Discounted Cash Flow (DCF) analysis stands as a widely employed financial valuation technique, offering insights into the prospective worth of an investment based on future cash flows. Despite its widespread use, the method grapples with several intricacies and critiques. This article aims to delve into the key challenges linked to Discounted Cash Flow analysis.

- Future Cash Flow Predictions:

A pivotal hurdle in DCF analysis lies in accurately forecasting future cash flows. The task of predicting a business’s financial trajectory involves assumptions about variables such as revenue growth, operating costs, and capital expenditures. The inherent uncertainty in these projections can lead to significant disparities between anticipated and actual outcomes.

- Sensitivity to Assumptions:

Discounted Cash Flow analysis is markedly sensitive to the multitude of assumptions made throughout the valuation process. Minor alterations in factors like the discount rate, growth rates, or terminal value can yield substantial changes to the final valuation. This sensitivity underscores the need for a meticulous and thoughtful approach to assumption-setting.

- Determining the Discount Rate:

The selection of a fitting discount rate, typically represented by the weighted average cost of capital (WACC), poses a critical challenge in DCF analysis. Pinpointing the correct discount rate involves considering the risk associated with the investment, and analysts may employ diverse methods to estimate this figure. Discrepancies in discount rate selection can result in significantly divergent valuation outcomes.

- Estimating Terminal Value:

In DCF analysis, the terminal value constitutes a substantial portion of the overall valuation and is often calculated using perpetuity growth models or exit multiples. The challenge lies in accurately estimating the terminal value, as miscalculations in this aspect can markedly influence the overall valuation. Choosing the appropriate method for terminal value estimation is a nuanced decision that introduces additional uncertainty.

- Lack of Flexibility:

Discounted Cash Flow analysis presupposes a stable and predictable future, which may not always align with the dynamic nature of businesses and markets. Evolving economic landscapes, technological breakthroughs, or shifts in consumer behavior can render initial assumptions obsolete, potentially leading to inaccurate valuations.

- Inability to Account for Non-Financial Factors:

DCF analysis predominantly centers around financial metrics and cash flows, often overlooking non-financial factors that can impact a company’s value. Intangible assets, brand reputation, and management quality are examples of elements that might not be fully considered in a DCF valuation, potentially resulting in an incomplete assessment of a business’s value.

Conclusion:

Discounted Cash Flow analysis serves as a potent tool for investment valuation, but it grapples with its set of challenges. Practitioners must approach DCF with caution, acknowledging the inherent uncertainties and limitations associated with the method. By being mindful of potential issues and continually refining assumptions in response to new information, analysts can enhance the accuracy and reliability of DCF valuations.

Tags: cashflow discounted cash flowYou might like reading:

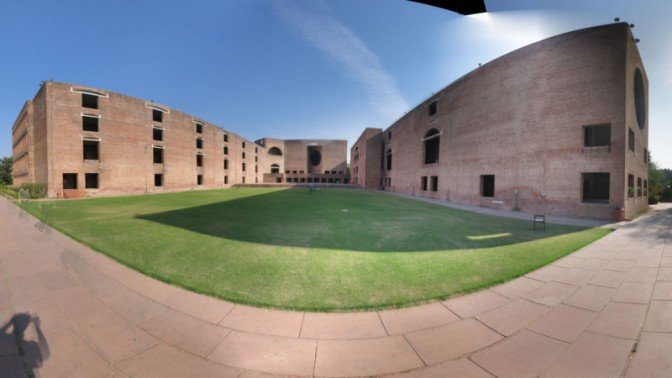

IIM Ahmedabad Placements Batch of 2018-20: Highest Package of INR 1.3 Crores+

The placement process for the graduating batch of the Post Graduate Programme (PGP) in Management at lIM Ahrnedabad was successfully completed within three clusters. The third and final cluster was held on 13th February 2020. The placement process, with the concept of “Dream Application”, allowed students to choose the sectors and functions of their choice for their final placement. There […]

ODISHA’S FIRST STARTUP WEEKEND HELD AT XIMB

Xavier Institute of Management, Bhubaneswar hosted the first startup weekend in Odisha from 14th-16th August. This event was a joint collaboration of X-Seed, the idea and initiative cell of XIMB, the E-Cell of CET and Google Business Group, Bhubaneswar. The Startup Weekend is a global network of passionate leaders and entrepreneurs on a mission to inspire, educate, and empower individuals, […]