institute witnessed participation of multitude of companies across varied domains. 145 students of PGP05 batch successfully availed opportunities across diversified profiles and various functions in the organizational setup. Our corporate visitors were delighted to see the enthusiasm students exuded in the placement process, which was […]

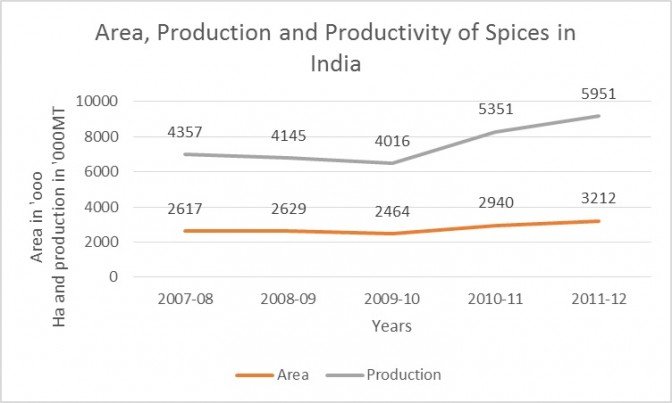

Flavouring the World: Indian Spices Industry

Introduction India is land of spices and produces almost all the spices used in the world. It is the largest producer, consumer and exporter of spice and its’ products. From the ancient time itself, India was centre of Attraction for Rome and China. Further Portuguese, Arabs, Chinese and several other country established trade with India mainly for spices. From ancient […]