Service Licensing:

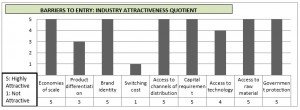

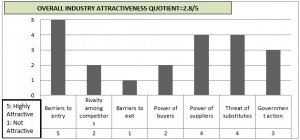

Licensing also acts as a major barrier to entry as sometimes it becomes very difficult for the new entrants to obtain license. Existing players pay huge revenues to obtain licensing and new entrants face retaliation from incumbents regarding licensing. This increases the industry attractiveness.

Technology Retaliation:

Wireless technology is based on two competing platforms GSM and CDMA. Accordingly, players have united themselves in lobbying with GSM service providers represented by Cellular Operators Association of India (COAI) and CDMAs by Association of Unified Telecom Service Providers of India (AUSPI). With each technology possessing inherent advantages as well as disadvantages, it presents a difficult proposition for a new entrant to decide on its offering.

Rivalry among competing firms:

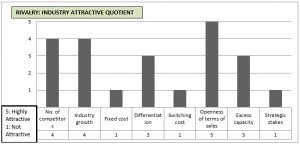

The Hirschman-Herfindahl Index (HHI) for the Indian telecom industry stands at 1421.29 which indicate a highly contestable but oligopolic industry. Moreover, the concentration of top four firms at 66% also confirms this hypothesis.

Price wars:

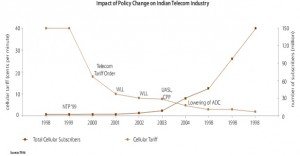

The switching costs being low, the Indian market is highly value-driven and price sensitive, and telecom companies are in continuous pressure to deliver new services while improving customer experience and loyalty. The service providers’ priority is to add maximum number of subscriber per month and retain the existing user base. The preferred strategy among all competitors is to offer lower prices coupled with more value added services. This has a damaging effect on the bottom line for the industry as whole, leading to commoditization of the market with decreasing individual market capitalization and makes the industry unattractive for the entrant.

Fixed Cost:

The industry suffers from high fixed costs and fast technology obsolescence. The service providers also incur expenses in procuring licenses and laying down network infrastructure. To garner these expenses, it becomes essential to have adequate capacity utilization. It takes tremendous capital to build a cellular network, backhaul and operations center. Operating a cellular carrier requires specific human resources, with specialized skills. It requires a field force to install and maintain the physical assets, a training division, a support group and web experts to build a reliable website. These human resources are in limited supply and are expensive. Thus, increasing subscribers’ base becomes very important. This also furthers the competitive stakes.

Strategic stakes:

We see players in this market are the ones typically considering big business powerhouses in India (Bharti Airtel, Reliance), and they branch out into other industries as well. These increase strategic stakes for the players. The tele-density is very less in rural India and this presents an untapped potential for the service providers once the urban market has started maturing. Migration to the new market requires more upfront investments and thus hard cash availability with the providers becomes essential. Moreover, it is always profitable to have the first mover advantage as it provides the opportunity to garner certain premium in pricing for services.

High degree of Imitation, lowering switching costs:

There is almost no differentiation among the service providers regarding basic services, and even any innovations in value added services are quickly copied. So, it is very easy for the users to change their service providers and the industry operates with minimal customer loyalty. This makes the industry rivalry most prominent.

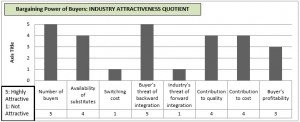

Bargaining power of buyers:

Buyer’s threat of backward integration and industry’s threat of forward integration are nil. However, contribution to quality and cost, along with buyer’s profitability, plays a good part in determining buyer’s bargaining powers.

Switching Costs :

The market can be divided into household and industrial consumers. Additionally, they can be differentiated as either pre-paid or post-paid users. In case of post-paid users, customers exercise certain degree of loyalty because of high switching costs. Also, the industrial users have customized offerings from service providers that bind them. For household customers, TRAI’s recommendation on MPN (Mobile Number Portability) has made it all the more important for the companies to charge lower tariffs besides providing better services to retain subscribers.

Maturing Urban market :

With urban tele-density well over 100% the additional growth in revenue by service providers can only be achieved by market cannibalization. This results in more pronounced buyers’ power.

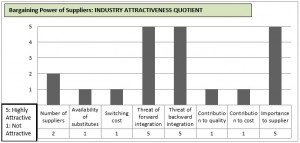

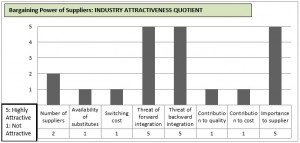

Bargaining power of suppliers:

The supplier for the telecom industry includes:

a) Network Infrastructure provider

b) Information technology support

c) Passive infrastructure providers

d) Telecom equipment manufacturers-including handset manufacturers

On analyzing the industry, it is evident that infrastructure suppliers wield intermediate degrees of bargaining power over the service providers because of necessity of infrastructural support like network towers, high-tech broadband switching equipment, fiber-optic cables, mobile handset and billing software. The number of suppliers is few, substitutes are rare, and contribution of these supplies to cost and quality are huge. Thus, although suppliers do not have a scope of forward integration, the high switching cost for the telecom industry provides great bargaining power to suppliers. But, here too, shared tower infrastructure has brought forth a transformation. Silicon chip manufacturers (for processors, memory chips, etc), sub-contractors and employees also act as suppliers to this industry. Due to heavy competition among chip manufacturers, their bargaining power is essentially low. But there is medium switching cost for telecom vendors since changing their hardware would lead to additional cost in modifying their architecture. Also, the switching to different set of hardware support involves modification in design architecture at the service providers’ end and this entails some costs. The suppliers’ side also faces the pressing issue of dearth of talented and skilled manpower, and this curtails the capabilities to innovate and strengthen the bargaining power for suppliers.

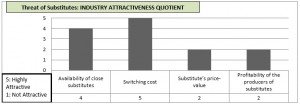

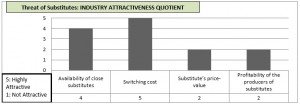

Threat of substitutes:

The potential major substitutes for the telecom industry are as follows:

-VOIP (Skype, Messenger etc.)

-Online Chat

-Email

-Satellite phones

Additionally, products and services from non-traditional telecom industries such as Cable TV and satellite operators are laying their own direct lines into homes, offering broadband internet services. Railways and energy utility companies are utilizing their vast infrastructural installations to support high-capacity telecom network alongside rail-tracks, pipeline networks, and electricity transmission lines. Many ISPs (Internet Service Providers) are offering “internet telephony” at low prices. For service providers skillfully managing their transition from voice to data services, internet messengers such as Skype, Google Voice and Chat pose a threat.

Unlicensed frequency options (ex: Wi-Fi, UWB, Walkie Talkie) also compete alongside. But, the issue of security, reliability and flexibility associated with mobile telephony, along with switching costs associated with substitutes, still make mobiles a preferred choice. Satellite options incur higher operating costs and the technology is not promoted by government due to security considerations.

Key Financial Indicators:

ARPU: Average Revenue per User, which is calculated by dividing the total revenue by the number of subscribers. Given the total volume of VAS that contributes to revenue, this is a better measure than AMPU, or average minutes per user.

Figure 8: Increasing Subscriber Base and Decreasing ARPU [Source: Telecommunication, Market opportunities by IBEF]

Customer Base: Analysis of annual reports of the major telecom companies revealed that almost all take great pride in commanding a huge subscriber base, and revenues are directly dependent on them.

Penetration Levels: In this saturating urban market, telecom companies look out for possible expansion in any region using the penetration levels. Very low penetration levels are existent in rural areas, basically due to lack of infrastructure. Telecom companies target medium level penetration zones where added infrastructure cost would be low, and return on assets high. Low penetration level in Africa was one major factor which motivated Bharti Airtel to set up operations there.

Data Rate Units: With data becoming the major segment of revenue earner, companies strive to provide data rate in the range of Kilo Bytes and Mega Bytes to enhance user browsing experiences. Thus, Mbps is becoming one of the most important success factors in years to come.

Churn Rate: It is defined as the rate at which customers leave a provider for a competitor. Largely due to fierce competition, the telecom industry boasts – or, rather, suffers – from the highest customer churn rate of any industry, with a monthly churn of 1.9-2.1%. Strong brand name marketing and service quality tends to mitigate churn to some extent.

Quality of Service: QOS serves as an important statistic that service providers monitor using signal strength indicators to maintain their standards of service.

[The article has been written by Souvik Kumar Saha & Abhishek Kundu. They are presently pursuing their PGDM from IIM Bangalore.]

Nice Insight, Thanx!