“It doesn’t matter if a cat is black or white, so long as it catches mice.”

– Deng Xiaoping, Former Chinese premier

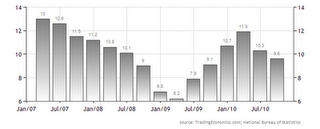

These words of none other than the architect of liberalized China indicate the spirit of modern China- the economic powerhouse of the 21st century. Yes, china has arrived on the world stage and has brought about series of changes that has transformed it to such an extent that it is poised to overtake the US as the world’s largest economy by the year 2030. Even the present US president Barrack Obama visualizes creation of a G2 consisting of US and China in order to maintain the economic and political stability of the world.

The Chinese economy can be interpreted as a combination of several sub economies. The prosperous east coastal regions are reminiscent of sub-economy of Germany whereas if we move slightly towards the central and western China they are representative of sub economies of countries like Italy and even Bangladesh. Overall the growth rates have also been largely very different. For instance Shanghai lying in the east coast has today twice as many sky scrapers than New York and is fast evolving as the trade centre of Asia.

China has chartered its own path by creating the world’s second largest economy valued at over 7 trillion USD through investment and an annual growth rate of 9%. China has achieved this growth largely through construction of schools, hospitals, skyscrapers, factories, malls, technology parks and newer cities in a scale so far unknown to mankind. In fact, in a period of 5 years from mid 1990s to 2000 nearly 20000 towns and 360 cities came up though many of them finally ended up being ghost cities. The per capita income though is significantly lower than its western counterparts at around 7500 USD. It has become the world’s highest consumer of cement and steel- two of the prime components of its infrastructure spring. However, this growth has not arrived without the perennial problem associated with it, the problem of inflation and over capacity.

The World Properties market

The US mortgage crisis followed by the European debt crisis has taken a very heavy toll on property and real estate prices the world over. In fact, in the US the prices have crashed to such an extent that in most cases the mortgage value is higher than the prevailing market prices. Even in MKIT (Mexico, Korea, Indonesia and Turkey) and BRIC nations (excluding China), the real estate prices are coming down. In Mumbai, the properties market have been severely hit due to fewer sales and rising interest rates and developers are considering reducing the floor price rates in prime locations. Hong Kong though remains an exception to the rule and has emerged as the world’s most expensive properties market.

The two main ingredients- Steel and Cement

Two of the main ingredients in creating a real estate boom are going through two different phases in case of China. Global steel prices are undergoing a slight correction at the moment though its long term future looks good. According to World Steel Association, global demand for steel is expected to reach record levels of 1441 million tons in the year 2012. The People’s Daily estimates that out of this China’s demand alone will be 635 million tonnes if it maintains a growth of 5% year-on-year on its steel consumption. However the point to be noted here is the fact that major portion of its steel needs are met through imports and it is China’s hunger for steel that has driven prices in the world market.

In case of cement, though it is a totally different story altogether. China remains the world’s highest consumption ground and its net consumption is greater than that of the rest of the world. For the year 2010, China’s net capacity was at 1.8 billion tons as against the world’s total capacity of 3.3 billion tons. Being the world’s largest producer of cement, China does not depend on imports for cement and hence cement prices are within its control. In fact based on an estimate, Chinese cement is nearly 50-60% more expensive than comparable quality produced in countries like Thailand and hence has little demand in the world market leading to over capacity.

The labour market though will not be affected as due to China’s high scheduled investment in infrastructure development most of the workforce will be utilized in these activities.

The decision making process in China and the property bubble

The entire development in China takes place mainly through government owned companies or through companies owned by individuals who belong to the Communist Party. According to an estimate nearly 80% of all companies in China are either owned by the government or by those having strong allegiance to the communist party. The rapid development that has taken place over the last three decades has occurred mostly by acquiring farmland at extremely low prices and in return those displaced have received urban citizenship. Once the land is acquired, there is breath taking development in partnership with private developers which increases the prices manifold.

Here, the fact that should be pointed out is that the entire Chinese economy does not follow the conventional model of economy driven by demand like say India, instead the growth in the Chinese economy has been caused by creating excess capacity. For instance, the amount of floor space created in the city of Tianjin is sufficient to last for the next 25 years. Similar is the case with Shanghai which has quite significant properties still lying without an occupant. Chinese government has tried to create their economy on the basis of the multiplier model where higher investment will trickle down to create higher demand and thereby leading to economic growth.

However having excess capacity does not reduce property prices in China. This is another area where Chinese economics defy conventional logic. In fact, despite there being no tenants in places like Beijing, state companies are buying and selling office spaces for more than 450 USD per square foot. Even though more than ninety percent of South China mall, one of the largest malls in China, was unoccupied it wasn’t affecting the prices at all. The flipping of assets between government owned entities has led to the fuelling of the property price bubble in China – an artificial floor price being created due to cartelization between the agencies and the developers. Can it lead to a sub-prime crisis as in the US ? Probably not. This is so because unlike US most property purchase in China is being fuelled through savings and not through credit – 56% of properties in US were purchased through credit as against 17% in China which implies that there is far less chance of a possible bubble burst.

(The concluding part of the article will be posted in following part)

You might like reading:

IdeasMakeMarket.com presents Budget Expectations 2016

The Campus ambassador team of IdeasMakeMarket.com brings to you Budget Expectations 2016. Here’s what you can expect from the budget in all the sectors. Read it online or download it ! Tags: budget IMM magazines

GDP vs Inflation

Whenever, one talks about country’s economy, the two parameters GDP and inflation plays important role in determining country’s economy. Before getting into the details, lets look at brief definition of GDP and Inflation. GDP: The gross domestic product (GDP) is the amount of goods and services produced in a year, in a country. It is the market value of all […]