Bonds or Fixed income securities are the largest asset class in terms of investment value (if we do not consider real estate). Bonds are an extremely useful financial instrument if one needs to maintain a periodical cash flow or match the liabilities. For example, if we consider you have to meet periodical cash outflows, the same can be managed by creating a portfolio of bonds with coupon payments matching your outflows. Bonds are also a good tool to hedge against inflation. In this regard, two types of bonds are broadly considered: Inflation linked bonds and floating rate bonds. Let us understand the difference using a simple example.

Consider a straight bond with principal amount as 100,000, annual coupon rate of 5% and inflation rate of 3%. In this case, the principle will remain unchanged and there will annual coupon payment of 5000 (5% * 100,000). If we take into account a inflation linked bonds, the principal will change to 103,000 ( 3% inflation rate * 100,000 + 100,000). The coupon payment of 5% is then calculated as 5150 ( 103,000 * 5%). If it is a floating rate bond, the principal will remain unchanged but the coupon rate will change to 8% (5% +3%). The coupon payment will then be calculated as 8000 (8% * 100,000).

| Type of Bond | Redemption value after year 1 | Coupon Rate |

| Straight Bond | 100000 | 5000 |

| Inflation Linked | 103,000 | 5150 |

| Floating rate | 100000 | 8000 |

If we look at the table, it may seem that inflation linked bonds have a clear advantage over the other bonds. However, the same may not hold in all cases. For instance, if the tenure of the bond increases to 5 years, the actual return will depend on the inflation rates and paths taken by the bonds. Assuming that after 4 years, there is a deflation of 4%. In such a scenario, the straight bond will outperform both the inflation linked and floating rate bond.

As an investor, it depends on our own risk appetite and investment plan to choose the desired bond. Our objective in choosing the right instrument for us should depend on our requirement for coupon payments to meet our liabilities. Happy investing !

Tags: bonds inflation personal financeYou might like reading:

TEDxNMIMSBangalore 2013 : Different Strokes

TEDxNMIMSBangalore 2013: The journey of TEDxNMIMSBangalore started on 2nd February, 2013. The theme ‘Different Strokes’ for the event aimed to bring some inspiring people at a common platform and took the students, through their journey. During the session the speakers shared their experiences and how they realized their goals in their chosen respective fields. They offered valuable insight into what […]

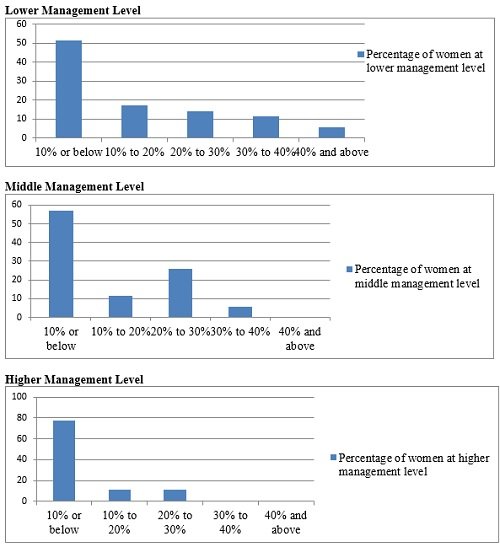

How to crack the glass ceiling ?

On March 8, 2013, the Jewish Museum of Florida, the only museum dedicated to the story of 250 years of Florida Jewish heritage, announced the winners of the 17th Annual “Breaking the Glass Ceiling” awards for five women who have been successful in fields generally dominated by men. What is Glass Ceiling? Introduction Glass Ceiling is the invisible but […]