Reserve Bank of India(RBI) is the central bank of India. Its main function is to establish monetary stability in the country. For this, it is equipped with independence in formulating and implementing monetary policies in order to maintain price stability and adequate money supply in the system.

RBI takes different expansionary and contractionary steps to achieve the same and utilizes its tools such as Cash Reserve Ratio(CRR), Statutory Liquidity Ratio(SLR), Bank Rate, Open Market Operation(OMO) and Liquidity Adjustment Facility(LAF) for this.

The use of these tools varies the supply of money in the system. Whenever RBI wants to reduce money supply i.e. curb inflation in the country it follows contractionary measures, whereas when achieving growth is the target it takes expansionary measures.

Why are interest rates important for an economy?

Amongst all the rates, it is the Repo rate which influences most the given money supply in the economy. Repo rate is the rate at which the banks borrow short-term funds from the RBI. It is a secured nature of borrowing similar to a loan against fixed deposits availed by individuals during emergencies. RBI raises repo rate to increase the overall cost of funds in the banking system. Higher costs will keep in check the demand for funds. If the central bank hikes its repo rate, it becomes costly for banks to borrow money from RBI so they in turn hike the loan interest rates at which customers borrow money from them to compensate for the hike in repo rate.

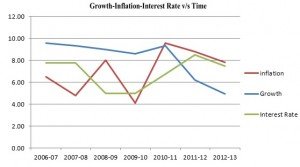

In the following graph, the trend in inflation, growth and interest rates have been plotted for the past seven financial years from 2006-07 to 2012-13 have been plotted.

Interest rates have high influence on both growth and inflation. Higher the interest rate, higher is the cost of capital and contributes to slowdown investment in the economy. Interest rates are a significant factor in determining the economic environment in which investment has to take place, especially when many companies are not cash rich. High interest rates also impact FDI due to the uncertainty in the exchange rate as the market expects interest rates to eventually fall.

Lower the interest rate, higher is the supply of money in the economy and greater purchasing power of individuals. This will result in increase in the price of Goods, since there is more demand and less supply of the goods. Manipulating interest rates thus creates a variation in growth and inflation in the economy.

Thus Interest rate is amongst the most significant components of the cost of many companies and uncertainty of this variable only amplifies overall uncertainty in which investment decisions have to be made. RBI has to maintain a balance between these two factors which runs the economy. RBI’s interest rate policy can help anchor expectations and reduce uncertainty.

|

Year

|

Growth

|

inflation

|

Interest Rate

|

|

2006-07

|

9.57

|

6.50

|

7.75

|

|

2007-08

|

9.32

|

4.80

|

7.75

|

|

2008-09

|

9.00

|

8.00

|

5.00

|

|

2009-10

|

8.59

|

4.10

|

5.00

|

|

2010-11

|

9.32

|

9.60

|

6.75

|

|

2011-12

|

6.21

|

8.80

|

8.50

|

|

2012-13

|

4.96

|

7.80

|

7.50

|

Source: Planning Commission

Table 1. Historic data of growth, inflation and Interest Rate

As per Table 1, from 2008 to 2009, the inflation rose by almost 4 percent and the repo rate was reduced by 2.75% as the growth rate was steady at 9% whereas from 2011 to 2012 the inflation as compared to previous year lowered its pace to 8.80% and growth suffered. Central Bank in 2011-12 had to therefore increase Repo rate to control inflation.

Current Indian Scenario

The global economic activities have slowed and risks remain high, most recently on account of uncertainty over policies of systemic central banks. On the domestic front, macroeconomic conditions remain weak, along with supply constraints, lacklustre domestic demand and weak investment sentiment.

Annual inflation rate, based on WPI has been currently showing a downward trend from 4.89% in April 2013 to 4.7% in the month of May. Many high weightage items from the basket had lowered its price as compared to previous year. Petrol that occupies around 1.09% of weight age in WPI has its contribution decreased by 4.43% due to global falling in prices. Basic metal and alloy products occupies a huge position of 10.74% has lowered its contribution in growth of WPI by 1.5%. The similar has been the trend with Iron and Semis. Also the global gold prices are falling. All this provides central bank a room to lower down the interest rate to prosper growth in the economy.

Due to the remarkable economic growth of India over the recent years compared to other nations, increase in foreign currency inflow caused the demand in multiples in India. Inflation has moderated as projected however the depreciation in rupee value and imbalances in the commodity markets pose a big challenge. Given that food price are still high, the inflation figures will be influenced by efforts to break food inflation persistence and also the impact of the ordinance passed for the food security bill.

Comaparison with other Economies:

Various steps were taken by other developing nations in order to control their monetary policy and economy. Among the developing nations, Indonesia responded to outflows and market volatility by unexpectedly raising interest rates – the first Asian central bank to do so since 2011 – in a bid to support its currency, while Brazil said it would scrap a tax on foreign exchange derivatives as the real weakened. Other major developing countries with large foreign financing needs such as South Africa and Poland are also seen at risk.

If we check the current scenario of developed nations, they have a very low interest rate. US Fed has kept its fund rate to as low between 0-0.25%, Japan’s call is between 0-0.10% whereas European Central Bank has kept its key interest rate to 0.5%. This shows to achieve growth we need to keep these rates low, but again the central bank must have a control on money supply in order to curb high inflation.

Interest Rate and Reserve Bank of India:

Historically, from 2000 until 2013, India Interest Rate averaged 6.6 Percent reaching an all time high of 14.5 Percent in August of 2000 and a record low of 4.3 Percent in April of 2009. Due to tight cash conditions in the system, banks have been borrowing an average Rs.80,000 crore daily from RBI. Due to worsening liquidity conditions, bank borrowing shot up to Rs.1.2 trillion from the central bank in December 2012. That apart, banks have also been tapping the refinance facility of RBI. Also, RBI has infused about Rs.1.3 trillion into the system last fiscal through so-called open market operations.

RBI (Reserve Bank of India) had to control this excess liquidity in our economic system. The RBI in its last review meeting decided to keep the repo rate under the liquidity adjustment facility (LAF) unchanged at 7.25 per cent and to keep the cash reserve ratio (CRR) of banks unchanged at 4.0 per cent of their net demand and time liabilities. The Central Bank warned of upward risks to inflation posed by a falling rupee and increases in food prices.

The Reserve Bank’s monetary policy stance will be determined by how growth and inflation trajectories and the balance of payments situation evolve in the months ahead.

Inflation has moderated as projected however the depreciation in rupee value and imbalances in the commodity markets pose a big challenge. Given that food price are still high, the inflation figures will be influenced by efforts to break food inflation persistence and also the impact of the ordinance passed for the food security bill.

Recent measures to dampen gold imports are expected to moderate the current account deficit in 2013-14 from its level last year. The main challenge is to reduce the current account deficit to a sustainable level and the short term challenge is to finance it through stable money flow.

Conclusion

Interest Rates are very important tool for an economy. It determines country’s growth, its inflation, value of its currency, indirectly the level of employment and investments prospects in the country(in the form of DII, FII, FDI). To achieve an open economy, India should be open to investments thereby reducing prevailing interest rates taking into consideration the inflation. Again with continuous depreciation of Rupee in last few weeks, indicates the need to absorb liquity in terms of Rupee to stabilize the currency.

Also if we see the trend, even though Central Bank reduced its repo rate, the same has not been transferred to the consumer by banks. The lending rates have not decreased by the same percentage as expected by RBI. Thus there has been not much investment on the growth front. This leads to a question as to whether further reduction in interest rate by Central Bank would provide a helping hand to growth of the country or will merely increase the money supply(causing inflation) and providing high profit making opportunities to banks.

The big question still remains to be seen is that with an inflow of Rs. 1.23 lakh crore in the economy in the name of food security bill , will it boost the money supply and decrease prices or will the spending in the elections cause further create a hole in government’s treasury!

[The article has been written by Neha Agarwal and Utkarsh Tathagath. They are presently pursuing their MBA from NMIMS, Mumbai.]