Equity and Corporate Debt market:

The Indian capital markets have transformed since the economic reforms in early 1990’s and are now comparable with international best markets in trading and settlement infrastructure, risk managementsystems, efficiency and levels of transparency and governance, backed up by good technology infrastructure and systems of international standards. Transaction costs have been lowered and volatility contained to some extent inspite of integration with global markets. Savings of household sector in form of shares,debentures and mutual fund units is at relatively low levels,investors preferring safer contractual instruments like fixed deposits, provident fund,etc. ( table ??). This is a far cry from the days of the “ outcry” system of trading and stockmarket scams witnessed post liberalization adjustment phase when the markets were relatively insulated from global imbalances.

The corporate debt market remains underdeveloped, thus leading to high cost of issuance, absence of liquidity in the secondary market.

A growing economy like India requires a right blend of risk capital and long term resources for corporates to choose an appropriate mix of debt and equity, particularly for infrastructure projects which is the need of the day and needs infusion of USD 320 billion over next 5 years.

A well functioning domestic capital market is also necessary for the banking sector to raise capital and support growth and also have suitable capital adequacy ratio to mitigate risk.

On the supply side,rising income levels and savings would require alternative investment options to broadbase their returns, including equity and corporate debt.

The reforms in capital market need to focus on developing strong domestic institutional investors, adherence to international best practices in corporate governance and reduction in time/cost of floating public issues. Mutual funds penetration needs to be increased to attract larger share of household savings in financial assets.

The market development process for bonds is likely to be a gradual process as in other countries. The corporate debt market would require a large number of investors and large sized issues to function effectively. The role played by PD’s in developing the government securities market may need to be replicated through an appropriate institutional framework in corporate bond market.

The market regulator SEBI ( Securities and Exchange Board of India) is looking into these issues to create a more vibrant, liquid and deep corporate debt market and also improving the capital market structure , systems and process by various initiatives like demutualization of stock exchanges, technology upgradation and smoother trading/settlement systems across geographies, to improve investor confidence and provide a stable environment to corporates in face of challenges of globalization and become more competitive. After all, capital moves around the world looking for the best returns, and the markets supported by the government and regulators have to create the right environment to capture the maximum share of both domestic investors as well as foreign institutional investors and try to avoid flight of capital in short run to maintain stability and hence growth in the long run.

Financial Market Integration:

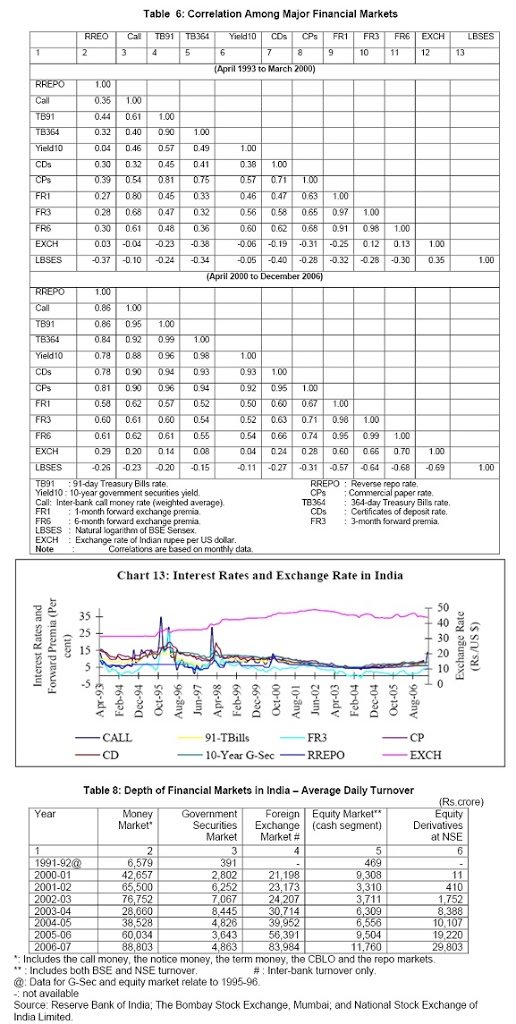

The domestic financial markets integration is largely facilitated by wide ranging financial sector reforms since early 1990’s. Financial markets have acquired greater depth and liquidity,thus better integration of foreign exchange market with the money market and government securities market has enabled better liquidity management by the central bank. However equity markets have low correlation with other market segments. Growing integration amongst various financial market segments in India has been accompanied by lower volatility of interest rates.

There has been growing international integration through trade and cross border capital flows,especially in Asia due to regional FTA’s ( free trade agreements) and shifting of production and servicing base of several industries from the Western world, powered by Asia’s robust economic growth prospects and improving physical and social infrastructure. Since the integration across international markets involves several benefits as well as risks, underlying need is for appropriate risk management strategies ( being addressed by implementation of Basel norms by March 2008) and greater coordination and information sharing among central banks to prevent adverse global developments to affect the domestic economy and markets. The tables below give a clear picture of the integration/correlation among various market segments and depth of financial markets over a period since reforms began in 1993.

References

1.Reserve Bank of India: http://www.rbi.org

2.Bombay Stock Exchange: http://www.bseindia.com

3.National Stock Exchange: http://www.nseindia.com

4.NASDAQ: http://www.nasdaq.com

5.Securities and Exchange Board of India: http://www.sebi.gov.in

6.Central Statistical Organization: http://www.mospi.nic.in

7.Insurance Regulatory Development Authority: http://www.irdaindia.org

8.Asian Development Bank: http://www.adb.org

9.www.macroscan.com

10.Directorate General of Commercial Intelligence & Statistics: http://www.dgciskol.nic.in

11.Jairaj Purandare, Executive Director,PWc,India, “ Financial Services-Policy and Tax Issues”.

12.The World Bank: http://www.worldbank.org

13.IMF: http://www.imf.org

14.IFC: http://www.ifc.org

15.UNDP: http://www.undp.org

16.http://www.unescap.org

17.http://www.emeconomy.com

18.http://www.indiasocial.org

19.http://www.iussp.org

20.UNCTAD: http://www.unctad.org

21.Indian Bank Association: http://www.iba.org

[The article has been written by Amit Gupta. He is a strategic management consultant with interest in teaching, corporate training and business planning for start-ups. He also focuses on setting up projects in the skill development domain.]

You might like reading:

The ThinkTank Volume I- Grab it now !

Finally our e book is now available ! YES ! You heard it right !! The Thinktank(Volume-I) is now available for download and its free !! Features: * 50 Top articles on business * Articles by IIM, IIT & NIFT alumni, Project Managers, Consultants and lots more !! *Completely free !! Tags: ebook thinktank

XIMB Hosts Corporate Sports Meet “Colosseum 2015”

On 26th and 27th September 2015, XIMB hosted “Colosseum 2015”, the first of its kind sports event including the corporate houses of Bhubaneswar. The event was a celebration of the enduring relationship XIMB shares with the corporate houses and marks the beginning of “Athlos2015”, the annual inter B-School Sports Meet of XIMB, to be held this October.Infosys Limited and Tech […]