The Indian e-commerce industry is now two decades old. It started with online classifieds back in 1997 and now it has been predicted to grow to $16 billion by Deloitte and ASSOCHAM by the end of 2015.Although e-commerce is present in India since two decades, major developments have occurred only in the last five year. The causes for the same will be described in the next sections.

There are many segments in e-commerce business. Those are online travel, Online retail, Online Classifieds, Financial services and Digital Downloads. Out of these segments online travel comprised 70% of the e-commerce market size. But gradually online retail is catching up with online travel and both make up to 90% of total e-commerce market.

E-Commerce Business Models

Companies in the E- commerce industry are using different kinds of unique business models to attract customer and increase profitability. Players in online retail segment are following one either marketplace model or inventory based model. Some have gone a step ahead and are using a model which is a hybrid of both. E.g. Flipkart is using a hybrid model to serve its customer. It has gone a step ahead and has invested in currier business (Ekart) which is a vertical integration in its supply chain. This has increased its control over its supply chain and has increased reliability of the delivery process. The table below gives similar strategies adopted by other companies to remain competitive.

Apart from this E-commerce companies use different revenue models to jack up their cash flows. Some examples are given in the table below.

Key Factors Responsible for E-commerce boom

In the last decade or so several factors have come together and created a perfect conducive environment for the e-commerce to boom. Those are increase in internet penetration, increase in smartphone penetration, robust online payment systems, and finally increase in disposable income of households.

Increase in Internet penetration

In the last decade India has witnessed a surge in internet penetration. Internet user base has increased from 5.5 million in 2000 to around 250 million in 2014. Similarly broadband subscriber base has increased form a meager 51000 in 2001 to more than 100 million in 2014. But the major boost to the e-commerce industry came after the proliferation of smartphones. Now India has more than 200 million smartphone users with internet connection. The appeal of smartphone is so much that an Indian company “Myntra” decided to go app only. Moreover the proliferation of 3G and 4G phones have made the internet more reliable and in turn helped the e-commerce industry.

Robust Online Payment System

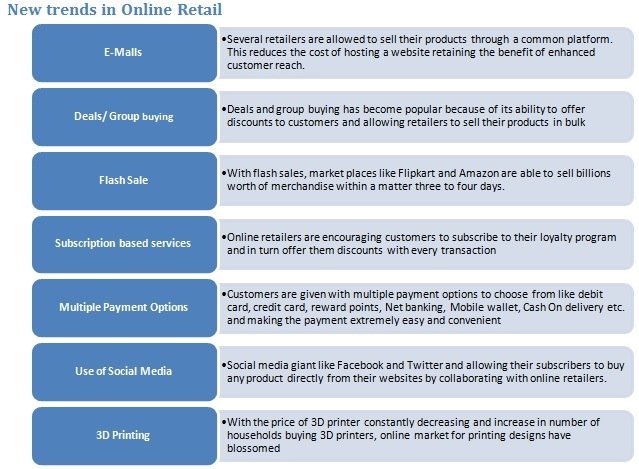

The online payment system has evolved to be very efficient and reliable in the last five years. It has cleared a major bottleneck for the e-commerce industry. Earlier the rate of online payment failure was pretty high which kept customers away from online shopping. With the increase in reliability of online payment system with multiple authentication layers, customers are now turning towards e-commerce industry. To add to this the use of credit cards and debit cards has grown over the years to a great extent. This has become a prime factor fueling the growth of e-commerce because of its convenience.

Increase in Disposable income of Households

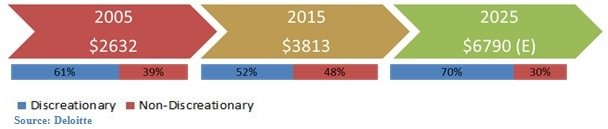

Disposable income of people in India is rising over the years. More and more households are growing out of poverty and joining the work force. This has affected the demand in all the sectors. Apart from this more and more are rural population is moving towards urban areas in search of jobs. This has made life easy for the e-commerce players as urban customers are easier to serve and bulk of demand comes from them. The figure below shows the gradual increase in household disposable income in India.

As the figure above shows, not only the disposable income is increasing but also the proportion of discretionary income is increasing. This is another factor adding to the growth of e-commerce.We will now analyze a few significant segments of E-commerce individually and analyze their business strategies.

Online Travel Industry

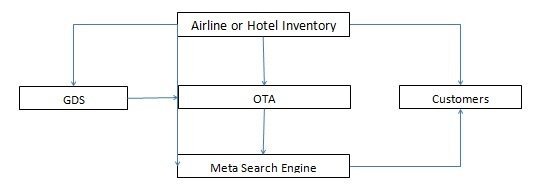

Online travel is the largest segment in the e-commerce industry. It accounts for nearly 60% of the market size. It started with in emergence of LCCs in 2005-06 which made air travel affordable to a larger audience. Moreover the airlines started selling their tickets online which increased convenience and efficiency. Since the last decade online travel has grown to be a diversified segment with the Online Travel Agents (OTAs) adding hotel reservation, bus travel and packaged travel to their portfolio. In the recent years advent of online taxi aggregators such as Ola and Uber have made the market more competitive. The online travel business model works with three entities i.e. Global Distribution system(GDS), OTAs and Meta search engines. The figure below shows the business model of online travel industry.

Emerging Trends

For the OTAs the traditional revenue model has been the service charge they collect from transactions. But it’s very less for them to sustain in the long term. To increase their revenue stream, OTAs have forayed into hotel reservation and bus ticketing segments. The table below provides a comparative analysis of the margins in different segments.

As we can see from the table Hotels and Tour Packages are very attractive compared to air travel. Hence this has led the OTAs to shift the focus to Hotels and Tour Packages. Now they have started bundled services e.g. providing bundled services from all the segments i.e. Air travel, Bus travel and hotel.

The aggregator Model

In the recent years taxi aggregators like Ola and Uber have revolutionized the online car rental market. With their sophisticated software they are able to map customers with taxi providers and provide a very convenient and cost effective mode of transport to the customers.

Online Retail Industry

This is the fastest growing e-commerce industry in India. The total retail industry is currently valued at $530 billion and has grown at a CAGR of 15% in the last five years as per a KPMG report. But it’s mostly fragmented with unorganized sector forming the major part. As per the same study there are 12 to 15 million retail outlets in India and constitutes 92% of total retail market size. But the organized sector is growing at an impressive rate and is predicted to touch $95 billion in 2019 from $15 billion in 2009. This gives a unique opportunity to organized retail sectors like online retail as organized sector penetration is going to increase further.

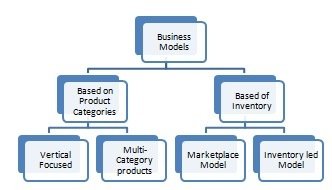

Business Models

Players in online retail sector typically follow one of the two models i.e. Vertical focused and Multi-category players. Vertical focused players cater to a particular sector such as garments, food, etc. For example Myntra.com only focuses on garments whereas Flipkart caters to multiple categories of products. Another form of differentiation is Marketplace model Vs Inventory led model. In the marketplace model the online retail website works as a channel between sellers and buyers. On the other hand an inventory led model allows the online retail store to keep stocks in warehouse and sell it themselves. Apart from this now most product based companies are now selling their products through both online and offline channels. For example Mahindra recently launched its online retail platform M2ALL where it plans to sell all Mahindra products.

Online Classified Industry

Online classified is one of the first industries to enter into e-commerce space. It has several categories such as recruitment,matrimonial, real estate, automobiles and B2B. The business model and revenue sources for this industry are as given below.

Changing Scenarios

As internet penetration increases more and more people and able to access the internet. This has made the internet a viable medium to reach out to maximum customers with significantly lower cost. For this reason online classified market has overtaken offline classified market in the year 2012. New business models are being created in this space with emergence of players like Housing.com, Zorooms etc. which are disrupting the online real estate market with innovative business models. Matrimonial sites are now providing customized products such as area wise and cast wise search options. Online recruitment is the most preferable options available to both recruiters and candidates. Alibaba, China’s biggest e-commerce player has revolutionized the B2B e-commerce industry. Now even capital goods can be ordered online.

The article is written by Pritish Kumar Panigrahi and Swapna Samir Shukla. They are presently pursuing their MBA from XIMB.

Tags: ecommerce etail flipkart retail snapdealYou might like reading:

Rouble Trouble: Russian Rouble Crisis & How to Solve It…

The year 2015 doesn’t seem to bring much good news for the Russian economy as the rouble crisis continues in the wake of staggering global oil prices. If this trend continues, Mr. Putin is facing an imminent threat of both recession and internal inflation, similar to something that happened in 1998. All events that have happened in the past year […]

Evolution in Organizational Diversity: How to manage it better!

Organizational Diversity has become the ‘Hot Button’ issue in every domain. So what do we actually mean by this very term? According to Harrison and Klein, 2007, diversity can be defined as the collective amount of differences among members within a social unit. However, according to Cox, 2001, diversity is reflective of the variation of social and cultural identities among […]