Introduction

Hindustan is one of the most attractive destination for retailer across the world. India is fifth largest market in the world and ranks fourth among the surveyed 30 countries in terms of global retail development. Day by day changing lifestyle, increasing dominance of western culture, rising population and rising income of rural and urban population is influencing the retail sector with growing literacy level and quality consciousness. The retail Indian industries has been emerged as most dynamic and fast paced industries due to the entry of several key players into the India’s retail market. The Indian retail industry is segregated into two sectors: organized and unorganized retailing. Organized retailing consist of those kind of trading activities which are undertaken by retailers who are registered for income tax, sales tax etc. Corporate backed hypermarkets, retail chains, privately owned large retail businesses are some of the examples of organized retailing and it occupies just 6-8% share in rural and urban retailing. Unorganized retailing mainly includes of local kirana shops, owner managed general stores, street vendors, convenience stores etc. however, nowadays it can be seen that traditional markets are paving way for supermarkets, specialty stores and development of departmental stores. Shopping from malls and buying branded products is also gaining momentum. In-spite of all these things Indian retail sector is mainly dominated by unorganized segment with 92-94% share.

Rural retail market

The almost 70% of India’s total population resides across 6.38 lakh villages in the country (833 million/1.21 billion per 2011 Census). Generally Indian rural retail stores are in the form of haats, bazaar and either melas or jatra. Undeniably, the urban market such as metropolitan cities, tier II, III cities offers great opportunities to organized retailers but they are anticipated to saturate in the near future due to entry of e-commerce and online service provider. Hence, most big retail companies are envisaging entering in untapped rural retail market. For example, ITC has taken a rural initiative through Choupal Sagar, DCM Hariyali Kisan Bazaars, and Pantaloons in a JV with Godrej (Aadhars). Besides, several other Indian companies are agonize over launching rural retail brands to face the current economic slowdown, as rural areas have been less affected by the slowdown.

Government initiatives

From the last couple of years there has been an outstanding spurt in the villager’s income due to higher agricultural production, as the total food-grain production in India reached its zenith at 257 million tonnes in FY14. The sharp rise in the minimum support price (MSP) for various cereals such as wheat and paddy in the past few years also made the farmers richer. Farmers also getting benefits from the agricultural loan waiver, various development schemes such as SGRY, SGSY, the make in India Programme for improving rural infrastructure Pradhan mantri krishi sinchai yojana, MNREGA and Pradhan mantri gramoday yojana. These initiatives are not only increases the rural people’s income considerably but also increased their consumption levels and consumption pattern. Rise in income of rural population leads to change in taste and preferences of rural consumers.

Key players

The major key players of rural retailing are Hariyali Kisan Bazaars (DCM), Aadhars (Pantaloons-Godrej JV), Choupal Sagar (ITC), Kisan Sansar (Tata), Reliance Fresh, Project Shakti (HUL) and Naya Yug Bazaar are developed rural retail outlets for providing qualitative products which may be farm input or family needs and other services to farmers and their family.

Challenges

Setting up organized retail outlet in rural India is itself is a challenging task because its initial penetrating cost is really high, for instances cost of land, skilled labor etc. Retailer has to formulate the strategies which should be different from urban retail markets because their lives is mostly dependent on the income generated through agriculture and agriculture allied activities.

Retailer has to gain knowledge and insight of rural marketing, by understanding all these differences, the retailers can decide a merchandise-mix that matches the needs of rural consumers. Nowadays, operating cost for rural retailer has gone down, reason behind it is growing level of literacy in rural area but growing demand for different products leads to incur high operating cost. Product should be built or modified to suit lifestyle and needs of rural customer.

Some major challenges for rural markets are widely dispersed i.e. large number of small market, dispersed population and trade, poor road connectivity, low density of shops per village, inadequate banks and credit facility, poor storage facility, low investment capacity of retailer, poor communication of offers, higher bargaining, poor visibility and display of products on rural shop and shelves leads to fear for investor. For, overcoming all these things government has to implement the infrastructure in villages, where real India lies.

Opportunity and opportunity sectors

The rural section of the Indian economy is growing at a rate of 8-10% per annum and expected to add new consumption of US$ 90–100 billion over the period 2012-2017 to the current base of US$ 240-250 billion. The some leading opportunity sectors and growth indicators are listed below.

Automobile– Rural India accounts 35% of automobile industry sales, led by demand for two-wheelers, entry-level cars and tractors.

FMCG (fast moving consumer goods)– Rural consumers spend around 13 percent of their income, the second highest after food (35%), on fast moving consumer goods (FMCG), as per a RMAI study.

Telecommunication- A joint Confederation of Indian Industries and Ernst & Young report reveals that of the next 250 million Indian wireless users, approximately 100 million (40 %) of it belongs to rural areas, and by 2012, rural users will account for over 60 % of the total telecom benefactor base in India. In a bid to acquire rural benefactor, most Indian telecom operators have been started investing in infrastructure to roll out their services in these areas. Rural marketing communication is going to appear in a big way as the users of smart phones are expected to grow from 50 million now to touch 150 million by 2014.

Internet & e-Commerce- In a step to increase Internet introduction in rural India, the Government of India (GoI) will create more than 250,000 nodes for broadband by 2016 that will serve more than 6.0 lakh villages.

Consumer Durable– India will be fifth largest consumer durable market in the world by 2025. The consumer electronics market is expected to increase to US$ 400 billion by 2020. The production is expected to reach US$ 104 billion by 2016. The rising demand from rural and semi-urban areas is projected to increase at a CAGR of 25 per cent to US$ 6.4 billion by FY15, with rural and semi-urban markets are contributing majorly to consumer durables sales. In rural markets, durables like refrigerators and all other consumer electronic goods are likely to reach growing demand in the coming years as the government planning to invest significantly in rural electrification.

Agriculture input-This is most prevalent sector among the mentioned, 54% population of rural people rely on farm income so most of Retail Company has to set the target for development of organized retail sector in India.

Food and grocery– food and grocery industry has expected to grow at the rate of 30% in next couple of years from US$ 70 billion in 2011 to US$ 225 by 2025 billion.

Conclusion

Corporate India stepping up in rural retail market due tremendous potential for growth in organized retailing due to rising purchasing power, changing consumption pattern and increasing access to information technology and communication, leading to changes in rural lifestyle. Rural India accounts more than 2/5th of the total consumption of India. Thus, the industry players do not want to be left out and are designing strategies especially for the rural consumer. In-spite of, players should be ready to tackle some unavoidable challenges in rural area. For instance, competition from local stores as they sell on credit, logistics hurdles due to worst infrastructure in rural areas, higher inventory overhead and different buying preferences among rural population. Thus looking at challenges and opportunities in rural retail market, we can say that the future is very promising for those who can understand the changes of rural market and exploit them to their best advantage. An only ten thousand out of more than six lakh villages in India have access to organized retail services. A basic changes in an attitudes of marketer towards, the vibrant blooming or growing rural market is called for so they can successfully impress on 833 million rural consumer spread over 6.38 lakh village across India. Finally, I hope all those key players which are correspondingly operating organized retail outlets has to further penetrate more outlet and channelize to serve qualitative product for field and family needs to Indian villagers.

Tags: India Management retailYou might like reading:

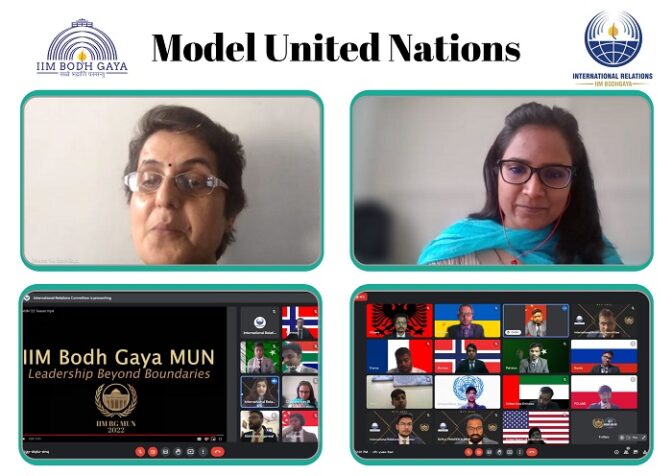

Model United Nations at IIM Bodh Gaya

International Relations Committee, IIM Bodh Gaya organized its flagship “Model United Nations”- MUN on 26th February 2022. For the first time, the event was held as an Inter College conference under the mentorship of senior members of the IRC team. MUN is an educational simulation designed in such a manner to familiarize students with diplomacy and international relations in and […]

Embedded Marketing: Relevance in Today’s Markets

Ask any viewer today, and you’ll get quick answers to which fashion magazine was Priyanka Chopra working for in Dostana? Which Fashion apparel had signed up Dhoom 2? Which motorcycle did Rishi Kapoor ride in Bobby? Which malted drink does Hrithik have in Koi mil gaya? Super hit movies like Dilwale Dulhania le jayege, Yaadein, Phir bhi dil hai Hindustani, […]