You might like reading:

Story of Auxin Crop Consultants : Redefining Agri-business

Interview with Mr. S. Suresh and Mr. M. Govarthanan, founders of Auxin Crop Consultants (ACC). ACC is a start-up consulting firm providing viable solutions for agri startups & poly houses. They offer school gardening demos & kitchen gardening kits, along with various other services. A very warm welcome from IdeasMakeMarket.com team. We thank you for sparing some time for this […]

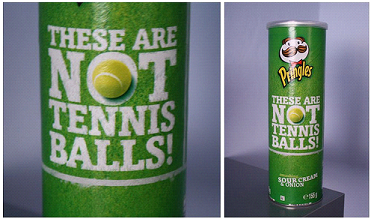

Ambush or Anguish ?

Imagine you put in a lot of effort and mighty amount of time to write an article! And imagine how it would feel, if someone plagiarizes or claims credit for the same? The same situation, when happens in business, in terms of marketing, involving plenty of money is called ambush marketing. In other words, Ambush marketing is a form of […]