What connects Cayman islands, Mauritius and Virgin islands besides being picturesque tourist locations – they are all tax havens ! Tax havens which have played a significant role in tax evasion in India. According to an estimate India has lost about 263 billion USD in taxes in actual value and 435 billion USD in terms of net present value. The total external debt of the Indian government as on date is about 316.9 billion USD, so if the proper policies were in place we would have been a debt free country !

How do these companies avoid taxes ? The very existence of tax havens has been a matter of great debate especially post 9/11. These companies operate in the form of shell companies. Shell companies are those companies which exist only on paper with practically no physical assets and are just used to act as channels for foreign investments. The cause of concern arises as there are several layers of shell companies. For example lets assume I am a foreign investor based in UK. I will first register a shell company in Virgin islands. This company will in turn register another subsidiary company in Cayman islands and which in turn registers another firm in Mauritius before the Mauritius firm invests in India. As there are several layers of shell companies involved, it becomes quite difficult to track the real source and the flow of money- thereby causing hindrance for the tax authorities. Even the IPL teams including Rajasthan Royals, Kings XI Punjab and Kolkata Knight Riders had used similar method to avoid taxes.

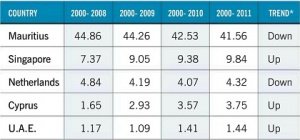

To make matters worse, it is not only the companies that are investing in India who are indulging in such practices- even established foreign players like beer maker Sab Miller have been accused of evading taxes in India. During presidential election campaign, even Barack Obama raised the issue by suggesting that there is a building in Mauritius that is the head office of 12,000 companies ! The building in question- Ugland House, isn’t too big- in fact it is just five stories and looks more like a hotel ! However even though, Mauritius remains the main source of FDI into India there has been a significant change in trend of FDI flow in India.

|

| All figures in billion USD |

Tax heavens have been in existence since ages. In ancient Greece, traders used to store their goods in off-shore islands in order to avoid a city tax of 2% in Athens. At present there are about 63 tax havens in the world- while most of them have retained their shadowy nature of not disclosing ownership of businesses, some like Hong Kong and Singapore have more clearer policies and have emerged as business hub destinations. Creating tax havens have their own set of advantages as it leads to much faster growth of the economy. For instance, who could have imagined that a war torn country like Congo can emerge as a tax haven? However, the growing instances of tax avoidance and failure to disclosure information has led even the OECD to blacklist 45 territories for not complying with its banking secrecy norms and has even threatened them with financial sanctions.

The strongest signal to avoid tax evasion has come from US which has enacted the Foreign Account Tax Compliance Act( Facta). According to this act, foreign financial institutions will have to reveal identities of American account holders – in case the account holders are unwilling to identify themselves, the institution will impose a withholding tax of 30% on any transfer payments made. The Indian government is also planning to change its taxation regime by including CFC ( Controlled Foreign Company) policy whereby the foreign company will not be taxed only if at least 50% of its revenue are not from capital gains. What remains to be seen is whether India can successfully implement it and control the tax evasion !

You might like reading:

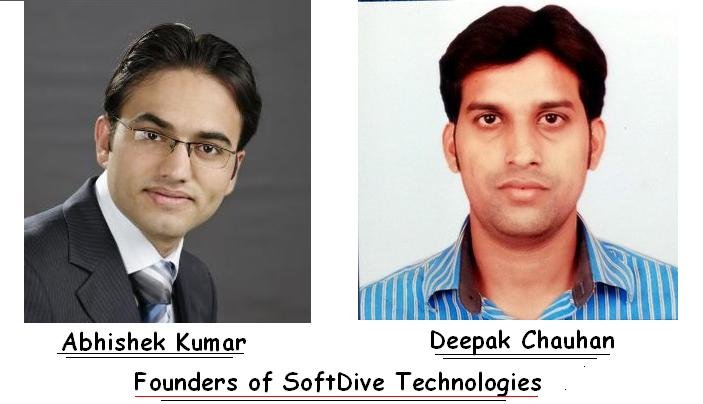

Rendezvous with Founders of SoftDive Technologies

SoftDive Technologies is the perfect example of a company that has never lost its vision of being a market leader in the IT product space, despite diversifying successfully into the IT services business. We got an opportunity to understand the founders’ dreams and their journey. This one is a story that will inspire. Excerpts from the interview with Abhishek Kumar […]

Overview of ASEAN !

ASEAN – An Introduction The Association of Southeast Asian Nations (ASEAN) is a geo-political and economic organisation of ten countries located in Southeast Asia, which was formed on 8 August 1967. Current member countries are Indonesia, Malaysia, Philippines, Singapore, Thailand, Brunei, Cambodia, Laos, Vietnam and Myanmar. ASEAN covers land area of 4435674 km square, which is approximately 3% of the […]