Dividend Discount Model (DDM) is one of the most widely used valuation models. It can actually be considered as a derivation of the same principles that we use for determining the time value of money. The center piece of the model is based on assuming a discount rate which is then used to calculate the present value. Yet there are many misconceptions surrounding discount rate.

Many students often consider that discount rate will always have to be less than the defined rate of return for an investment. This rate is assumed to be constant for the entire holding period of the investment. However, this is fundamentally not correct. Instead, just like the rate of growth in dividends can vary over a time horizon, so can the rate of return otherwise known as the discount rate. Yes, discount rate is nothing but the rate of return. This is an area that most people get confused. It is the same reason why different investor classes value the same asset differently. For example, an angel, VC and a PE firm will value the same projected cash flows at a different valuation owing to their discount rate variations.

Now let us look that in a multi-period investment from an individual perspective. His return requirements will definitely change depending on the stage of his life. For example an individual will have a different rate of return in his work life and post his retirement. In a similar manner, in a valuation model, the discount rate should vary depending on the stage of the investment as well as the investor.

The other important factor is the risk involved. The higher the risk, the higher the discount rate. The discount rate should also take into account factors such as inflation. This will provide clarity if an investment is actually generating any real return or not for the investor. The real challenge however lies in determining the same. There are several models that can be used for calculating the rate of return such as CAPM or multi-factor models such as Fama French Model. The higher the number of factors, the higher the probability of accuracy as long as the factors are not corelated with each other.

One thing that everyone should remember though is, discount rates are based on assumptions and hence subjective. There is no clear formula that defines it with complete accuracy. A risky asset may be valued at a lower discount rate thus overvaluing the same and the vice versa is equally possible. The critical factor therefore is to understand the underlying factors impacting the asset before arriving at a discount rate. Valuation, after all, is art and not science.

Tags: discount model valuationYou might like reading:

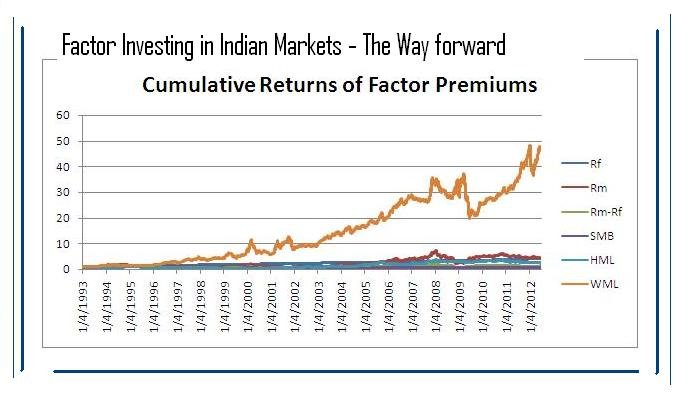

Regime Switching and Factor Investing in India

Global investment management industry is constantly evolving and undergoing a rapid shift in its view and understanding of financial markets and investment management. This article persuades the readers of the need for change in Indian investment management industry in order to catch up with the global innovations. Two recent paradigm shifts in the developed markets – Regime switching and factor […]

How to Deal with an Abusive Boss

You can never escape the boss. Even if you are the CEO of a company, your “bosses” are your investors and your clients. Sometimes, we’re blessed by wonderful bosses that nurture our autonomy and give us the support we need to do our best work. Other times, we’re cursed with the enfant terrible of the corporate world, the preening bully […]