Often new companies have a tendency to expand their business once they taste success in their local market. It is definitely the right way forward, if your idea is good- you will certainly gain new grounds. But in order to do so, you need liquid assets to finance your expansion. What should be the right way to plan it out? So that you fulfill your objective without running into bad debt?

Ideally it should be planned out in the following way:

1. Analyse your real goal

Often in a bid to expand, companies tend to ignore their primary objectives. One thing that I have noticed is that companies start neglecting their local market and tend to focus their strategies only on the new market- which is clearly a recipe for failure ! It should be very clear that you have reached this stage owing to your success in local market. Don’t loosen your grip over it. It can serve as a backup if your plans go topsy-turvy.

2. Analyse the new target market

Garner information on this! The demography, the consumer base,the competitors and most importantly the price sensitivity of the market. It is not necessary what worked in market A will work in market B. Plan it out carefully and conduct a proper survey before proceeding further.

3. Being first isn’t always good

Often companies have a feeling that being the first to enter a market with a completely new product gives them a tremendous advantage. It is true to a certain extent, but it equally puts you at a risk as you don’t know how the market will react to it ! A case to pint out in this context would be the Indian Cricket league (ICL) vs the Indian Premier league(IPL). Both were cricket leagues built around franchisee/club format. The ICL started first but was a huge financial loss to its founder Mr. Subhash Chandra. The IPL started later, built largely around the same format- but taking care of the mistakes committed by ICL. The result- In 3 years time , it is one of the 10 highest valued sporting events globally.

4. Don’t go RED

Companies sometimes tend to borrow so much money from the market- that they finally end up losing their direction. The reason for this happens as a result of being overambitious and targeting too many markets at the same time. Go slow targeting one at a time. That way you would certainly lower your chances of going into bad debt in addition to increasing your reaction time in case your initial strategy doesn’t work out.

5. Keep liquidity

Never forget this. It takes time to build and position your brand in the market. Keep liquidity for a period of at least 6 months with zero sales. That will serve you in good stead in realizing your plans.

You might like reading:

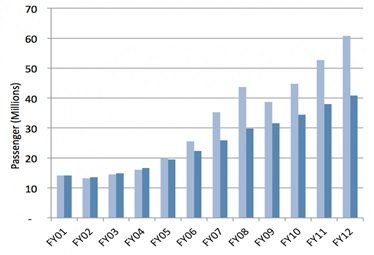

Analysis of Aviation sector

Overview The Indian Aviation industry is the 9th largest civil aviation market in the world and is ranked 4th globally in domestic passenger volumes. The industry handles about 2.5 billion passengers annually and has about 87 different airlines flying to & from India. Some facts and figures with respect to the aviation industry:- Total Passenger Traffic in FY12 – […]

Decoding : Viral Marketing

A very interesting phenomenon has been prevalent & making waves since couple of years now. Yes! You guessed right! I am talking about Viral Marketing. For those who do not have the slightest idea, let me tell you what exactly is Viral Marketing. Viral Marketing (or Viral Advertising) is a new form of marketing in which the marketer uses a pre-existing social […]