Online commerce in India is riding on the express highway at a growth rate of 60-70%annually to capture the market which has a huge hidden potential. They are making mistakes and innovations to capture the price sensitive Indian market. Heavy discounts during the festive month has risen many questions, among them legality predatory pricing was foremost. The sustainability of such model is in question. Can the hefty discount models sustain the growth of online retail? What can be done to increase the new customer base without compromising the experience of the loyalists? These questions are perturbing and one has to look at the growth of online market in USA since 1998. They have come a long way and their practices can give a pragmatic approach to the currently wild running bull of E-commerce. It was in late nineties when neo intelligence crept into the American market and the dotcom revolution was surpassed with advent of direct marketing of brands to non- print options like e-mail, websites, social media and mobile channels. Yet the objective of traditional market remains intact – reach the consumers directly.

The Online Market in India

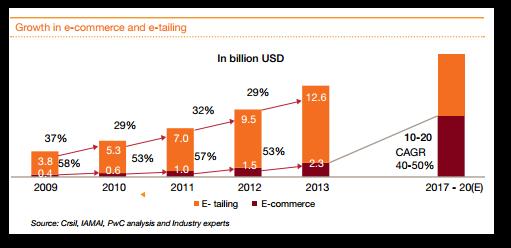

Last year Flipkart clicked a $1billion mark in generating revenue and Amazon pumped in $2 billionand also tied up with Future Group selling its apparel, Snapdeal acquired Freecharge last weeek, E-retail cannot be ignored anymore by brick and mortar. Current sales estimate at $4 billion, debarring travel. In next three years E-tail is set to spring up to $6-8 billion. Thus discussing the future ofonline market leads to e-retail.

Analysing the online market in India primarily we can notice investment riding high on e-retail due to the huge potential it has. According to a recent Technopak report, e-tailing has the potential to reach $76 billion by 2021 with a rising internet user base of 180 million broadband users by 2020, and an exponential class of mobile Internet users.

The Future Scenario

To assess the future scenario of the e-retail and deal sites some questions need to be asked.

- Does Cash on Delivery (COD), first adopted by Flipkart and later on by others, justify the economic cost that e-retailers have to bear?

- Can the Discount Any day model really generate new base of customers and give a loyal base?

- How to dismantle the reverse logistics cost which eats into the profit of e-retail?

The answer to these questions will change the way business is being conducted currently and give us a peek into the future scenario of online market.

Cash On Delivery

The COD gave the trust to the new online shopping community but ruined the return on investment. Sustaining this model of payment cannot be feasible. But removing it entirely can dismantle the buyer’s confidence which is running high.

COD model has few glaring problems, delay in payment as courier companies hold the money for two weeks thus creating problems in replenishing the inventory sold and a transaction fee plus a percentage of the amount collected, rupees 50 and rupees 50-100 as return fees in case of rejected goods before payment, makes it an expensive affair.

COD model has a high rate of pre-delivery return of 10-15% due to fizzling out of the dopamine effect on customers taking the delivery of goods at door.

The future will entail either in dismantling of COD or enabling the COD as a model where customer has to pay the delivery amount via credit card at first before completing the order. Thus there should be a smooth transition by decoupling COD from delivery charges.

Reverse Logistics

The future of e-commerce depends on reducing the cost of reverse logistics to a bearable extent. The reverse logistics is low for standardised products like book and DVD’s up to 7%, while industry average of 20% is beaten by apparels where return rate is almost 60%. The cost to process the return can be higher than the value of the product. In future the companies can expect 70-80% orders coming from tier-2 and tier-3 cities. Reverse logistics from there is a costly affair.

The future shall entail birth of several companies like Green Dust which handles reverse logistics Homeshop18 and Flipkart. These specialists will pick up the returned goods, bring back, refurbish and resell rejects and also share revenue with the supplier. Like Amazon in USA, in future several companies shall outsource the reverse logistics to these companies.

Acquiring a Loyal base of Customers

There is no guarantee that the free riders of deep discounted models like big billion day will form the loyal base

The companies in the future will engage more with the loyal base they procure. The companies will identify that virtual channels only reduce the interactions between the buyer and seller, acting as a barrier in formation of loyalty. Market leaders in coming time will focus on using telecommunications to restore lost relationships and engage with the current base by offering tailored pricing. Deeper level of interaction is specific to cultural traits of India.

Use of analytics will grow high but how many e-retailers can actually juggle the data and convert them into actionable plan will be the key to success in future.

Models like Recency Frequency Monetary (RFM) model and Lifetime Value model are going to be used in future by e-retailers. RFM is used in the West and they have achieved a high rate of success in tailoring prices. It segments existing customers on historic behaviour hoping that history can, with correct motivators, be caused to repeat.

Companies in the future will make conversion of ‘window shoppers’ and ‘casual surfers’ a priority by decreasing margins to attract the former and give incentives to new customers setting up an account also advertise on social media to hook the latter. Once they purchase their behaviour will be tracked through RFM and pricing will be adapted progressively to capture more revenues.

It should be remembered that Profitability on retained customers far exceeds costs of adding a new one.

Omni-channel Partnership with the Retail

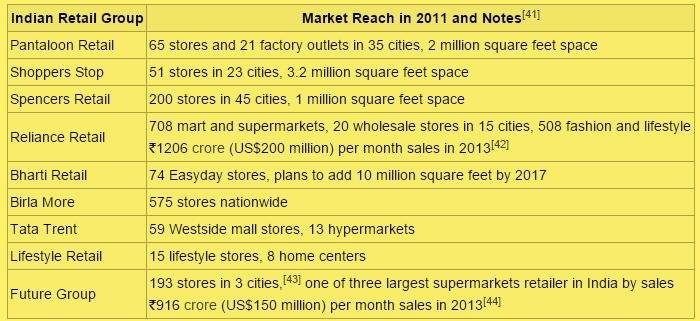

If two giants pool together their resources and develop an omni-channel partnership, the survival rate of the e-retail and brick and mortar increases manifold. The idea is pretty simple. The retailers in India have a huge market reach as shown in the table below which can be leveraged by e-retail. Retailers can become the distributor or the warehouse where the goods are stored and dispatched when customer orders it online. E-retail need a warehouse in every tier-2 and tier-3 cities to save the logistics cost and make profit from it.

Extracting benefits from each other online retail and brick and mortar can develop a symbiotic relationship because even in the coming 3-5 years the unorganized sector will continue to be market leaders in retail overall. The only chance of reaching its true potential with lesser time and investment as otherwise expected is through this symbiotic relationship, an integration of processes, information system and infrastructure to empower the retailer to meet customer demand from whatever location is positioned to provide the best customer experience.

The future is also dependent on m-commerce which is set to grow in the coming time and enactment of GST which makes the tax structure uniform for every state. The future can also witness the entry of giants of E-retail like Alibaba and Rakuten. The future will really depend on company using analytics like RFM to sustain loyal customer base and increase it. COD model currently used will go under a significant change. Reverse logistics will be outsourced or minimized by developing its own logistics but it incurs huge cost. And definitely symbiotic relation will develop in future.

India and USA comparison

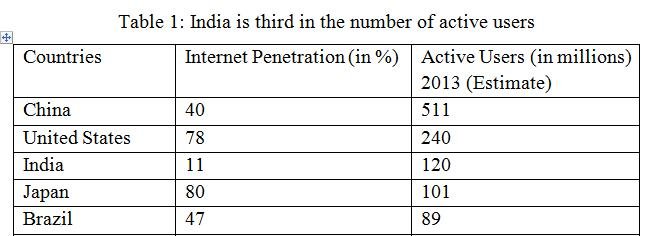

India has its own set of problems which differs from what USA faced in starting years. The glaring problems are of infrastructure and low internet penetration. USA has the advantage of best infrastructure available and the internet literate section readily adapted to shopping online.

- India has the lowest internet penetration of 11% in comparison to USA’s 78%, leaving a huge potential only to be realized if the infrastructure is built faster. It is Achilles heel for online market in India.

- The market in India is still immature in usage of credit card as the payment option. India is a decently carded country with more than 18 million credit cards and 310 million debit cards. Instead of cash on delivery, the e-retailers could move towards accepting card on delivery. There is a need to figure out a way to offer value and build trust with consumers. USA has propensity of engaging in liberal spending with use of credit card in comparison.

- Both the markets are facing two threats, how to reduce the reverse logistics cost to a bare minimum as it is nibbling deep into the profits and second from Alibaba encroaching the market which is a bigger threat to India than USA because the online market is nascent here and far developed in USA.

- India’s e-commerce logistics is largely concentrated around major cities and dependent on third party Logistics Company, except for the use of e-Kart by Flipkart which needs to be present in tier-2 cities as well. Although the business from smaller cities is rising yet the concentration of warehouses remains in big cities. In USA the Amazon partnered with Collect+, shelling out numerous passcode protected lockers in local shops or other public avenues which allows parcels to be collected from participating local shops. This has enabled deep penetration in rural areas. They have opened smaller scale facilities to offer same day delivery services. The e-retailers are increasing control over their e-commerce supply chain, which in future might displace the traditional role of parcel operators.

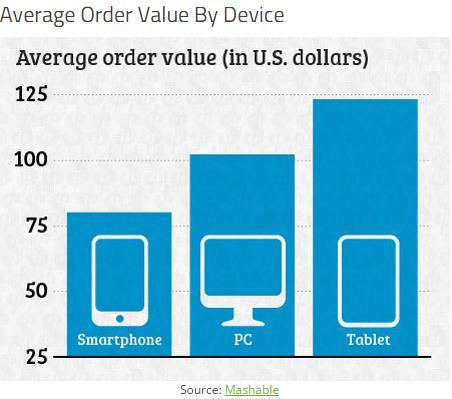

- M-commerce is growing in e-commerce market. But it is already established firm roots in USA. ‘Go mobile or go home’ is the verdict.E-retailers are pumping in money to create a responsive mobile website design that scales to fit different device screens. Around 60 per cent of orders in Indian e-retail comes through mobile platform. The future entails this to be 90 per cent over the next three years, as tier-2 and tier -3 cities can easily order via smart phones. While USA has large amount of orders via tablet India will see smart phones as a more popular choice.

- Walmart had started its online operation and has become an ideal example of the aforementioned symbiotic relation which can be named brick and click channel. They shipped more than 10% of ordered goods on walmart.com (the website) to a customer’s door from a store. Macy’s- US departmental chain announced plans to begin shipping online orders from its stores and extend order fulfillment from 292 to 500 stores. For India the key to future lies in brick and click channel. This symbiotic relation will pave the way for faster growth of organised retail sector in India.

Conclusion

The world of start-ups in online market is flush with funds from venture capitalists. A model initiated by Flipkart who utilised the $1billion venture capitalist fund to give deep discounts, is percolating in other online markets. Taxi service marketplaces like Ola Cabs and Taxiforsure have e-commerce presence and are adopting the deep discount model by raising fund from the market to be a part of the low-fare revolution. It has become an accepted market practice and companies are intentionally oblivion to the fact that such model will not earn them brand loyalty. They have to adopt a standard model for long term survival. The online market is surging high and the proof is Japan’s SoftBank becoming the largest investor in online start-ups. The way the business is being conducted is definitely changing and future entails two things surely, symbiotic relations and adopting virtuous practices to ensure brand loyalty.

Tags: digital age digital marketing e-commerce flipkart market penetrationYou might like reading:

IIM Indore Final Placements Batch 2018-20: Highest Domestic Offer at INR 50 Lacs

Indian Institute of Management, Indore (IIMI) has successfully completed the campus placements of Post Graduate Programme (PGP) 2018-20 and the 5 Year Integrated Programme in Management (IPM) batch, securing 100% placements for its largest outgoing batch of 578 students. Major Recruiters More than 160 recruiters participated in the IIM Indore Placements 2019-20 including Accenture, Aditya Birla Group, Amazon, American Express, […]

Redefining HR in the minds of the employees !

Nineteenth century ideas of employment relations find themselves ill-equipped, outmoded and counter-productive when applied to a liberal and knowledge-centric workforce of the day, no wonder HR may feel repressive, parochial and bureaucratic at times. We would like to take up employment life-cycle to show where exactly the HR practices are changing or should change for the better. The primary way […]

Loved reading it. Great analysis. How about the fact that despite all the innovations, everyone from Amazon to Flipkart is still losing money ?