|

Parameter

|

2000

|

2012-13

|

|

No. of Aircraft

|

125

|

369

|

|

No. of Operational Airports

|

50

|

125

|

|

Passenger Handling Capacity at Airports

|

66 million

|

233 million

|

|

Scheduled Airlines: Distance Flown

|

199 million km

|

762 million km

|

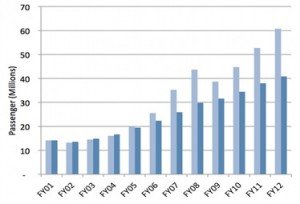

- Trends, as per the past decade, show a 300% increase in the domestic passengers, and 160% in international passenger traffic

- Domestic passenger traffic expanded at 15.6% compound annual growth rate (CAGR) over FY06-12

- International passenger traffic expanded at 10.5% compound annual growth rate (CAGR) over FY06-12

|

Revenue Areas

|

Expense Areas

|

|

Freight

|

ATF

|

|

Passengers

|

Crew

|

|

On-Board Sales

|

MRO

|

|

Cost for carrying luggage

|

Passenger Services

|

|

Five Forces

|

Analysis

|

Impact

|

|

Threat of New Entrants

|

High capital requirement

Existing customer loyalty to established brands

Inadequate airport infrastructure

Shortage of qualified pilots

High fuel cost

|

LOW

|

|

Threat of Substitute Products

|

Large no. of substitutes like railways, buses, cars etc.

High buyer switching cost with respect to time

High buyer propensity to substitute with respect to cost

Ease of substitution for short distances

|

LOW

|

|

Bargaining Power of Buyers

|

Travel agents act as middle men for Business and Regular travelers providing them the best option for a travel

Buyers have access to large amount of information online

High cost involved in switching airplanes

No major differentiation in services of airlines

|

LOW

|

|

Bargaining Power of Suppliers

|

Very few suppliers due to high expertise required – Only two major global aircraft manufacturers – Boeing and Airbus

The products delivered by the suppliers are extremely standardized

Eco-friendly planes manufacturers getting an edge

High switching costs to change suppliers due to contract obligations

|

HIGH

|

|

Intra Industry Rivalry

|

High price rivalry

High fixed costs and input constraints

Most airlines earn low returns due to high cost of competition

|

HIGH

|

|

Parameters

|

Indigo

|

SpiceJet

|

JetLite & Jet Airways

|

Air India

|

Go Air

|

|

Market Share

[May 2013]

|

29.50 %

|

19.80 %

|

22.50 %

(JetLite – 5.40%)

|

19.10 %

|

9.00 %

|

|

Passenger Load Factor

[May 2013]

|

89.60 %

|

80.90 %

|

76.15 %

|

82.00 %

|

85.80 %

|

|

On-time Performance [OTP]

[May 2013]

|

95.00 %

|

85.20 %

|

91.80 %

|

89.20 %

|

89.40 %

|

|

Cancellation Rate [May 2013]

|

0.10 %

|

0.80 %

|

0.50 %

|

0.70 %

|

0.40 %

|

|

Airline Debt

[in USD billion, FY 2013]

|

0.1

|

0.2

|

2.1

|

9

|

0.07

|

|

Revenue

[in USD billion, FY 2013]

|

1.5 – 1.6

|

1.0

|

3.0 -3.5

|

3.0

|

0.4

|

|

Net Income

[in USD million, FY 2013]

|

100 – 110

|

(34)

|

(90 – 100)

|

(950)

|

(14 – 16)

|

- SpiceJet has a high cancellation rate, which ultimately is affecting its market share

- Air India’s debt is approximately twice that of all the other carriers in India combined (taking Kingfisher’s debt of 1.8 billion USD)

- Indigo scores the best on all the parameters. Except Indigo, all airlines are suffering loses

- The three Low Cost Carriers combined account for just 4-5% of total industry debt and this is largely aircraft-related

- Combined loss of over 1.1 billion USD in FY2013

- Over 9.5 billion USD revenue in FY2013, down from 2.28 billion USD of previous year

- The market share of Jet Airways and Jet Lite has shown a decrease over the year, while others are filling up the vacancy left by Kingfisher

- Passenger load factors of all except kingfisher and Air India has not changed significantly, Indigo above 80%

- IATA estimates that for every 1 USD increase in average price of barrel, a recovery of around 1.6 billion USD is required

- Airline industry fuel bill rose to 177 billion USD as price of oil barrel rose by 20 USD in 2011

- The barrel price rose by 10-12 USD by the end of 2012

- Recent News

- The Direct ATF Import Policy was approved in 2012 but could not be implemented because of lack of infrastructure

- 76% (SPV’s) of equity would be owned by AAI and State owned oil marketing companies

- 24%(SPV’s) would be owned by airlines

- ATF costs for Full Service Carriers (FSC’s) is around 30-45% which rises further to 40-55% for the Low Cost Carriers (LCC’s)

- The ATF prices are linked to fluctuations in crude oil prices in the global market and movement of INR vs $

- The higher central and state levied taxes makes the price of ATF 60-70% higher than global average

- With the direct ATF import it is expected that airfares will come down and passenger load factor for each airline would increase

- This will help increase the current market share from 4.4%

- Bilateral traffic rights of seats will increase from 24,000 to 72,000 seats per month

- Bring in the highly sought dollars through FDI

- Done in bid to compete with low cost airlines

- The deal is to dry-lease the aircrafts for 6 years

- Benefit of earning JetMiles on purchase of mobile phones and tablets both online and at retail stores

- Low cost to be achieved by providing high volumes

- Direct competition to SpiceJet

- Since its commencement in 2005, it grew steadily and had the 2nd largest market share till the end of 2011

- License suspended in October, 2012 and in February, 2013 DGCA withdrew both domestic and international flight entitlements

- Bilateral air service agreement signed between India and Abu Dhabi

- The deal was announced on 31st January 2013 but ran into problems with SEBI in July, 2013

- As of today, no new demands have been made by agencies like the Foreign Investment Promotion Board, Cabinet Committee on Economic Affairs and SEBI but the approval from CCEA is still pending

- Both the airlines plan to sign a “code share agreement” shortly

- MOU to pave way for better commercial viability

- An increase in domain of operations for both the airlines

- In the Union Budget for FY13 the Finance Minister has proposed support worth USD 58.3 million to AAI to develop airport infrastructure in north eastern states

- Aviation Regulator DGCA has been allocated USD 12.5 million for implementing developmental plans

- Under the Twelfth Five Year Plan(2012-2017), Government of India have set aside USD 11.4 billion for infrastructure investment and development

- GOI have plans to invest around USD 30 billion in next 10 years to open new airports and modernize the existing ones

- 100% tax exemption for airport projects for period of 10 years

- 100% FDI under automatic route for Greenfield projects

- 100% FDI for existing projects with automatic route up to 74% and Government route beyond 74%

- 49% FDI in civil aviation sector for foreign players

- Increased traffic rights under bilateral agreement with foreign countries

- Approval for Greenfield Airports in 2008

- New regulatory body (Airport Economic Regulatory Authority) set up in 2009

- Increase in people travelling by air

- Rise in tourist travelers- almost 19% last year (Source: Tourism report)

- Strong growth in external trade- 14% increase

- Delay in take-off and landing because of below par infrastructure

- High Airport charges is also attributed to it

- Stifling growth rates further mar the work done by government in this industry

- High import price of fuel

- Profit margins go down because of the high ATF prices

- Customers are the end losers as the cost is recovered from their pockets

- Lack of focus as in case of kingfisher when it transformed from Low cost economic airline to an airline catering to business class people

- Faulty M&A decisions- Kingfisher-Air Deccan, Jet-Air Sahara

You might like reading:

A glimpse into the Co-working world of StartHub Nation

StartHub Nation was started in August of 2014 by four friends with an aim for providing co-working space for firms where they could work together and share their ideas simultaneously. Co-working is currently not very well known in India. Mr. Parampreet singh Kalra, one of the founders of StartHub Nation, gives us a chance to discover more about Co-working and […]

Diversification holds the key !!

The recent ongoing period of recession has shown the world two simple things- the evergreen importance of liquidity and the need for diversification. This article is regarding the importance of the second. Previously companies used to concentrate only on their core sector, but with the dominance of globalization over the last decade or so has made it imperative for companies to look […]