A few months back, some businessmen launched world’s first gold ATM in London. You put in your credit card and the machine will give you the real gold.

The current global economic scenario has become increasingly interesting with the gold rising and the euro and the dollar falling apart. The point here to be noted is, the dollar is in long term decline. This can be seen from certain recent events happening across the globe. IMF released a report that says that the Dollar holdings by central banks in their reserves in declining for last few years. UBS recently conducted a survey of investment institutions with more than USD 8 trillion under their management and most of them think that the dollar will lose its reserve currency status in 25 years from now.

For more than 50 years, the dollar has dominated the global trade. It was the most dominant unit used for cross-border transactions and formed major part of the reserves of central banks and governments. This bright and shiny currency has now started losing its luster. It has lost its share in the global trade, a change from 70% to just over 60% in last decade. The reason is so clear, US economy no longer dominates the world economy to the extent it dominated in the past. Also, it makes more sense for the global monetary system should direct the global economy in becoming multipolar. The stage, which belonged solely to USA, must now be shared with other economies and the dollar must create some room for other currencies. The US debt- ceiling fiasco has created concerns for the central bankers for holding dollars. Europe has failed to resolve its sovereign-debt crisis and there is a doubt on the existence of euro. Thus, the central bankers are now looking for alternatives other than these two falling currencies.

Everybody seems to admit the fact that sometime in future the dollar will lose its position of the global currency but there is no agreement on what will replace the dollar as world’s reserve currency.

There are many contenders to take this crown like Gold, Yuan, SDRs, Euro, Commodities, etc.Now let us explore each of these options one by one.

Gold

The gold has been on a rise as the dollar continues to fall in the international market. The gold has been riding on the increasing concerns over dollar as reserve currency and the risk of dollar falling further. The long term graph for gold shows that it has adjusted for inflation over a long period of time

Central banks in Asia are increasing their exposure to gold so as to protect the value of their reserves. They have bought about 151 tonnes of gold so far this year (2011-12) according to the World Gold Council. They are further going to make more purchases which will be the largest annual purchases of gold since the collapse of the Bretton Woods system in 1971, that pegged the value of the dollar to gold.

Gold cannot be controlled by any government and cannot be debased unlike fiat currencies. Furthermore, sovereign defaults is considered as the biggest risk for the next year and reserve managers across the globe have predicted that gold will be the best performing asset class in coming years.

The steps required will be as follows:

-Stop printing the paper currency

-Remove custom duties on gold and any other restrictions on its import/export

-Removing restrictions on possessing, owning, buying and selling gold

-Removing restrictions against possession of currencies and making them competition free

But, this is just not enough to make gold as the world’s new reserve currency.

The supply of gold is inadequate. Thus, implementing gold standard might result into deflation. The supply of gold is highly imbalanced across regions of the world and maintaining reserves of gold will be very challenging. The demand supply gap will eventually result into inflation in some regions. Gold standard will create greater price instability in short term. The prices are highly volatile as gold is a commodity. The gold standard is inelastic and it will create a mismatch in the quantity of money in relation to volume of economic activity.

Again, the governments cannot be trusted to maintain the gold standard. In 1960s, the US was accused of breaching the agreement and printed money more than gold reserves. In the past, it was constantly re-valued as countries were finding it difficult to stay within the disciplines. It was highly affected by wars.

With increased complexity of the global economy and constantly changing environment, it will not be a wise decision to again go back to gold standard.

Standard Drawing Right (SDR)

The SDR will be similar to a hybrid currency. It consists of following four currencies by weights as given below.

U.S. Dollar: 41.9%

Euro: 37.4%

Yen: 9.4%

British Pound: 11.3%

It can be seen that around 80% weight is given for dollar and euro combined. Thus, using SDR in the current form will not be really different than using dollar. Some other countries have also demanded for inclusion of their currencies in SDR. In that case, SDR can be said to have potential of becoming a true global currency. A more diversified SDR will reduce currency based risks, stabilize the global economy and make the rest of the world less reliant on the events happening in the United States.

The IMF has issued only 21.4 billion SDRs since 1970 and they are valued at $32 billion at today’s exchange rate. There is a proposed issue of $250 billion. But, it still looks smaller when compared with trillions of dollars of reserves held globally. Also, SDRs are issued in proportion to the country’s quota in IMF. Thus, two-third of them will go to developed countries and countries like India and China will get 2% and 3.7% respectively. This is definitely not serving the purpose of a truly global currency. Also, the process of issuing SDRs is cumbersome. SDRs cannot be traded in private markets.

Thus, it will take time for SDR to evolve as a truly global reserve currency.

Yuan

The Chinese government has kept its currency pegged to dollar to make Chinese goods less expensive for American consumers. To maintain the artificial exchange rate, the central bank in China keeps on purchasing dollars. Now, the “money-printing policy” of USA has made dollar lose its value steadily. Thus, China has to increase its dollar purchases to maintain the exchange rate and prevent yuan from rising against dollar. Eventually, the Chinese will have to depeg the currency from dollar and allow it to appreciate against dollar.

Now, China is promoting use of its currency for cross border transactions to reduce reliance on dollar. Japan and China have agreed to promote direct trade of yen and yuan between the two countries. China has also arranged currency swaps with some of its trading partners. It allows China to receive yuan and not dollars for their exports. Thus, China will be able to perform direct trade without putting the currency in the open market.

It can be seen from the past that the currency of the world’s biggest economy has been the reserve currency. It was true for pound as well as dollar. China is likely to replace the US as the world’s largest economy sometime during 2020s. It is already the world’s largest exporter (On contrary, the US is world’s largest debtor!).

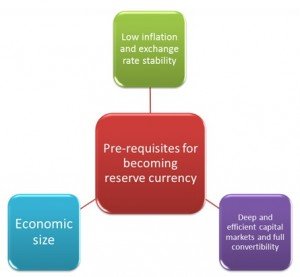

The current situation can be considered similar to the transition from pound to dollar except that yuan is not fully convertible and china is not politically stable. China does not have open capital market. The domestic bond market is small and illiquid. The access to these markets is highly restricted.

Thus, before heading towards becoming a global reserve currency, China must address these issues. Even if China overcomes all these issues, what it will still need to overcome is network externalities that are favouring dollar and euro currently. Still, yuan seems to be the strongest contender today that can replace dollar as global reserve currency.

Euro

The GDP of the euro area is 76% of the GDP of the United States. Euro is the second most traded currency. Also, euro-dollar currency pair is the most heavily transacted. Euro has its basic attribute as stability which is given priority over strength. Stability is one of the most important requirements of a global currency which will in turn impart credibility to the currency. Even is SDR, euro is a major contributor.

But, the sovereign debt crisis has raised doubts on existence of euro. The objective of euro was to challenge the role of dollar. But, euro is not in a better position than dollar today. The central banks are losing faith in dollar and euro as well and are in search of a new currency to hold their reserves in. Thus, euro is not in a position to become global reserve currency.

Commodities

A possibility is to use a currency based on a basket of commodities. Raw materials are the things that every country has to have access to. A currency unit that is formed of commodities like gold, oil, iron ore and rice will be something that will hold its value for a long period of time.

The currency will be linked to something real. Also, it will be more diversified unlike gold standard. It will also overcome the issues with gold standard regarding the adequacy. Basket of commodities will make more sense than basket of currencies (SDR).

GDP Linked Bonds

One innovative alternative will be to create a global reserve asset. The ideal would be a global GDP linked bond. The returns on it will vary with global growth rates. Thus, the central banks will be holding instruments that will behave like a widely diversified global equity portfolio. It would compensate for inflation and currency fluctuations as the payout will depend upon the nominal GSP and not real GDP. IMF can purchase GDP-indexed bonds from governments and provide new global reserve assets and capacity to generate interests.

According to IMF, governments should issue GDP-linked bonds, but convincing them to do so has been difficult so far for the IMF. So, convincing them for a global GDP indexed bond would be harder. Thus, this alternative is also not very close to be implementable in near future.

A Final Word

As the dollar is the reserve currency, the US can run trade deficits indefinitely. But, if some other currency replaces dollar as the reserve currency it will lose this advantage. But, in near future, this does not seem to happen. There is no indication from Gulf countries that they are intending to move away from dollar for their oil trades. The US shares a very high degree of political and strategic relationship with some key Gulf countries. Euro seemed to be the only currency with the ability to displace dollar from its position but with the Eurozone crisis, euro itself is in deep trouble. Yuan is still miles away from being a potential global reserve currency. There is no doubt that the world will witness a shift of power from US and Europe to Asia. But, the dollar has a long way to go before stepping it down as the global reserve currency.

Bibliography

Books and articles

1.Will the euro eventually surpass the dollar as leading international reserve currency?, by Menzie Chinn and Jeffrey A. Frankel, 2007

2.The rise and fall of the Dollar, or when did the Dollar replace Sterling as the leading international currency?, by B Eichengreen, 2008

3.Why SDRs could rival the dollar, by J Williamson, 2009

4.Explorations in the gold standard and related policies for stabilizing the dollar by RE Hall, 1982

5.The end of dollar hegemony, by R. Paul, 2006

Websites

http://www.dbresearch.eu

http://www.cnbc.com

http://www.telegraph.co.uk

http://arabnews.com

http://online.wsj.com

http://the-diplomat.com

http://www.bis.org/

[The article has been written by Ajinkya Patil. He completed his B.Tech in Computer Engineering from VJTI,Mumbai and his MBA at JBIMS,Mumbai. ]

You might like reading:

XIMB/ XUB achieves spectacular placements for its 2014-16 Batch

Xavier Institute of Management, Bhubaneswar has established itself as one of the premier B schools of the country attracting and encouraging the top talent having best of both – business acumen and thought leadership. It has always been a name to reckon with when it comes to foster talents for the ever dynamic business world. Matching the aspirations of this […]

Pan IIM Alumni Meet 2015 – Delhi

“When the going gets tough, the tough gets going”, has been rightly said for start-up theme base Pan IIM Alumni Meet 2015 at Delhi on July 26 at Taj Vivanta. We were given a warm welcome by Mr. Saif Khan, the chief facilitator for the event, who made the entire show go on with tremendous enthusiasm. The event was completely […]