In the past few years, rural development has assumed global attention especially among the developing nations. It is a great opportunity for a country like India where 65% of the people reside in rural areas. The present strategy of rural development in India mainly focuses on provision of basic amenities, poverty alleviation, better livelihood opportunities and infrastructure facilities through innovative schemes of wage and self-employment. Thus Indian rural markets offer a sea of an opportunity for the retail sector that needs to be tapped with care.

Rural India is proving to be the emerging growth centre for Indian retailers as the rural population dominates the Indian market with over 720 million consumers (approx. 70% of the total population) spread across nearly 0.63 million villages. Usually, Indian rural retail stores are in the form of haats, melas etc. Purchasing power of rural people is on rise and market is growing at a rate of 3-4% per annum. Coke/Pepsi or Colgate/Close Up or Dove/Pantene or Ariel/Surf Excel or Lays/Bingo are household brand names in rural markets today. To give a boost to the rural economy, the Union Budget for 2015-16 allocated a total of Rs 79,526 Cr for rural development activities including Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA).

Undeniably, the urban market (metropolitan cities, tier II, III cities) offers great opportunities to organized retailers but they are expected to saturate in the near future. Moreover, low penetration rate in rural market facilitates most big retail companies to enter the untapped rural market (bottom of the pyramid). For example, ITC has taken a initiative through Choupal Sagar, DCM through Hariyali Kisan Bazaars, Pantaloons in a JV with Godrej through Aadhars, TATA through Kisan Sansars to name a few. These corporate retailers have already established the farm linkages resulting in Indian farmers making good money, after centuries of social and economic exploitation. Also, as rural areas have been affected to a lesser degree by the current economic slowdown, several other Indian companies are contemplating over launching rural retail brands. Thus, rural retailing in India has a very long haul ahead.

In rural markets, consumers are experimental and price conscious. Even though consumers at the bottom of the pyramid do not seem to have fixed income (which affects purchasing dynamics), the rural market prove to be surprisingly loyal. So if the companies could channelize this sentiment then they could really reap the rewards. Also, it is well known that for the same level of income, the purchasing power in rural areas is much higher as the expenditure on basic necessities is relatively lesser due to being subsidized or free in comparison to the urban India. Rural consumer insights show that they buy products more often (mostly weekly), buy small packs (low unit price more important than economy) and buy value for money, not cheap products.

However, there are intrinsic problems in the way products and services are retailed in rural India therefore the organized retailers have been facing a difficult time to lure customers from traditional kirana stores, especially in the food and grocery segment. Other impediments include gaps in road and telecommunications connectivity, lack of reliable electricity and water supply, higher overhead costs, fluctuating demand that depends on the monsoon etc. Rural populations share several commonalities like domestic constraints, financial hardships, difficult living conditions, lack of basic information for making informed decisions, amongst others.

The Indian rural retail scenario is headed for a quantum leap. Besides newer names set to dot the landscape, new and emerging retail formats are driving the diversity of the fast-changing retail backdrop. As organized retail in rural India awaits the arrival of new players, current majors like ITC are expanding their retail operations by setting up more stores, offering newer product categories and entering new states. A shift from selling agricultural-inputs will help these stores target the non-farming segments. It is a little known fact that 25% of the rural population is not engaged in agriculture but it earns 50% of the rural income. The Indian rural retail market is the next growth frontier for corporate India as it offers an opportunity for a large player to build approximately Rs. 40,000 Cr retail business spanning multiple categories by the end of 2015 (at current prices).

Tags: markets retail RMAX Rural IndiaYou might like reading:

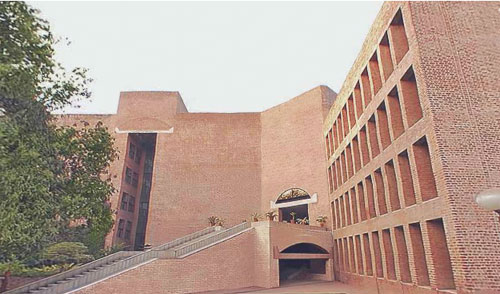

IIM A and Bank of America partner to set up Centre for Digital Transformation

Indian Institute of Management Ahmedabad (IIMA), the premier global management institution, has partnered with Bank of America to launch a Centre for Digital Transformation (CDT). The Centre aspires to become a vibrant knowledge hub for academia, policymaking, and the private sector by facilitating cutting-edge research on digital transformation and innovation. The Centre for Digital Transformation was launched with an event […]

Property price bubble in China- Part II

Read the earlier part here However, the property prices are showing increasing chances of the creation of a bubble- in fact if we consider the city of Shanghai, real estate prices increased by more than 150% between the years 2003 to 2010. The price of property to income ratio in places like Beijing is at 27 to 1 for double […]