May 16,2014 may have seen Narendra Modi getting elevated to a platform from where he could have a clearer view of the direction in which he wants to steer the ship; the foggy atmosphere ensured by the hostile international events and the trail of economic burden left by his predecessors may prevent him from having a fluid movement of the rudder. On the upside, he has a clear majority in the house and a disintegrating opposition. But the demons of instability in the form of rising fiscal deficit, possible escalation of crude prices due to current situation in the Middle East and a poor monsoon as predicted by many due to the El-Niño effect, might keep the government on the tenterhooks for the coming few months at least.

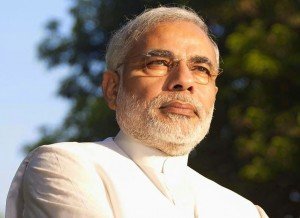

Symbolically, Modi’s victory created huge waves across the world and especially the west. Cognizance of the fact that a tea seller can dream big and lead the world’s next superpower- India has astonished many who were not aware of Modi’s popularity within India. Moreover, he epitomized what an Indian youth stands for and that becomes significant for a nation having a median age of 25, thus, explaining the overwhelming victory he achieved.

|

| A bright start, but quite a long way to go! |

It’s a well-known saying, “Well begun is half done”. Whatever Modi has achieved (or rather done) in the initial few weeks after coming to power has been a bit underrated because of the enormous weight of the expectations and responsibilities that he carries. He espouses the ‘minimum government, maximum governance’ mantra and seems to have streamlined the decision making process by amalgamating related ministries and eliminating the redundancy. His every move gets captured almost to the levels of caricature by the eager media. At the end of the day, he seems to be visible, affirmative and transparent and juxtaposes to be a perfect antithesis of Mr Manmohan Singh. Still, a lot needs to be done and some of the major issues that we face are discussed in the coming paragraphs.

The government seems to be clearly banking on giving a boost to the economy than controlling the expenditure in order to keep the fiscal deficit in check. The subsidy regime that has steadily grown from 1.4% of the GDP in 2008 to 2.5% today creates a significant hurdle in this process. The major subsidies (that account for almost 96% of the total subsidies) have in fact marginally risen to Rs 2.46 lakh crore. This remains in spite of the government’s efforts to deregulate the price of the diesel by periodic hikes. The latest CAG report dated July 19, 2014 reveals that OMCs (Oil marketing companies) overcharged the customers and collected additional Rs 26,626 crore in five years by exploiting the loopholes in the pricing mechanism of the state owned firms. The Comptroller and Auditor General of India observed that the notional charges such as insurance, freight, wharfage, ocean loss etc. amounted to Rs 50,513 crore in five years up to March 2012, but the actual cost that was paid on imported crude was only Rs 23,887 crore. This is because the notional charges are added for the entire quantum of fuel sold although more than 20% of the oil they refine is sourced domestically. The report also brought to light the fact that the OMCs were buying fuel from private refiners at a price equivalent to the landed price of the fuel if it was imported after paying freight charges, insurance and customs duty and made no efforts to renegotiate and bring the prices down. Thus they gave an undue benefit of 0.7% to Essar Oil and 0.58% to Reliance industries by buying their fuel at higher prices.

Dark shadows loom over the crude prices due to the conflict in Syria and possibility of the increase in the brent crude by the behemoth Gazprom as a response to the sanctions placed against Russia over the Crimea conflict. This seems even more likely to occur after US proposed to further tighten the noose by imposing more sanctions on Russia as Malaysian airlines MH17 was reportedly shot down by pro-Russian rebels.

While the petroleum subsidy has reduced by 26%, it has been more than compensated by the increase in the food subsidy (a 25% increase in the subsidy takes the amount to Rs 1.15 lakh crore); thanks to the stage-wise implementation of the food security bill. It will be a lot easier to inject money through the DCT (Direct cash transfer) mode to ensure that the money reaches the other end of the pipeline in a secured and efficient manner by completely bypassing the rapacious middlemen. Modi, though, has made one wise move by not scrapping the UIDIA (Unique Identification Authority of India, Aadhaar). The UIDIA plans a target of covering 100 million people under its purview at the earliest. Once this is achieved, the DCT mode of payment can be efficiently rolled out.

The best part amidst all of this is that the Indian stock market is not only discarding the anomalies be it the Palestine-Israel conflict or Russia laying siege on Crimea, but also Sensex/NSE is the best performing index in EM (Emerging Markets) category. Both the Sensex and the Nifty have hit their all-time highs with returns at upwards of 22% over the past one year. Increase in the FDI limits in insurance and the defence to 49% has been well received by the analysts and researchers. This will ensure technology transfer or at least exposure to advanced technology over the long term in the crucial defence sector that is outdated and will help India to keep pace with the ambitious Chinese defence program. In the insurance industry, that is starved of approximately Rs 25,000 crore, the proposed investment through the FIPB (Foreign Investment Protection Board) route will help the Indian promoters to exercise management control.

In order to encourage FDI and FII inflows; the government needs to improvise the tax structure and come out with clear directives in regards to retrospective taxation as observed in the case of Vodafone. Many companies like Wal-Mart, Carrefour etc. have been completely bewildered by the intricate tax structure and as a result were left with no other option than to wind up their shops on account of spiraling losses. GST has become a national debate with many reformists and analysts predicting that its timely introduction might help the GDP to grow by 125 basis points at least. Every state of India levies taxes that are disparate in nature and hence, the efficacy in collection of taxes upon the introduction of GST needs to be studied in detail.

Though the government may not have completely treaded the anti-populist road that was indicated by the BJP’s manifesto, it went a step ahead and can be credited for being unambiguous on the agenda of growth. In all certainties, we should not turn cynic in judging the steps taken by the government simply for the fact that it has been only slightly over two months since it has come to power. The government has rather taken a safer route by leaving key issues like those on subsidy reforms and introduction of GST to the findings of the report by a special committee constituted for analyzing historical data and recommending the path ahead.

In times when there are more tectonic plate movements of hatred and war above the earth than there is below, foreign policy has to be further crystallized. Just a notional photo opportunity followed with flattery won’t suffice. With India’s defense sector opening up for FDI, there has been an umpteen rush of dignitaries from the west to strike a deal and have a first mover advantage, keeping in mind that Modi is in favor of India’s erstwhile look-east policy. It is to be seen how India reacts to the Israel-Palestine conflict in the Gaza strip. India has long been an ally of Israel and is still to issue a public statement on this burning issue. The death toll has already crossed 1000 mark with no end in sight.

On strategic front, India should have bargained more with respect to setting up of the proposed $100 bn BRICS bank, with its headquarters in China, than nominating the president for the initial term of first six years. Just like IMF and the World Bank are headquartered in Washington DC- a show of strength by the US and a fair reflection of the dominance of dollar, headquarters in Mumbai rather than Shanghai would have sent strong signals to both domestic and International investors. India would have definitely got a better bargaining power for lending to Indian companies. Nevertheless, Modi did not return empty handed and an Indian nominee might do as well to serve best to the Indian interests for the upcoming six years.

The chair of the devil’s advocate is empty as the opposition, even with its meager numbers, struggles to hold on to its own resources. Regional parties like the TMC and AIDMK are not expected to do anything apart from bargaining for their own states during the time of budget allocation to states. During such times, the best way to remain on course would be to set strict and ambitious deadlines and adhere to it. This is exactly what the BJP government has committed with each of the ministries, having declared their 100-day deadline, being told to ramp up the efforts to meet them.

Well, the hangover from the victory may not have completely subsided as the market still soars high on sentiment and on expectations of new reforms. This may also be a reflection of how bad the previous government functioned over the last 10 years. As indicated by Jaitley in the post budget interview, one needs to do away with the word retrospective- be it the tax or the performance of previous government. More than a billion hopes are pinned on one man, Narendra Modi – right from an aspiring student wanting to contribute to the nation, ambitious businessmen looking to grow their businesses or an ordinary street hawker. He provides tremendous inspiration to all of them.Let’s hope he delivers !

About the Author:

Nitesh Chivukula

He has completed his PGDM from K.J.Somaiya Institute of Management Studies & Research (2012-14 batch) in finance stream and presently works as Credit Manager with Kotak Mahindra Bank.

You might like reading:

Buying a Product for the First Time – A Consumer Experience

“I don’t know what to Buy, where to buy, which to buy” This analysis goes about that what all problems goes around in customer mind while making a purchase of a product which he/she had never done before and what all steps consumer takes to finally buy. I looked at the sports Skydiving and to go about which skydiving equipment […]

A brief journey back in time

There are moments in life which just shape your life from what you want to be to what you eventually become. One such person was a professor whom I had met while travelling in a bus to my tuitions. I can still recollect the conversation vividly. As a 15 year old, I was reading some mathematical puzzles, when this professor […]