During the recent elections, news that India had the most expensive petrol among its neighbouring countries spread like wild fire in social media. On exploring further into the issue, I found the news to be completely false. Venezuela had the cheapest oil among all the countries. In fact, it is the country where petrol is cheaper than water. But there were many developed countries that were paying exorbitant prices for petrol like Italy, Netherlands and Norway.

There are several factors that affect the price of petroleum products in a country:

Crude oil: The presence of oil reserves in a country affects the price. Countries like Venezuela, which has one of the largest oil reserves in the world, can have prices as low as INR 7 per litre.

Taxes: State imposed taxes add to the price of various petroleum products. Every country adopts different taxing mechanism. Norway, the world’s fifth-largest oil exporter, has the costliest petrol in the world. The government levy heavy taxes on petrol to discourage people from using private vehicles in order to fight climate change.

Marketing and distribution: The location of the country from the exporting nation or refinery adds to the price. Nepal has no refineries or reserves. It imports 100 % of its petroleum products from India. The distribution adds to the cost of petroleum products and as a result, the price of petrol in Nepal is higher than India.

Other factors: These include war or natural calamity like situation in the oil producing country. Political instability in the Middle East in countries like Syria and Iraq have recently caused spike in the international oil prices due to uncertainty of supply.

Petrol price build-up in India

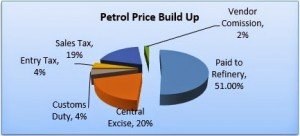

In 2010, Indian government decided to deregulate the petrol prices. As a result, it presently fluctuates in accordance with international markets but the taxes remain unchanged and any change in the price is passed on to the customer. Nearly 47 % of the price is in the form of taxes paid to the government. Out of the remaining, 51% goes to the refinery including the transportation cost and paltry 2% commission is left with the vendors. Local taxes may vary from state to state leading to price disparity within the country.

In 2012, Goa reduced the VAT on petrol to .1% leading to lowering of price by INR 11. Goa became the first state to have petrol price lower than diesel price. The price build-up of diesel is almost similar but taxes are little lower as compared to petrol. It’s not only the consumers who are at receiving end but also oil companies in India which are struggling to make ends meet. To understand this, we need to know the supply chain mechanism of petroleum products.

Supply Chain of Petroleum Products

The petroleum industry is divided into upstream, midstream and downstream segments. The upstream sector includes searching for potential underground or underwater crude oil and natural gas fields, drilling of exploratory wells and operating the wells. The major players in E&P sector are ONGC, Oil India and GAIL. The midstream sector involves transportation (by pipeline, rail, barge, oil tanker or truck), storage and wholesale marketing of crude or refined petroleum products. The downstream sector includes refining of petroleum crude oil, marketing and distribution of products derived from crude oil. The major players in Petroleum refinery and marketing in India are Reliance, BPCL, HPCL and IOC.

Under-Recovery

Oil marketing companies (BPCL, HPCL and IOC) buy oil from E&P companies (ONGC, Oil India and GAIL) and sell it at a discount to customers. The selling price in India is pegged to Singapore markets, but OMCs sell petroleum products to consumers at a lower price due to prevalent price regulation in petroleum products by government of India.

This difference in price accounts for under-recovery. The under- recoveries are shared between the government and oil companies, both upstream and downstream. These are not to be confused with losses as under-recoveries are on selling price and losses are on cost price.

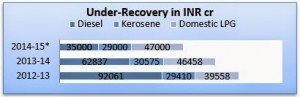

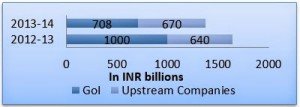

After the deregulation of petrol, the under recoveries in petrol have now been tackled to a large extent. Any change in petrol price is passed on to the consumer directly. But diesel, Kerosene and LPG are still regulated by the government. Since 95% of diesel is consumed for commercial use, any change in price of diesel will affects the prices in all sectors including manufacturing and transport industry. From the above figure, it is clear that GoI is trying to reduce under-recoveries. The biggest challenge is to arrest the under-recoveries from domestic LPG consumption which is as high as INR 506/cylinder. The government does not pay full under-recovery but only about 50-60%, the rest being shared by upstream and downstream oil companies

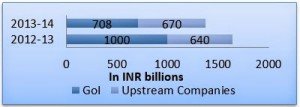

The gross under-recoveries (GURs) of OMCs was INR 1399 billion in FY14. The share of upstream companies in under-recoveries increased to 48% (Rs. 670 billion) in FY14 from 37% in FY13 as the GoI reduced its share to 51% (Rs. 708 billion) from 62% in FY13.

Subsidy

Out of the total INR 3600 billion in subsidy, a sizeable proportion of 27 % subsidy (INR 970 billion) is utilized for petroleum products. Food and Fertilizer subsidy have a higher priority, hence the government always tries to lower petroleum subsidy in each fiscal plan. Petroleum subsidy amounts to about 1% of GDP in India.

Contribution from Petroleum Sector

In spite of the huge amount of subsidy, petroleum sector contributes largely to Indian economy. Last year, the centre collected Rs. 64,335 crore from excise duty on petroleum products, which is more than a third (about 35%) of its entire excise collections of Rs. 1.79 lakh crore in 2013-14. Barring the years 2008-09 & 2011-12, this sector has always contributed significantly to Government exchequer.

Recommendations

Alternate Pricing model: There is a need to find new pricing mechanism for petroleum products. The current systems of pricing using Singapore markets do not reflect the true cost.

Reduction in Under-Recovery: The under-recovery on diesel, kerosene and LPG should be eliminated in a phased manner.

Targeted Subsidy: Subsidy should be given only to people below the poverty line along with direct transfer of subsidy to beneficiary account.

Alternate Source of Energy: Currently, India’s consumption of petroleum products is only about 1/5th of world’s average per capita consumption. As we move towards being a developed country our energy requirements will increase. To ensure the safety of environment, we should invest in renewable sources of energy.

Growth in Exploration and Production Activities: Nearly 70 percent of India’s domestic oil consumption is imported mainly from the Middle East. GoI should emphasize on exploration and production (E&P) activities in the country. Currently, this sector is dominated by domestic players due to several bureaucratic and political hurdles faced by foreign investors.

Saurabh Aggarwal

He is presently pursuing his PGDM from T.A.Pai Management Institute (TAPMI), Manipal.