Jamnalal Bajaj Insititute of Management Studies(JBIMS) has once again successfully completed its placements in one of the shortest possible times. JBIMS enjoys the triple benefits of location, small batch size as well as a strong alumni base, hence this placement should come as no surprise.

Out of the batch of 120 students, 117 participated in the placements. The batch had a good mix of freshers and experience as only 11% of the batch had more than 3 years of experience.

117 Candidates

75 Companies

50%+ PPOs & PPIs

Roles & Recruiters

CONSULTING has always seen the best companies recruiting from JBIMS. This year was no different. Major global strategy consulting firms like The Boston Consulting Group, Accenture Strategy, Ernst & Young, Jones Lang Lasalle, Infosys, ZS Associates, etc. hired from the campus offering exclusive profiles, clearly demonstrating that talent is always well acknowledged by the industry. The enhanced depth in the consulting industry was an achievement and set the tone for JBIMS to be one of the stalwarts in the consulting field.

In BFSI & IB this year one of the major highlights for the finance domain was number of students opting for the front-end investment banking profile. In line with the trend of past placement seasons, the BFSI sector continued to recruit students from JBIMS in large numbers with companies such as Barclays Capital, Citibank, HSBC, RBS, JP Morgan, Trafigura, ICICI Bank, ICICI Prudential AMC, HDFC Bank, HDFC Standard Life, YES Bank, IIFL, Indiabulls, CRISIL, Bajaj Finserv, SBI, Fullerton etc. offering roles like corporate banking, treasury, commercial banking, wholesale banking, transaction banking, strategy, retail banking etc. which have reinstated their faith in JBIMS as one of the primary finance destinations of the country.

Along with these profiles, attractive roles like investment banking, equity research, treasury, hedge funds etc. were offered by Goldman Sachs, Edelweiss, Religare, ICICI Securities, Axis Securities, DE Shaw, Indus Valley Partners, Motilal Oswal, SBI Capital Markets etc.

FMCG & PHARMACEUTICAL companies hiring from the campus saw a mix of some of the top names in the industry. JBIMS continued to strengthen its relationship with FMCG majors such as Hindustan Unilever Ltd., ITC, Colgate-Palmolive, Mars, Nestle & Britannia. The Pharmaceutical Industry leaders like Cipla, Sanofi etc. recruited a substantial number of candidates.

MANUFACTURING COMPANIES & CONGLOMERATES such as Samsung, Larsen & Toubro, Daimler, Tata Steel, Future Group, Hero MotoCorp., Raymond, Arvind Brands, Trident, Sandvik, Huhtamaki PPL Pack, etc. offered coveted profiles in General Management, Sales, Marketing, Operations and Supply Chain. JBIMS once again proved to be the campus of choice for these recruiters.

TELECOMMUNICATION giants Vodafone and Idea maintained their strong relationship with JBIMS, offering profiles like Corporate Finance, General Management and Sales & Marketing.

TECHNOLOGY companies also fostered their relationship with the institute, hiring students across top profiles like IT Consulting, International and India sales etc. Top recruiters from this sector were the likes of Google, IBM, Tata Consultancy Services, Infosys, Wipro, Hexaware, Mogae Media, Nucleus Software which hired across diverse profiles.

Key Highlights:

You might like reading:

Shift in consumer preference: Generic versus Name Brands

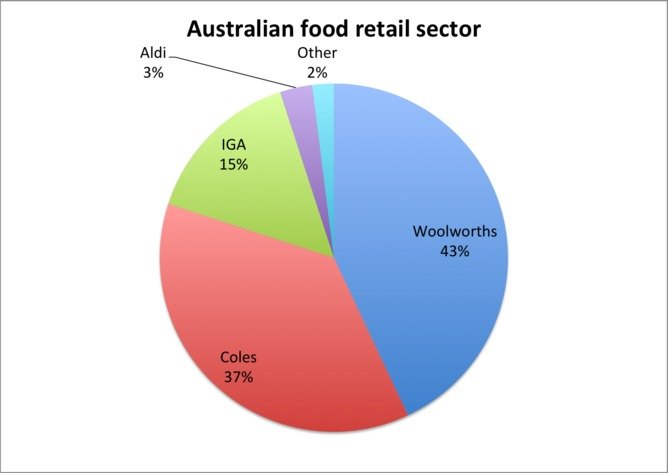

In recent years, there has been a shift in consumer preference of the grocery products and such an emerging market is Australia.Australia has one of the most concentrated grocery sectors in the world with total revenue of $92.7 billion in 2013 and projected CAGR (Compounded Annual Growth Rate) of 3.8% for the period 2013-2018. [bctt tweet=”Australia grocery sectors total revenue […]