Amazon, the world’s largest E-retailer, controls over 60% of the global e-book market (USD 10.5 billion+, 2014) according to Forester Research. The domination of the e-book market is largely a reason of the successful management of the range of Kindle devices that has clearly redefined the way we read, publish or distribute books. However, all is not well in Amazon’s publishing kingdom.

The company has been involved in wide scale disputes with publishers often accusing the Jeff Bezos company of arm twisting them and eating into their profits and royalty. Most of these disputes are owing to the pricing model adopted by Amazon in e-book format and involves leading publishers like Hachette (now resolved) and Harper Collins.

So how exactly does the pricing model of Amazon work? Amazon essentially looks at a three way distribution of revenues with 35% for the author, 35% for the publisher and 30% for Amazon. For self-publishers, Amazon looks at a differential sharing of revenues: For books priced under $10, the author receives 70% of the revenue while that for books priced over 10 USD, the author receives 35% of the share. This kind of pricing has been nicknamed as “incentivized” agency pricing, implying that the author is incentivized to price the book as low as possible for maximizing the revenue share. For instance, if a self publisher prices his book at $8, he makes more revenues than if he sells it at $12 using this model.

Till this part, the pricing looks fine. But what follows from here is the start of the dispute.

Amazon is keen(and has been so far) setting its own price for the e-books it sells. For example, say a publisher X retails its books in retail stores at $30 and wants to price the e-book at $22 on Amazon, it cannot do so. Amazon can change the price of the e-book to $14 and this becomes the price on its online store. In short, this gives Amazon to play the volume game and respond to price wars effectively by cutting prices at will and increase its user base. This is also the key to the effectiveness of its subscription model known as “KindleUnlimited” which charges users 9.99 USD per month.

This pricing model is very similar to what Apple follows for its iBookstore and iTunes and also faced similar issues in the past. But Amazon is no Apple, nor its own aura of irreplaceable evangelists or the Jobs brand-wagon.

The pricing row was at the centre of its dispute with Hachette, one of the leading publishers. While the issue now stands resolved, Amazon has had to climb down significantly. The statement released by Hachette to its authors and agents read:

“The new agreement delivers considerable benefits. It gives us full responsibility for the consumer prices of our e-books. This approach, known as the Agency model, protects the value of our authors’ content, while allowing the publisher to change e-book prices dynamically to maximize sales.”

As Amazon is now moving to the Agency model with Hachette, such deals can also be expected with other publishers. It is widely believed, however, that Amazon has set a cap on the maximum price that publishers can charge. Furthermore, this deal also implies that as publishers can now set their own price, their books will be sold at the same price across all the online stores- effectively weakening Amazon’s domination over the ebook economy. Amazon’s dream is a simple: “A paperless world of books”. But can it dominate it any longer? What caused Amazon’s change in stance?

Firstly, Amazon was afraid that if a large publisher like Hachette leaves, others will follow suite and start selling on its rival platforms. This will not only be devastating for its e-book sales but also deal a huge blow to the long term prospects of its Kindle devices. This comes at a time when the US ebook industry is expected to grow upwards of 8 billion USD in near future. So perhaps, Amazon intends to kill off its rivals first before reverting back to its original scheme of things.

Secondly, the release of Samsung Galaxy Tab 4- Nook for the first time looked like a real challenge to Amazon’s Kindle. The device priced at 180 USD offers the same facilities as Kindle Fire range of devices along with the network of Barnes and Nobles, the primary rival of Amazon in this segment. What happens if others follow on the footsteps of the Samsung –Nook experiment? Surely, Mr. Jeff couldn’t afford it at this juncture.

Thirdly, entry into newer markets like India and financial troubles are also a cause for concern. In India, regional language e-books constitute more than 70% of e-book sales – clearly an area where Amazon is not strong. At the same time, India’s home grown retail giant Flipkart is posing enough challenges for it in the fastest growing ecommerce market globally. To add to it, Amazon itself posted losses which show no signs of abetting. In fact, they seem to keep piling up.

Fourthly, Wal-Mart is investing heavily to increase its online presence in the US, the largest market for Amazon. The much hyped Amazon drone delivery and decision to set up warehouses in the cities in US can be seen as reactions to this development.

Furthermore, its current thrust on several capital intensive R&D projects would require board approval. Under the circumstances, Amazon needed to work out a compromise with Hachette to keep its shareholders happy and retain the investor confidence.

However, doing so has opened up the Pandora’s box of troubles for Amazon. It remains to be seen how the ecommerce giant deals with it and whether it extends such terms to other publishers as well. Till then, let the paperless kingdom prevail.

You might like reading:

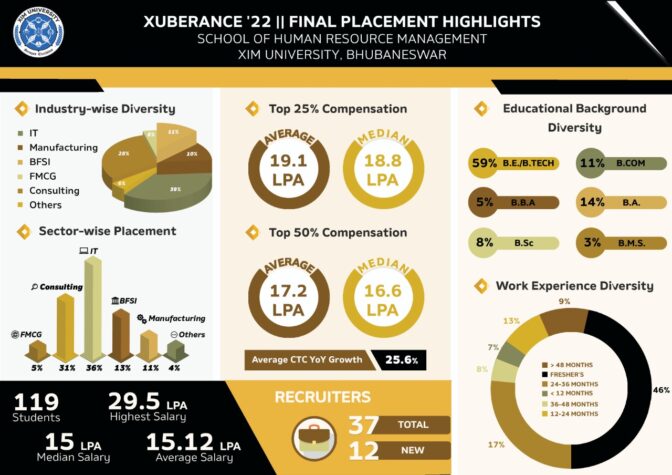

School Of Human Resource Management (XIMB) accomplishes 100% placements

Established in the year 2013, the School of Human Resource Management inheriting the 34-year-old legacy of Xavier Institute of Management, Bhubaneswar (XIMB) is a premium B-school. It aims at delivering quality education and making students as industry leaders. Under the umbrella of XIM University Bhubaneswar, the School of Human Resource Management provides a one-of-a-kind two-year flagship program completely dedicated to […]

IIM Bodh Gaya PhD Admissions 2022

IIM Bodh Gaya is inviting applications for admission to the Ph.D. Programme in Management 2022. It has added 2 more streams in Ph.D. viz. Business Communication and strategy apart from the previous 5 streams. Fee is Rs. 500 for males and Rs. 250 for females and reserved categories. Eligibility is B.E./B.Tech/Masters/CA/CS with CAT/GRE/GMAT/JRF/GATE. 2nd Year specialization course at IIM-Bangalore. Attractive […]