It has been a significant period since you have been operating profitably and leading the show. However there is a new kid on the block. He quickly redefines business strategies with his innovative thinking and has begun to get a slice of the existing market. You realize you must act fast. What should you do?

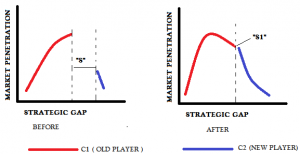

Often companies are seen to emulate the strategies of their competitors. If we compare the graphs of the two companies( Old and New) with respect to the strategy gap it should look something like this:

If we consider the initial strategy gap as ‘S’ in its bid to emulate the new kid the gap becomes lower and lower until it is negligible. Also notice the nature of the curve of the two players, a rise in the new bie is marked with a fall in the seasoned player. Furthermore if we consider it at the point S1- Is there any thing which separates the company C1 from C2 ? No. Instead everyone knows it is C2’s line of thinking which has made it standout. So what it actually means is you despite being the market leader at one point of time no longer retain your USP? Is this what you set out to do?

Let us consider two exclusive cases:

South west Airlines is known as the pioneer of low cost flying in the world. In the early 1980s, one of the former disgruntled co-founders of South-west formed his own company : Muse Air. Unlike South west, Muse Air offered greater comfort and had a cosy airline fleet. According to a survey conducted during that period, passengers preferred Muse Air by a long way over South-west. Everyone urged Herb Keheller, the then CEO of South West to change his fleet of aircrafts, however he stuck to his guns because he believed that he won’t be able to deliver air flying at low price as it will reduce his liquidity and increase his operation costs. The strategy paid off ! In fact if someone had invested 10000 USD in South-West in 1972, it would have been worth way over 15 million USD as on date ! The reason South West succeeded was because it knew its USP was in low cost flying and did just that.

Let us now look at a recent scenario. Nokia was the dominant player in the mobile market in India since cellular phones where introduced in India. However things started to change with the entry of several low price players which now begun to eat up its market share. How did Nokia tackle this ? It introduced lower cost models to match this- The result the brand value decreased and it was no longer exclusive to own a Nokia and the poor results continued in market performance. If everyone is selling phones at same low price why should one buy a Nokia?- This can be the counter argument in favour of Nokia’s strategy, however what I would like to ask is can you tell me what differentiates Nokia and why I or you should buy it? It remains to be seen though whether the strategy pays off in the long run.

The point that should always be kept in mind for any player is to know the purpose of their business and the core of it: The 5 W’s: 1. Why does your product sell? 2. Where does your product sell? 3Which of your products sell? 4. When does your product sell( season) ? 5. Who is your buyer? When you face a new competitor, innovate and strive hard but not shift the core of your business. If you can do that, chances are you will be on the winning side 8 out of 10 times.

You might like reading:

IMM Comics : Myths about MBA

There are several myths around MBA. IMM Comics brings to you a creative take on some of the key myths around MBA in India.

The Good Boy of Euro-zone: Estonia – Why did it adopt Euro ?

Estonia adopted the EURO as its currency on January 1, 2011 at a period when there were growing concerns over the fate of the Euro zone in the face of growing debt by Greece. It became the first former Soviet Union country to adopt the Euro. Why should a country join such an economic union whose fate is unsure? Let […]