In recent years, there has been a shift in consumer preference of the grocery products and such an emerging market is Australia.Australia has one of the most concentrated grocery sectors in the world with total revenue of $92.7 billion in 2013 and projected CAGR (Compounded Annual Growth Rate) of 3.8% for the period 2013-2018.

[bctt tweet=”Australia grocery sectors total revenue of $92.7 billion in 2013, projected CAGR of 3.8% for the period 2013-2018.”]

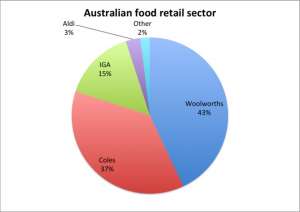

Supermarkets such as Woolworths and Coles have 80% of market share in the grocery market, with a valuation of AUD 80 million. Generic house brands also known as private label brands are growing in Australia as a result of ever-changing consumer shopping patterns thereby creating complex landscapes for various brands due to intensification of supermarket shelf space wars.

Australia Food Retail Sector

Consumer food purchase patterns are globally changing and are varying across the countries due to a change in income levels. Developing nations are witnessing an increase in sales of high value retail goods while in developed nations this increase in sales is an outcome of improvements in food safety and fulfillment of customer expectations.

There is a fierce competition in Australian food retail industry. There are both large and small players in the marketplace and since consumers have negligible “switching cost”, these players are constantly fighting for customer loyalty through competitive pricing structure.

Post Global Financial Crisis, consumers have become price sensitive by and large and as a result their inclination towards generic products Now, they tend to prefer the generic brands over the name brands. According to Findlay & Sparks, Generic products are not innovative but they survive through replication of the product produced under name brands. These brands have been scoring well even during the blind taste test. This has been owing to a couple of factors.

According to Tuttle, Market researchers claim that the economic downturn led to 93% of consumers change their shopping habits. As per Consumerreports, following are some of the most important factors because of which consumers might prefer the generic brands and a shift in consumer preference is observed:

- Product is of cheaper price than name brands.

- It’s sold by well-established retailers such as Woolworth, Coles, etc. so in turn profitable for retailers as well hence, they promote it.

- It’s well distributed through the parent retailer.

- The gap between price of generic brand and name brand is quite wide making private brand as an economic choice.

- Customers’ perception about products being adopted to as only label differs.

- Options such as money back guarantee given by stores that ensures that the product can be returned if doesn’t satisfy the customer needs.

While for the name brands there are still some hidden persuaders that attract consumers and make them spend more than the alternative home brand product. Following are a few of these factors:

- Time: If a customer has limited time, he would not prefer to look for alternatives and would rather stick to his own list of tried and tested products.

- Level and position on Shelf: Shelf level and position are crucial as the consumers tend to pick the items primarily noticed on the shelf. It’s the matter of ease for which consumers pay extra price.

- Offers: Name brands keep coming with value added options such as bundled food product, coupons, freebies, etc. along with the main product that lures a customer to buy them.

- Nutrition factor: Name brands differentiate themselves by portraying that their products as better quality products thus as healthy and higher in nutrition value. Sometimes two products when compared (brand and non-brand) may have the same freshness, quality and nutrition value, but may differ in composition of ingredients.

- Convenience: These products are easily available in close proximity and customers are well aware of them because of their old and established distribution network.

I hope the above information will provide interesting insights related to this shift in consumer preference.

Tags: Australia home brand MarketingYou might like reading:

Anirudh Sainath , TEDxNMIMSBangalore 2014

Anirudh Sainath , better known as “Molee” is a freelance digital artist, who started drawing at the age of 3. He is known for his work on Indian mythology inspired by the ancient Indian scriptures. Depicting his artworks online he tries to educate the masses about the narrative aspect of Indian mythology which he feels is ignored today by most […]

How to build a successful startup

“Start-ups are as old as the word itself” as quoted by the most eminent person of our nation in the recently concluded Indo-US Start-up Konnect 2015. He went on to add that “Start-ups are close to my heart”. Our Prime Minister Mr. Narendra Modi pressurized the need of blooming of start-ups in India. Why start-ups have been the hottest trend […]