Placements for SPJIMR’s PGDM Class of 2020 witnessed 44 new recruiters across sectors. An increase in the average CTC by 15% as compared to last year coupled with a significant increase in the number of offers made by marquee names in Consulting, FMCG/ FMCD and E-Commerce firms reflected a strong demand for talent from SPJIMR.

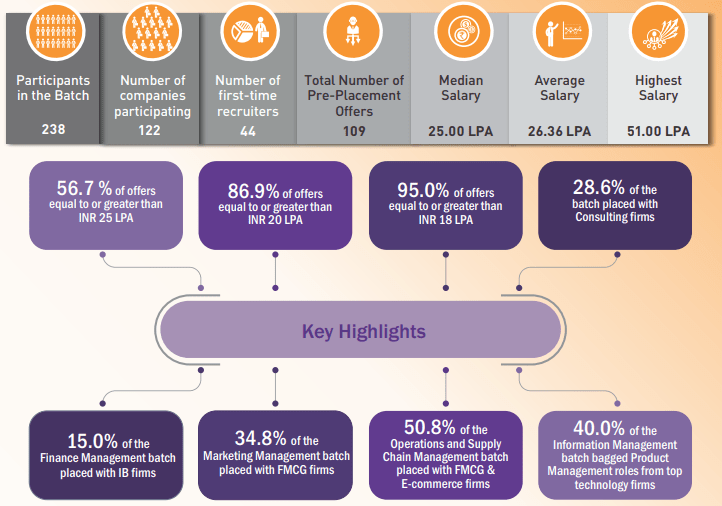

The median salary of the batch stood at INR 25 Lakhs Per Annum (LPA). Over 86% of the batch received offers in excess of INR 20 LPA. A total of 122 companies participated in the placement process rolling out over 300 offers to the PGDM Class of 2020 participants. Management Consulting, FMCG/FMCD and E-commerce continued to be the most dominant sectors of hiring on campus with 28.6 %, 22.6% and 22.2% of the participants, respectively placed in these sectors. More than 60% of the batch took up PPO/PPI opportunities through the autumn internships with leading companies such as Accenture Strategy, Alvarez & Marsal, Amazon, Edelweiss, Hindustan Unilever Limited, Intuit, ITC, Procter & Gamble, Microsoft, Tata Administrative Services, Boston Consulting Group, Uber amongst others. The increasing trend of PPO/PPI opportunities reassured industry’s continued faith in SPJIMR’s unique model of Autumn Internships.

The Autumn Internships take place only after the completion of the core courses in Finance, Marketing, Operations & Supply Chain and Information Management as well as advanced specialisation courses at leading universities in the US through SPJIMR’s Global Fast Track programme. This ensures that SPJIMR students are industry ready and will be able to deliver on their mandate even at the internship stage, leading to the high PPI/PPOs.

General Management and Leadership RolesThis year, conglomerates such as Aditya Birla Group, Amazon, Capgemini, GE Healthcare, Mahindra & Mahindra, Philips, RPG and Tata Administrative Services extended multiple offers to participants for Mid-level management positions. The roles pertain to the application of business acumen and concepts learnt in all relevant domains and involves close interaction with the CXOs. The participants are groomed to be future leaders in their respective business subsidiaries.

Management ConsultingThe Management Consulting sector drew significant interest for hiring by both recruiters and participants at SPJIMR. 28.5% of the batch secured offers from elite consulting firms with profiles in Business Strategy, Technology Strategy, Health and Insurance, Operations and Supply Chain consulting. Alvarez & Marsal, The Bridgespan Group, Praxis Global Alliance visited campus for the first time this season along with other regular top recruiters like Accenture Strategy, Avalon Consulting, Bain & Company, Boston Consulting Group, Deloitte, Ernst & Young,

GEP, IBM, KPMG and PwC amongst others.

SPJIMR witnessed a phenomenal increase in offers from the E-commerce sector as compared to last year. A total of 22.2% of the batch was placed in companies like Amazon, BookMyShow, Cloudtail, Flipkart, Go-MMT, Ninjacart, Ola Cabs, Swiggy, Uber and Udaan amongst others. SPJIMR developed a new niche with a stark increase in the number of product management roles offered by these firms. Other highly coveted profiles offered were Category Management, Program Management, Sales and Marketing, Business Development, Data Analytics, Financial Analyst, Corporate Finance and various Leadership Development Programs. Beyond the traditional roles, the prestigious Finance Leadership Development Program (FLDP) and Building Operations Leadership Development (BOLD) roles from Amazon were a key highlight this year.

Sales and Marketing/Operations and Supply Chain

SPJIMR has continued to maintain its niche in FMCG/FMCD hiring. This year witnessed an overwhelming response from the FMCG/FMCD sector. A total of 22.6% of the batch and more than 55% of the combined Marketing Management and Operations & Supply Chain Management batch accepted offers in this sector. Sales & Marketing and Supply Chain Management roles were offered by FMCG/FMCD giants like ITC which came back to campus this season along with premium recruiters like Asian Paints, Colgate-Palmolive, Hindustan Unilever Limited, Johnson & Johnson, Landmark Group, Marico, Mondelēz, Nestlé, Nivea, Procter & Gamble, Pidilite and Reckitt Benckiser amongst others.

Finance19.7% of the Finance Batch secured roles in the Banking and Financial Services sector. 15% of the Finance batch specifically secured roles in Investment Banking profiles. A plethora of roles were offered across sectors such as Equity Research, Digital Banking, Private Equity, Wealth Management, Corporate Finance, NBFC etc. Investment Banks and Private Equity firms such as Bank of America, Goldman Sachs, Nomura, O3 Capital, Sabre Partners, SBI Capital Markets and Spark Capital participated in the Autumn and Final placements. Asset Management, Corporate Banking, Treasury and NBFC roles were offered by Reliance Treasury, DBS, HSBC, JM Financial, Edelweiss, Axis Bank and ICICI Bank. Barclays had offered multiple roles in FinTech while corporate finance roles were offered by Amazon, ColgatePalmolive, Hindustan Unilever Limited, Mondelēz, Nestlé and Nivea.

IT and AnalyticsTechnology giants such as Airtel, American Express, BYJU’S, Cisco, Freshworks, InfoEdge, Intuit, Media.net, Microsoft and Samsung R&D Institute India – Bangalore offered Product Management, Analytics, Program Management, Tech Sales, and General Management roles on campus this year. GE Healthcare and Philips recruited for its renowned Digital Technology Leadership Program and IT Leadership Programme respectively. Corporate IT roles were offered by companies like Asian Paints, Hindustan Unilever Limited, Mondelēz and Pidilite. Almost 40% of the Information Management batch secured offers in Product Management roles.

You might like reading:

How to Get Promoted Without Asking

A promotion, moving up in life or simply climbing the corporate ladder is something that’s pretty high on the list of anyone who is either already working or planning to start working soon. That’s precisely why I chose to write an article that will give those of you who are looking to move up in life some tips on how […]

Dental Practices Can’t Upsell – Can They?

Not all Dental Practices are created equal and not all provide the same services. When most people think of going to the dentist, they think about getting their teeth cleaned, cavities filled, and when one is a little older, crowns and root canals come to mind as well. These are the basic preventative and restorative dental services that are usually […]