For any economy, infrastructure is the backbone of the growth. It affects the aggregate output in two major ways- firstly contributing to GDP and secondly by increasing total factor productivity. Thus, it can be considered as a complement to growth. A majority of studies report positive correlation between infrastructure and output, productivity or long term growth rates. Infrastructure investment is also complementary to other investment. On one hand insufficient infrastructure investment can constrain other investment, while on the other hand excessive infrastructure investment has no added value. Even the suboptimal investment constraints other investment, which in turn restrains growth. India falls under the suboptimal infrastructure investment category.

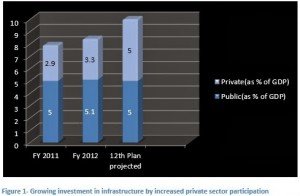

The Eleventh Five Year Plan (FYP) projected investment requirement for infrastructure to be about INR 20.5 lakh Crs (with base year as 2006-07 for prices). The Twelfth Five Year Plan projects to double the target for investment and projects it as Rs 41 lakh to sustain a real GDP growth rate of 9 per cent. The onus of this increasing contribution in infrastructure lies basically with private sectors.

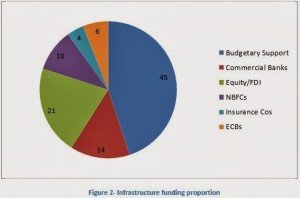

The infrastructure funding requirement has broadly been met from various channels in the proportion given below:

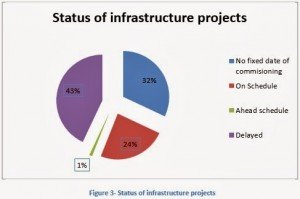

Though on paper this figure seems impressive but deeper analysis suggests that the target achievement differs from sector to sector.

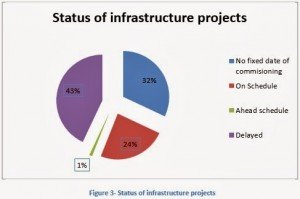

The growth story of India has been stalled by production and distribution bottlenecks mainly due to stalled infrastructure in roads, railways, and power, telecom, water supply and sewerage systems. This is reflected in the Global Competitiveness Report of 2013-2014 where India stands at a dismal 85 rank among 142 countries dropping 15 ranks further compared to 2012-2013 Report. The picture represented by the investment figures shows a fallacious representation of facts as it hardly incorporates factors like cost escalations. The data below shows how delayed projects are bottoming out the infrastructure sector. Almost 43% of the projects worth approximately 1.5 billion INR are delayed while 32 % of them have no fixed date of commissioning.

The dismal performance of major players like Larsen & Toubro and Reliance Infrastructure depicts the same saddening story. Larsen and Toubro, which is India’s largest engineering and construction company, suffered a 12.5 per cent fall in its net profit at Rs 756 crore for the first quarter this financial year. Reliance Infrastructure, a major player in roads, metro, rail and airports spaces , also recorded a dismal performance . Its profit rose by a paltry 0.8 % to INR 415.2 and revenue increased by 1.3 %.

Deterrents to infrastructure sector:

Corruption: According to Transparency International India ranked 94 among 176 countries. According to global corruption barometer 2013, political parties were at the top of the list among the most corrupt institutions and sectors.

|

Institutions/sectors

|

Percentage of people who think they are beset by corruption

|

|

Political Parties

|

86

|

|

Police

|

75

|

|

Parliament/legislature

|

65

|

|

Public officials /civil servants

|

65

|

Scandals like Coalgate Scam and 2G scam have already tarnished image of the nation. Improper bidding practices in spectrum or coalfields are not conducive to investor’s sentiments. Thus, corruption is not only stalling projects by delaying decision making but also by deterring foreign investors as well as Indian investors.

Delay in Land Acquisition: Land acquisition remains at the centre of policy paralysis. There are minimum 55 approvals required to implement any project. The POSCO case was not the only example of hitches and glitches in land acquisition. Bharat Forge also shifted power equipment project to Gujarat due to difficulty in land acquisition. Even Tata Motors was forced to abandon Nano project in Singur and move to Gujarat. The recent legislation, The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 which replaced 120-year old archaic regulations may further increase the difficulties. According to Crisil, the new legislation may further increase the gestation period and spike overall costs.

Stalled big projects: Rampant political dysfunction, unwieldy labyrinth of rules and the unpredictability of government policy has made India from an investor’s dreamland to investor’s nightmare. There are approximately infrastructure projects, steel, metals and alloys, power, road and gas and oils projects, in Karnataka which were stalled from years and facing delays.Other major projects which are stalled are JSW pellatisation plant in Bellary; Lanco and Shravanti projects in Uttarkhand; HKR and NAM road projects in Andhra Pradesh; JP power venture in Madhya Pradesh; Kinnur highway project in Himachal Pradesh; Navdurga-Dhalli road project; Anark aluminium project in Visakhapatnam in AP; Adur project in Orissa; and the NHAI highway project connecting Bangalore to Devanahalli International Airport.

Delays in environmental clearances: Many of the projects are jettisoned at the slightest dissent regarding environmental clearances. Quite a few times the fears of adverse impact are unfounded. The clearance process which has sequential hurdles either causes project proponent to give up the venture or burdens the project with time and cost overruns. Projects like widening of two lane road passing through Rajaji National Park, near Dehradun could not be undertaken due to hurdles created by Forest Act.

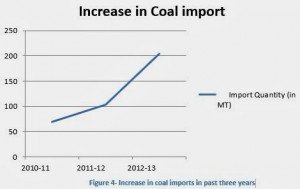

Dependence on imported coal: The constant increase in coal imports by Indian power utilities is sardonic, given that India has the fourth-largest reserves of coal in the world. Environmental clearances and land acquisition have become hurdles in domestic coal production. Coal India, which accounts for over 80 per cent of the domestic production is awaiting green clearances on 8 coal projects entailing investment of about INR 1000 crore.The imported coal quantity has almost doubled in 2012-2013 year as shown below:

This increase in coal imports is not only widening current account deficit but also stalling or causing cost overruns of various power projects.

Strict regulations: Projects worth over INR 7 lakh crore , which is almost half of the projected investment in Eleventh Five Year Plan, are stuck in red tape. The major sufferer is the power sector where projects worth INR 5.39 lakh crore are stalled followed by roads and steel. Even projects like Sasan and Coastal Andhra which were bid ostensibly with all approvals are held up.

The way forward:

According to world economic forum opinion survey, the three most problematic aspect of doing business in India are infrastructure inadequacy, corruption and inefficient bureaucracy. It is imperative to alleviate the various institutional constraints faced by infrastructure like corruption, clearances, lack of project management capability etc. There should be a concerted effort to fast-track policy and regulation reforms for better implementation of projects. The system should be made transparent by accurate tracking followed by performance-linked incentives and penalties. Setup of a single quasi-judicial authority for all infrastructure projects will enable quick dispute resolution. This authority should have statutory powers to resolve disputes between authorities and builders. There is a dire need to facilitate funding because risk associated with projects has increased making it difficult to raise funds , especially debt. Infrastructure bonds can be given boost by increasing the limit for tax exemption up to INR 100000 . There is also a need to change the way we approach infrastructure development. The transformation required is three-fold- across planning, bidding and execution of infrastructure projects. More thorough and forward-looking project preparation and a sound land-acquisition process will assist the implementation of infrastructure projects. A convincing infrastructure story is critical to controlling inflation by removing supply bottlenecks. Infrastructure will not only create a platform for product as well as service oriented industries but will also help attract foreign investors. It will lead to higher economic growth both on short as well as long horizons.