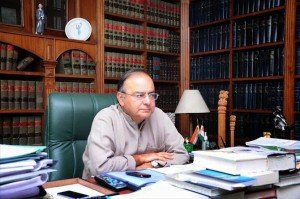

The newly elected Indian government will have their task cut out as they are set to present their first financial budget in the month of July for 2014-15. The economy is facing structural issues with GDP growth hovering around the 5% mark over the last 2 years.So can the new Finance Minister Mr. Arun Jaitley deliver?

There are a number of tax reforms that are expected in this budget. These include the reduction of the Minimum Alternate Tax (MAT) from 18.5% (with surcharges) to about 10-12%. The MAT was originally set at 7.5% when introduced. In addition, restoration of section 10A and 10B would provide the necessary tax incentive and fuel growth. Section 10A provides 100% tax breaks for an undertaking established in a FTZ, EPZ whereas 10B deals with providing the same benefits to export oriented units and those located in STPI units. The provisions were discontinued from the budget of 2011-12.

Though there is a growing demand for repeal of the 2% of net profits mandatory spending on CSR activities under the New Companies Act 2013, this is unlikely to happen.

In terms of personal taxes, the savings under section 80C of the Income Tax Act is likely to be raised by at least 50,000 INR from its existing limit of 1 Lac INR. In addition, there is a likelihood of raising the minimum taxable income from 2 lac to about 3 lac. It would be interesting to see how these populist measures affect the revenue stream of the union in the long run. India has one of the lowest tax compliances in the world with roughly 2.9% of the population filing income taxes.

It is likely that defence budget will be raised this fiscal year, especially as Pakistan has proposed a double digit hike in its defence spending. India is already the world’s largest importer of defence equipment at 8 billion USD which is growing at 13-14% on a yearly basis. The government is keen to allow 100% FDI in defence which would help in curbing imports and stemming the devaluation of the Indian rupee.

The government, though, is unlikely to go ahead with multi-brand retail FDI despite significant pressure from foreign players. The aviation sector in the country also needs an impetus which can come in the form of a reduction in fuel surcharge and a possible increase in FDI limit from 49% to 51% might be on the cards. The automotive sector too is looking for cut in import duties as it has been badly hit by the ec0- nomic slowdown. ACMA, the apex body has asked for the continuity of the 10% excise duty on auto components along with the removal of customs duty on alloy steel, mild steel, aluminium alloy and secondary aluminium alloy.

The situation in Iraq is likely to send oil prices upwards and it would be interesting to see how much of the impact is passed on to the consumer. Oil import comprises the largest component of India’s import bill. The duties levied on Gold imports are also likely to stay especially as falling prices have led to an upsurge in demand. In addition import duties on consumer durables and electronics is also likely to be raised.

The education sector too is expected to see an increase in spending with setting up of new IIMs, AIIMS and IITs along with focus on primary education. Smriti Irani, the minister for Human Resource Development has already stated that spending on education would increase to 6% of GDP in coming years from less than 4% presently. With upcoming elections in states like Maharashtra, the government may look at making non-subsidised LPG cylinders cheaper. In addition one may see loan waivers for farmers in drought hit areas especially with a weak monsoon seeming more probable.

The government has already shown a strong intent to bring the economy on track by trying to curb vegetable exports by raising minimum export price and implementing a 14.2% hike in railway fare & freight charges. The railway budget is unlikely to see any new major announcements of new projects owing to its financial state. Overall, the budget might spring up a few interesting surprises.

You might like reading:

It is very important to pursue your passion, says Saya Augustin

Saya is a digital marketing consultant at Go Digital With Saya. She has over 8+ years of solid expertise in helping start-ups and reputed brands alike. Her forte lies in PPC, CRO, SEO, and Analytics. Q1. Tell us something about your journey so far So far so good. I managed to get around 4-5 clients while I was working full […]

IMM Comics: Life of mba !

We would hereby like to introduce the first of our comic strips. This strip is based on the four different phases in life of MBA. Have a look ! Tags: life@mba MBA office life