1.Introduction

Billed as India’s biggest indirect tax reform since independence- Goods and Service Tax once introduced has the potential to boost economic growth and according to analyst add around 0.9%-1.5% to our GDP. GST has been implemented by over 150 countries owing to its transparency and revenue increasing capabilities.

The idea of GST is almost a decade old and was first proposed by a committee chaired by tax expert Vijay Kelkar in March 2004 after much deliberations and delays P.Chidambaram and Pranab Mukherjee formally introduced the legislation in Lok Sabha in March 2011. Thereafter the Bill has been stuck up in a quagmire of political opportunism and delay. The law, if finally passed by both houses of parliament will come into force from April 2016.

2.Nuanced understanding of GST

As opposed to a single comprehensive tax which is a global norm India has decided to adopt the dual GST model where there are two components- central GST (CGST) and a state GST (SGST) hence the centre and state will legislate and administer the taxes concurrently. GST will subsume various disparate taxes viz. Central excise duty, VAT, Service tax and also other taxes like luxury tax, entry tax thereby reducing the compliance cost and at the same time simplifying the tax structure.

GST is primarily a destination based tax and requires that the SGST accrues to the destination state this caused dissent among some predominantly manufacturing states like Maharashtra, Gujarat and Tamil Naidu as they would be losing a sizable chunk of their SGST. To alleviate their concern an additional 1% tax was imposed on interstate movement of goods which would be kept by the manufacturing state.

Further, to assuage the states and to get the desired 2/3 rd majority in Rajya sabha with support from various state level parties like AIADMK, TMC , BJD the centre has promised to write off any losses due to implementation of GST for the first three years on the lines of a formula suggested by the 14 th finance commission. Also, certain goods like petrol, high speed diesel, natural gas, turbine fuel and alcohol which were a point of contention have been left out from the purview of the bill hence state will have the power to levy taxes on the above mentioned goods.

The bill has proposed to have a GST council chaired by the union finance minister having finance minister of states and various other minster nominated by the state government as its member. In addition, there is also provision for a Dispute Settlement Authority that would look into various disputes that could arise as a result of GST. In order to address the disputes expeditiously the disputes would directly be heard by the Supreme Court.

3.Making a Case for GST

Subsuming various taxes under a single rubric will reduce multiplicity and eliminate cascading effect of various taxes also it will eliminate multiple point of contacts reducing corruption all these factors will contribute to reducing the price of the goods for the consumer. For example a shopkeeper sells product X worth 10000 in a month and collects 1500 as GST (15% assumed) . He would have bought product X worth 8000 from the wholesaler paying 1200 as GST so in the end he would remit 300 to the government.

Due to the merging of various taxes the GST will be much less then what the consumer pays today as individual taxes. The consumer as of now pays excise duty of 12% and VAT/service tax of 14% in addition to various other small taxes. The rate of GST is expected to be anywhere between 12% and 26% the world average is 18%. This will result in more liquidity in the market and more money with the investors indirectly pushing the GDP upwards.

GST will also allow for seamless movement of goods between various states and will provide a common market for the entire country by reducing barriers such as entry tax and deferential VAT rates. GST will also benefit the big MNCs as it simplifies the indirect tax structure and provides a general rate that can be applied by all companies.

4. Now, some skepticism

Administrative challenges: In India mergers between various government entities has not gone very well everyone remembers the debacle of the Air India and Indian Airline merger. Here we are talking of integrating the revenue collection agencies of all state and a powerful central agency which by no terms is easy. Central excise took various decades to settle down and there are still litigations regarding irregularity of sales tax pending before the Supreme Court.

Appeasing the states: The additional 1% GST proposed to appease various manufacturing states is against the principle of GST this levy would result in a cascading of tax with each interstate movement and will severely undermine the growth of a common market place. Also major goods such as petroleum and alcohol have been excluded from the purview of GST this does not augur well for fiscal prudence and the economic front as they are the major source of revenue for any tax.

With the dual system of GST the SGST can be levied by the state within a band of spectrum this critics argue kills the concept of a single market as various tax slabs would be introduced. Further, the Centre has promised compensation to the states for the losses they incur due to GST but none of the state have come up with a plan to compensate local bodies. Also, the pile up of litigation in an already slow judicial system remains a major concern.

5. The Final Say

After a quagmire of procrastinations the bill has finally been passed by the Lok Sabha currently the bill has been referred to the select committee and will need 2/3 rd majority in Rajya Sabha and ratification by more than half of the 29 states before it can be rolled out by April 2016.

The time is ripe to move forward with the ‘Imperfect GST’ for now which has been fractured by compromises on various key issues. People often forget that the word ‘ideal’ is often utopian in a federal democracy like ours. Reforms in a democracy are often incremental as opposed to game changing and big bang what most people expect.

Tags: current affairs goods GST services taxYou might like reading:

Tackling the challenge !

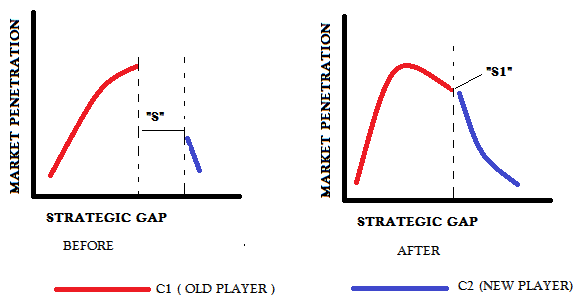

It has been a significant period since you have been operating profitably and leading the show. However there is a new kid on the block. He quickly redefines business strategies with his innovative thinking and has begun to get a slice of the existing market. You realize you must act fast. What should you do? Often companies are seen […]

ENVISION’15–National Level IT Summit held at XIMB

Envision’15 the flagship Business Conclave of XSYS, the Systems Association of XIMB was held in the premises of Xavier Institute of Management, Bhubaneswar on 29th August.The theme of the conclave was “Transforming Financial Services with Big Data Analytics.” The speakers for the day were Mr. Vinay Kumar, CEO Datawise, a Consulting, Research and Analytics firm; Mr. Ashok Dash, Senior Business […]