Importance of Supply Chain in Retail

With this growth in retail, not only front end but the entire network of activities leading to a culmination of a successful retail transaction has undergone a significant development. Supply Chain is no different. In the course of this retail evolution in India, the supply chain has also seen significant activity. After all, Supply chain forms a major part of the sustenance of any retail venture. For the retail venture to flourish successfully, it should have an efficient and well established supply chain. In the modern format, when all the other aspects of retailing have been discarded as being a differentiating factor, the role of supply chain has become even more important. Importance of an efficient supply chain for a retail chain may be assesses from the gamut of areas in which it helps the chain such as sourcing of material for Private Label, supplying of SKUs to the distant tier II and III cities, more and more retailers entering into Food & Grocery segment resulting in need for transportation of perishable items requiring cold supply chain, etc. hence it is deemed that from being just a part of the operations of a network, supply chain is soon going to become the source of competitive advantage for some firms.

If we look at the global scenario, we already have the example of retail mammoth, Wal-Mart. Wal-Mart is said to have the best supply chain which enables it to pursue the EDLP (Every Day Low Pricing) strategy. The Indian retail is yet to reach that stage and it will be an amalgamation of huge investments, government policies, third party intermediation, and fast changing consumer preferences which will characterize this back end revolution.

The key opportunities for investment in a retail supply chain lie in the areas of sourcing, distribution centres (warehouse, cold storage), transportation networks, inventory (both store level and warehouse), supply chain information systems such as warehouse management systems, planning, forecasting, inventory management, etc. different retailers have chosen a different combination of activities that they perform themselves while some activities are being outsourced to 3PLs (Third Party Logistics). On one hand a retail chain like Subhiksha has outsourced most of its back end work; on the other hand some like Reliance are investing heavily in the supply chain network to go for backward integration of their businesses. Some like Vishal Megamart and Pantaloons are excessively into selling of their in-house brands in their stores and have, hence, included manufacturing in their supply chain as well.

Indian vs. International Retail Supply Chains

The Indian retail has just started to develop. This is in contrast to the major international retailing countries where it has already reached the maturity stage. Due to this, there are still a lot many wrinkles which need to be smoothened out. The Indian retail is still not as effective as that in the global markets with the inventory turns being lower and stock outs being higher than global average.

Organized Retail SCM in India

With respect to supply chain, the various factors which organized retail impact can be summarised as:

Outlook towards Retail SCM: While the organized retail is expected to boom, the supply chain will take more time to develop at the same rate because of a general lack of SCM professionals in the country with even fewer having any experience in the retail sector. Even amongst them, the level of process expertise and best practice skills are low. These factors may prove to be a “comma” but not a “full-stop”. However, with the growth of organized retail and with the increasing number of professional courses offered towards supply chain management and retail; number of SCM professionals are gradually focusing more towards a scientific methodology in dealing with the back end supply chain.

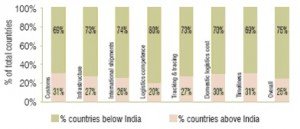

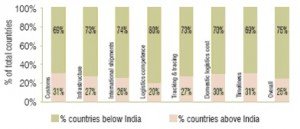

Infrastructure woes: The infrastructure in India is not as well developed as in other countries. Many parts of India still do not have roads and need to be delivered through bullock carts. Hence, any SC strategy for rural retail and tier II and III retail would need to take all these indigenous Indian factors into account. Below is a snapshot of how India fares vis-à-vis other countries.

|

Source: Connecting to compete: Trade Logistics in the global economy.

The logistics performance Index and its indicators (2007) |

Use of 3PL: Gap between the expectations and the actual level of services provided, and prices charged by the 3PLs are primary reasons why more companies are not looking towards outsourcing their logistics to 3PLs. furthermore, the current service levels of the 3PLs leave a lot to be desired. Hence, a mature company in this field will go a long way towards success.

Impact of VAT: The industry was eagerly awaiting an act from the government t o simplify the VAT assessment process across the different states. This VAT system has been recently introduced and not yet implemented to its full impact. When fully implemented, it would have long lasting consequences on the way the supply chain is being developed. The current form of VAT encourages retail trade within a single state, with significant implications on the location of warehouse and accordingly transportation costs.

Supply base: Due to the fragmented nature of supply chain in India, the players have to deal with a wide number of other players. This results in lower margins per level for the same amount of good being transacted. Furthermore, additional levels in the supply chain also result in increased overall wastage for the chain as the number of points, at which wastage may take place, increase as well.

Major areas of concern

With the Indian retail still in its developing stage, there are a lot of issues such as poor infrastructure, lack of mature 3PLs etc that need to be addressed. Till that time, the supply chain will remain inefficient due to the synergistic effects of these issues. The various areas of concern when attending the Supply Chain in the context of retail scenario are as follows:

The fragmented nature of transporters, due to poor infrastructure development, result in high lead times, absence of long term relationships and high transportation costs.

Due to a fragmented supply base and large number of intermediaries, the product costs get artificially jacked up, resulting in decreased margins at the retail point of sales.

The decision to locate Distribution centre are taken keeping the local tax laws under consideration. However, the operations inside these centres are not up to the standards leading to un-necessary expenses.

Retail industry faces a big problem of forecasting the requirements of inventory because due to lack of proper IT implementation, the historical data is not available at appropriate time. Even if the data is available, there is not enough technical competency to analyse this data to derive meaningful insights. This results in increase in number of stock outs, increased mark downs, low inventory turns and high pilferage rate.

The way forward

A typical supply chain looks like as shown above. In a supply chain, the role of retailer may vary. It may decide on only retailing and outsource everything else to a 3PLs or it may decide to carry out one or more of the activities, prior to its stage, itself and aim for backward integration.

In the near future there are several steps that any retailer would have to take to ensure an effective supply chain for their business to grow such as:

IT implementation to ensure that only as much is ordered as is required and not to store the inventory in the warehouses. The production should be accordingly scheduled to meet the customer demand.

There should be sufficient mechanism to link all the different segments of the chain with each other and responsive to the demands of the segments.

Parts of the value chain may be outsourced to a 3PL while a retailer can also look into backward integration for critical areas.

Since the supply chain is at an advanced level in the developed nations, they have tried and tested various formats and then crystallised on certain set of options. Hence, in this case in particulars, Indian retailers need to look at the global retailers and adopt their best practices to suit Indian requirements.

On a long term basis, there would be a need to build a flexible supply chain which would be capable of responding to changes, intrinsic or extrinsic changes, drastic or slow changes, in demand, supply and technology. Further, such flexible supply chains would allow retailers to accommodate the ill-effects of any dramatic events like natural calamities, terrorism, etc.

[The article has been written by Aashish Sood. He is a 28 year old blogger from India. He is a chemical engineer by graduation and MBA(Finance and Operations) from IIM Lucknow. He has worked with Evalueserve, Coal India, Arcelor Mittal and is presently working with Accenture. He is an ardent reader of fiction and fantasy fiction literature and an avid personal blogger. He writes his own blog at WanderingThoughts and can be reached on twitter@ aashusood.]