Few years back, “smartphone” as a concept belonged to giants like Samsung, Apple and the likes (purely in terms of market share). It was all about brand value, high-end components, better display, better camera and better things that we (non-geek community) possibly don’t know about! But consumers had to pay a price – a significant one I may add if you belonged to India / China. Cost of a high end smartphone in the US / Europe is a small fraction of the per capita income. But when the same smartphone comes to Asian countries, the conversion rate followed up by import duties and taxes inflate the selling price, which then becomes a sizeable number compared to the countries’ per capita income. While I agree that the high-end smartphones are not for everyone, this statistic is not something we can simply ignore.

So, a hole was discovered in this market and people with entrepreneurial qualities realized that there’s market in this hole! This led to the emergence of “so-called” value-for-money smartphones. While Apple and Samsung were fighting their own battle at their own battlefield, the newer ones emerged which has now complicated the whole dynamics of the industry. The smartphone industry was built on the following logic – high-end specs demand a higher cost. Enter Chinese manufacturers like Xiaomi, Oppo, OnePlus who started manufacturing high end devices and selling them at a fraction of the cost. They took advantage of local manufacturing, marketing through the internet, garnering reviews from the who’s who of the technology world and gradually generating a brand image for themselves.

Take the example of OnePlus. Very few smartphone owners will know this brand. But people who are tracking the industry will know OnePlus as a true “flagship-killer”. Their first smartphone, oddly named OnePlus One, boasts of a specification akin to the flagships of Apple and Samsung. But their cost is barely one third of the flagships, which completely nullifies the “high specs = high cost” theory. They sell OnePlus One at razor-thin margins, possibly share the manufacturing cost with their parent (Oppo) and bypass the traditional mode of marketing, thereby reducing the product cost by more than half. Still being a largely unknown brand among the masses is the trade-off it is happy to live with. Similar strategies are followed by other Chinese players as well.

Such a strategy will only succeed if the target market is humongous. China accounts for almost 1/6th of the world market. Adding India to this equation makes the target superset to 1/3rd. These players are already established in China and have now set their eyes on India. Their experience and learnings from the Chinese market will help them smoothen the early hiccups in the Indian market purely in terms of scale.

Allied industries like e-shopping / m-shopping are blossoming in India. Thanks to Amazon and FlipKart, supply chain has significantly improved. Backend Infrastructure like broadband, wireless internet (3G/4G) are improving with every passing day. Indian smartphone consumers are demanding better specs at competitive prices. Micromax, an Indian manufacturer, overtaking the leader Samsung in Q4 2014 is not an isolated incident and is surely a sign of things to come. India’s “Make in India” philosophy will push the Chinese players to setup a manufacturing unit in India which will further lower the cost and eliminate import duties thereby improving their margins.

But there is a flip side to this emergence and it’s in the origin of these smartphones itself. These brands are Chinese, which doesn’t resonate well with a product that’s durable and of high quality. Add to this, the whole security argument that Chinese phones in India are likely to bring in. There’s no running away from these issues. This is one battle where all Chinese players will have to unite and fight. And this is the “hole” that local Indian manufacturers will try to exploit.

As consumers, we can expect a plethora of Chinese smartphones in the near future fighting for one-upmanship with a device that similar in specs and price but differentiated only by their quality of service. That’s like smartphone industry restarting all over again.

If there was ever a disruption in the smartphone industry, this would be one of it! Let’s call this era – Smartphone 2.0.

Tags: china Marketing online Smartphone strategic decision Telecommunication valueformoney XiaomiYou might like reading:

Analysing learning organizations: Boundary-less at GE !

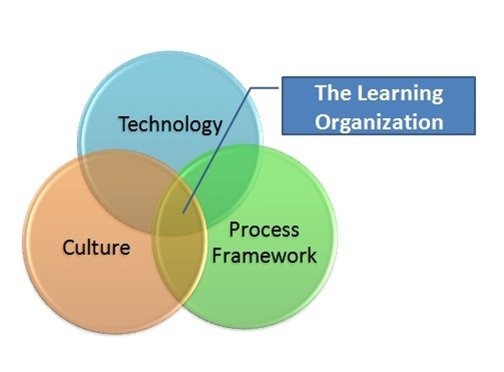

A Learning Organization is an organization that learns and encourages learning among its members. It promotes exchange of information between employees hence creating a more knowledgeable workforce. This produces a very flexible organization where people accept and adapt new ideas and changes through a shared vision. Need for Learning Organization As organizations grow, they lose their capacity to learn as […]

Citizenships for sale : Is this the way forward ?

Back in 1984, there was a small island nation of St. Kitts and Nevis. The economic scenario of the nation was not that good as there were frequent natural disasters and its main economical contributor- the ‘sugar’ production was not up to the mark. The Government of this small island nation then came up with an incredible idea- that is […]

I think apple and samsung follow Broad differentiation strategy while Xiaomi follows low cost with broad audience or may be best cost provider, coupled with an efficient supply chain minus the retail profit (as most of them are sold online). So the market of Samsung has been disrupted but these big names will soon come with new features and capture back some of the market. Even Moto for a long time was a front runner in the race.

@Swapnil You are right. Samsung has different products for different market segments. Apple has a clear target market for their current flagship and previous flagships (resale). Within minimum marketing cost and local manufacturing, the chinese brands clearly have a price advantage over global brands. Samsung, HTC, LG – on their part will now have to react and respond appropriately. My feeling is, they will fight these Chinese firms using the patent route. After all, this is another revenue generation channel for them!

I might sound silly… but if every company manufactures in China , uses the same cheap labour and quality, why are they not selling it cheap? Surely technology should be meant for the masses.

@Tulika Das Interesting question. Apart from manufacturing smartphones, the top companies spend a fortune on marketing.. Usually the per unit marketing cost is almost as much as the manufacturing cost for the flagship phones. Add to that their profit margin + retailer margin, you finally get a product which is of high cost. Companies like Xiaomi, OnePlus etc spend less on marketing and (until recently) have an online only mode of selling. All this significantly restricts the final price of the product.

@Binu Thomas While quality is normally not associated with Chinese products, one should also remember in my view that both One Plus and Xiaomi follow a very unique supply chain and as a result their costs are minimum. Even they do not have a huge marketing budget like Samsung or Apple.

@Abhirup Yes I agree. Their supply chain model (example: flash sales) are also important to regulate the demand, guage demand in the market using the online model and create curiosity and desire among potential buyers.

Yes flash sales are one part of it. Equally for companies like Xiaomi which sells its models initially at zero profit, makes it very difficult for traditional companies like Samsung to compete with them.

Well, it can be said that brands like Apple & Samsung can never sell smartphones for as cheap as their Chinese counterparts. So, does it mean that if the Chinese companies (only the top ones) could change the negative mentality of consumers associated with Chinese products, they can rule the smartphone world easily toppling Apple & Samsung from their seats?

Why not? If they produce quality products (read Xiaomi) there is no reason why they can’t. Lenovo, Huawei are equally good examples.